Handle With Care: How to Maximize the Value of Microinsurance for Emerging Consumers

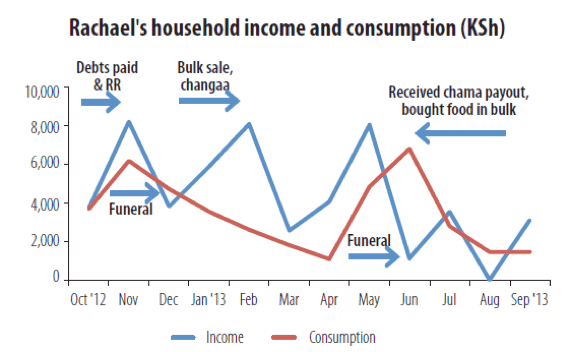

It goes without saying that emerging consumers are particularly vulnerable financially, with seemingly insignificant shocks potentially pushing families deeper into poverty. Consider Rachael, the head of a low-income household in Kenya, who took part in FSD Kenya’s recent Financial Diaries study. She was widowed after her husband, who worked as a civil servant, committed suicide before his 55th birthday, making her ineligible to receive his pension. She earns her income from brewing changaa (locally distilled alcohol) and receiving remittances from her children. Two of her grandchildren lived with her throughout the Financial Diaries study and, at different times, some of her children and daughters-in-law were also staying with her. The variable nature of both her income and consumption is shown below.

Rachael’s circumstances are quite common amongst emerging consumers who are squeezed from two sides through highly variable incomes and consumption requirements. It is inevitable in such circumstances that even small financial shocks (e.g. seemingly insignificant medical expenses) will have a material impact on the family’s financial wellbeing. In those cases, emerging consumers make use of multiple mechanisms to cope with the financial risks they face, drawing on many informal mechanisms (e.g. contributions from social networks and community-based credit and savings pools), and to a lesser extent formal mechanisms such as savings, credit and insurance.

Intuitively, microinsurance is well-suited to managing some of the financial risks faced by emerging consumers such as Rachael. Indeed, the risk pooling mechanism of insurance is designed to spread the impact of low-frequency, high-impact events throughout the insurance pool. Yet insurance penetration in emerging economies is very low, viewed absolutely or relative to penetration in developed economies – in 2014, premiums as a percentage of GDP were just 2.71 percent in emerging markets, compared to 8.15 percent in advanced markets. Furthermore, insurance penetration in emerging economies is usually heavily skewed towards businesses and wealthy individuals, leaving low-income consumers largely uninsured. Should insurance not be playing a substantially bigger risk management role for people such as Rachael, given the intuitive fit?

Utility theory can be used to demonstrate that insurance does in fact improve the welfare of emerging consumers under certain circumstances. This is particularly the case where a risk event gives rise to a loss that has a large impact on a family’s wealth. Consider the case of a death in the family. It has already been argued that insurance is a valuable risk coping mechanism, especially when the financial impact of the death is high. But the value of insurance to emerging consumers will crucially depend on the cost of insurance, amongst other things. The higher the cost, the less valuable insurance becomes.

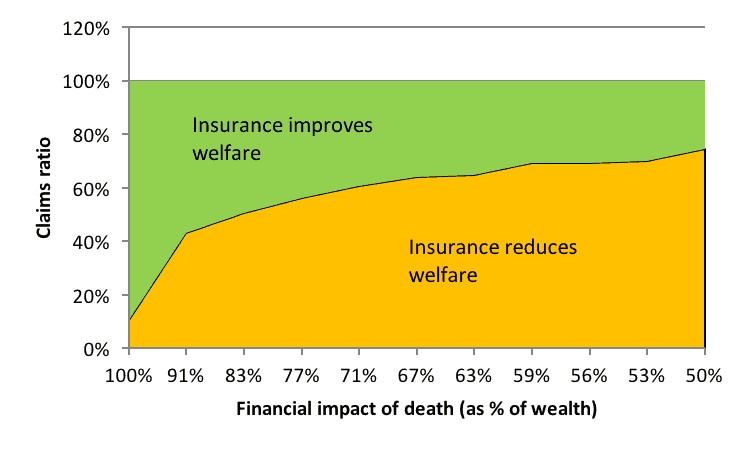

If the benefit amount is fixed (as it will typically be for life microinsurance products) and the probability of the risk event (death in the family in this case) is known or can be estimated reasonably accurately, a higher insurance premium will be reflected through a lower claims ratio – which represents the proportion of premiums returned to insurance customers in the form of benefits paid.

The figure below uses utility theory to show the claims ratios at which insurance improves the welfare of emerging consumers for different levels of impact arising from death in the family (where the impact is expressed as a percentage of the family’s wealth). When the impact is large (close to 100 percent of wealth), insurance improves welfare even if claims ratios are fairly low. The smaller the impact, the higher the claims ratio must be for insurance to have a positive effect on welfare.

The above brief application of utility theory supports the intuitive notion that insurance is a valuable coping mechanism for risks that have a potentially large financial impact on wealth, particularly when claims ratios are fairly high. But how does insurance stack up against alternative coping mechanisms that are (or could be made) available to emerging consumers? Is insurance a more efficient coping mechanism than, for example, using a microloan to finance the cost after the risk event has taken place? Such comparisons between different coping mechanisms are rather complex, particularly if one is attempting to compare against informal mechanisms. But, taking a microloan as the alternative mechanism and continuing with the case of a death in the family, we are able to reach some simple conclusions regarding its potential as a risk coping mechanism relative to that of insurance.

In particular, compare the cost of insurance as a mechanism for coping with a death in the family against that of a microloan. Suppose the financial impact of the death as 10,000. This may represent the cost of the funeral and medical expenses prior to death. The monthly insurance premium would be in the order of 17[1] compared to the monthly loan installment to finance the full cost of the death of 1,005[2]. So the monthly loan installment is roughly 60 times larger than the monthly insurance premium. This large cost differential arises because insurance spreads the risk of the event across the risk pool, whereas the microloan simply provides the family with a method of spreading the cost of the risk after the event has taken place over the family’s own financial resources. Irrespective of the reasons, it is clear that insurance is substantially more affordable as a risk coping mechanism than a microloan, and therefore potentially accessible to a much larger segment of the population.

In conclusion, insurance can and should be an important risk coping mechanism for emerging consumers, especially for low-frequency risks that have a potentially large financial impact relative to wealth. However, insurance as a solution should be marked with a “handle with care” sticker.

- Low claims ratios can destroy welfare rather than improving it. This is particularly relevant in the microinsurance space. Distribution costs are frequently high, driven by the need for high-touch models to address lack of insurance knowledge and trust in insurance. Furthermore, administrative costs are often high relative to the small premium amounts. Providers should choose business models carefully to ensure they are able to deliver value to emerging consumers. Mobile-based models show great promise in this regard.

- Providers should also take care to fully understand what informal mechanisms are being used and how efficient such mechanisms are before pushing formal mechanisms such as insurance that may end up crowding out potentially efficient informal mechanisms.

[1] Assuming probability of death over a year of 1 percent and a claims ratio of 50 percent. The annual premium is or approximately 17 per month.

[2] Assuming the loan is repaid in equal monthly installments over 12 months at 3 percent interest per month.

Photo credit: Pictures of Money, via Flickr.

Nigel Bowman is a Product & Distribution Executive at Inclusivity Solutions.

- Categories

- Uncategorized

- Tags

- microfinance, research