The Surprising Reason Why Savings Boosts Income: New Research Reveals an Unexpected Benefit of Financial Inclusion

Make it easier to save, and people will save more. This seems straightforward and holds true when offering savings accounts to customers in rich and poor countries alike.

Make it easier to save, and people will save more and earn more. This sounds a little more surprising, especially if you posit that this increase in income will happen almost immediately. But researchers in Kenya, Nepal and Sri Lanka have revealed that given a savings account, poor customers do save, earn and consume more. And they do that quicker than we would expect them to.

We know how a savings account should lead to increased income: It allows people to make “lumpy” investments in their microenterprises – in other words, those occasional large purchases that require planning, as opposed to everyday business expenses. The tailor is able to save up and buy a sewing machine, thus raising his productivity. The fruit vendor can save up and buy her own cart, rather than pay to rent one. Such increases in income will only become evident after a period of time – not only the time it takes to save up for an investment, but also the time it takes to increase production and wait for the return after making it.

However, a number of rigorous studies have shown that large increases in income and consumption happen fairly rapidly after gaining access to a savings account. For example, in a 2013 study, Pascaline Dupas and Jonathan Robinson gave a randomly selected group of (mostly female) market vendors in Kenya non-interest-bearing savings accounts. Relative to a control group that didn’t receive accounts, those in the treatment group showed greater savings, greater business investments and 37 percent higher daily private expenditures four to six months later.

Related Post: BIG DATA ISN’T ENOUGH: WE NEED AN ‘ALL OF THE ABOVE’ STRATEGY TO DRIVE INNOVATION IN FINANCIAL INCLUSION

In another 2013 study, Sylvia Prina offered female household heads in Nepal simple bank accounts and saw not only big take-up and usage, but 16 percent greater total assets a year later. Prina’s results also suggested that this increase in monetary and non-monetary assets such as consumer durables and livestock occurred without diminishing other kinds of assets or other methods of saving.

Other studies have shown that such beneficial effects can persist in the long run. But the nagging question remains, are the nearly immediate increases in income due to a cycle of saving and investment? Finding the answer might shed more light on the hard-to-pinpoint links between financial inclusion and poverty reduction.

Existing studies often have a gap between baseline and endline surveys, and often conduct no further follow-up surveys, so they face some limits when weighing in on this puzzling effect. But a 2014 experiment and its latest round of survey results may have identified the source of these speedy benefits.

Apparently, when people are given the means to save, they start working harder to have more money to deposit into the account.

Working with Sri Lanka’s National Savings Bank, researchers Michael Callen, Suresh de Mel, Craig McIntosh and Christopher Woodruff offered villagers who lived 5–10 kilometers from the nearest bank a savings account with a modest interest rate that was also exceedingly easy to use: Agents on motorcycles rolled up to their doorsteps to collect deposits once a week. Importantly, the researchers conducted frequent surveys, starting five months before the new product was offered and continuing for 13 months afterward.

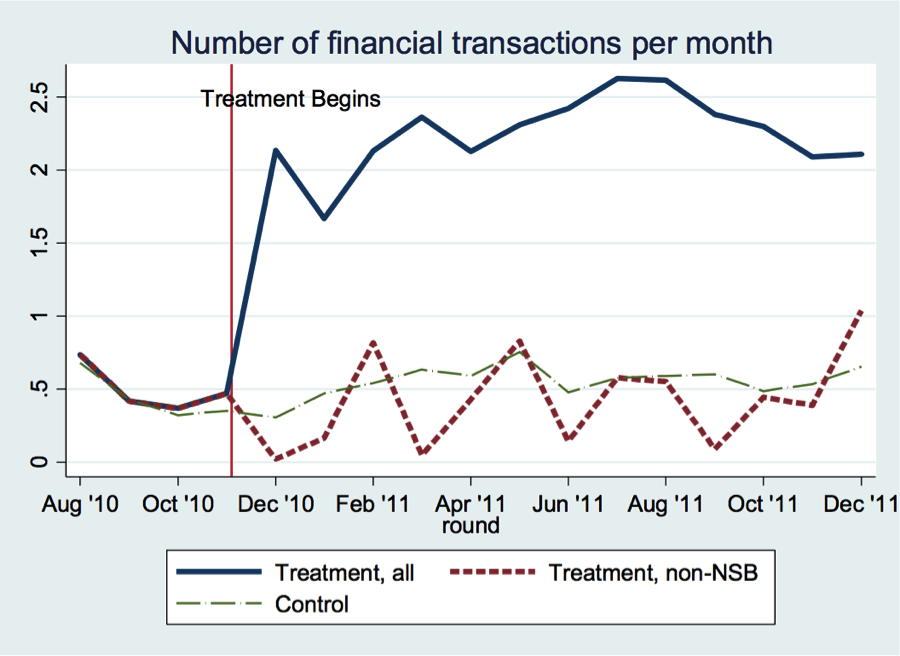

Intuitively, having a bank agent come to your doorstep once a week will help you to save more …

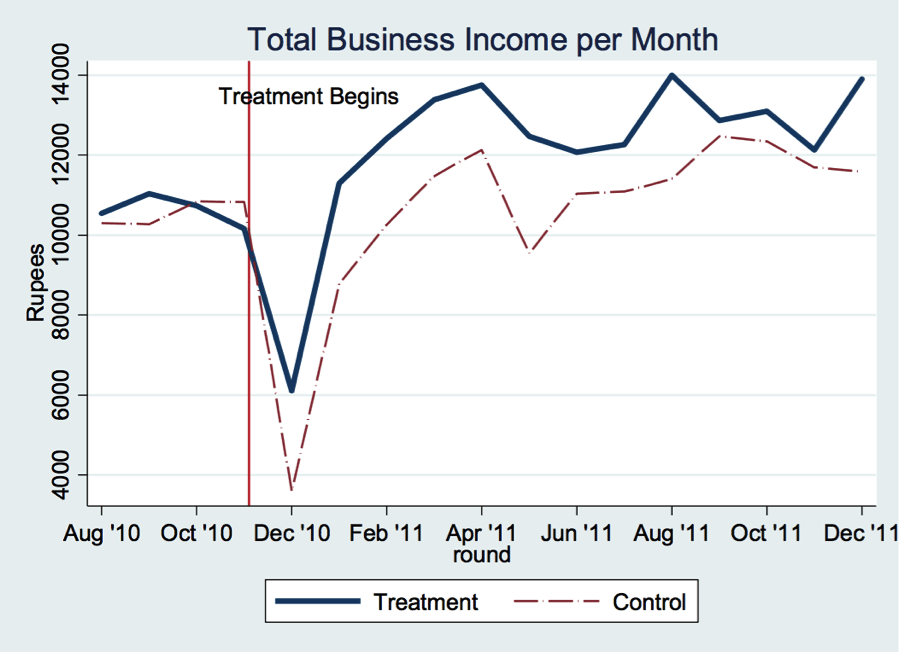

… counterintuitively, the money that you save will come from an immediate increase in income from your business. (The dip in the first month was due to rainstorms and flooding.) Source: Callen, De Mel, McIntosh and Woodruff (2014)

They saw that in the treatment group, the number of bank transactions quadrupled, the flow of savings into bank accounts almost doubled, and overall savings increased by more than 15 percent. In short, the intervention led to a statistically significant and economically meaningful increase in total savings by the individual.

In this case, the increase was clearly too fast to come from lumpy investments. Furthermore, the surveys showed that neither did it come predominantly from the other usual suspects, such as fewer trips to the tea shop, less lending to relatives, or lighter utilization of alternative savings methods such as seetus, the Sri Lankan version of a rotating savings and credit association (ROSCA).

Rather, the main source of the money for increased savings was a large increase in income. In the months following the introduction of the product, personal and household income both surged by about 5 percent. The individuals achieved this either by working longer hours in wage work (mainly as day laborers), by picking up some additional wage work in addition to running their business, or by expending more effort in their microbusinesses.

Related Post: WHAT STANDS BETWEEN WOMEN AND FULL FINANCIAL INCLUSION?

One of the researchers, Michael Callen of Evidence for Policy Design at Harvard Kennedy School, says, “When a new savings opportunity is opened up, it essentially raises the effective interest rate on your savings, creating two effects: Now you’re richer over the long run so you may need to work less, but also now you make more on what you earn today. There are now greater possibilities and new reasons to work harder.”

The research team has just received further confirmation of its findings. Two years after the window of the experiment, a survey indicated that 78 percent of those who opened accounts reported that the intervention helped them to save, and of those, 38 percent said this was achieved through increased income. Among those who said that income had increased, 59 percent reported increasing effort in self-employment or agriculture, 13 percent reported doing more work at a previously engaged wage-paying job, 5 percent took on new wage work, and 18 percent reported reinvesting in self-employment or agriculture.

It is important to note that 34 percent of those who saved more reported doing so through decreased consumption, and 22 percent through changes in intra-household transfers. Still, the greatest percentage of those who increased savings said that they did so by raising incomes, principally through more labor effort.

It is also interesting to recall that the Dupas and Robinson study showed that Kenyan market women had short-run increases in savings and consumption even in the absence of an interest rate. But maybe non-interest bearing accounts can also be said to have an “effective” interest rate, which derives from the fact that without them, savings is stored as cash, inventories in the business, loans to relatives, etc., which will depreciate for various reasons (self-control, family members asking for money, etc.). So even an account with no interest can grow money more effectively than the alternatives. Yet the existing data doesn’t weigh in on this possibility, so more research is needed.

Related Post: THE HARD FACTS ON ‘SOFT DATA’: DETERMINING RISK FOR LOAN APPLICANTS WITHOUT CREDIT SCORES IS MORE THAN A NUMBERS GAME

From the point of view of the bank, of course, sending agents around on motorcycles to collect weekly deposits is a pretty costly prospect. After the study period, the Sri Lankan bank solved this problem by installing dropboxes in villages. That way, villagers had only to walk a short distance to make deposits, and an agent came by once a week to collect them.

But the intriguing finding remains. Perhaps savings accounts don’t enable people to earn more, they inspire them to earn more.

On April 17–22, Michael Callen and other researchers and practitioners will be discussing the latest ideas in financial inclusion in Rethinking Financial Inclusion: Smart Design for Policy and Practice, a program offered by Harvard Kennedy School Executive Education and Evidence for Policy Design. Callen will be speaking on a panel on Innovations in Digital Financial Services and commenting on the Sri Lanka study, as well as discussing his work on spurring savings using mobile money accounts in Afghanistan, which he described in a recent post on this blog.

This is the third year of Rethinking Financial Inclusion, which has attracted scores of participants from banks, microfinance institutions, NGOs and government ministries from around the world.

Editor’s Note: This article was voted by readers as one of NextBillion’s Most Influential Articles of 2016.

Photo credit: Juan Felipe Rubio, via Flickr

- Categories

- Uncategorized