Are Impact Investors Really Listening?: Why Capturing Stakeholder Insights is Key to Impactful Investment Strategies

Collecting data is easy; acting on it is harder. At Acumen, as in other impact investment firms, turning data-driven insights into action happens in intentional spaces like investment committees, portfolio review sessions and industry convenings — places where the voices of customers, communities and other stakeholders directly shape capital allocation, risk assessments and post-investment priorities.

But for us, listening means more than collecting surveys or feedback loops — it’s about sitting down with company teams to make sense of what we hear together. The “magic” happens in this dialogue: When customer voices meet company insights, blind spots are revealed, solutions are co-created and impact strategies become sharper.

This shared reflection not only strengthens company operations, it also builds confidence among our co-investors and limited partners that impact is being actively managed, not just measured.

This article shares what we’ve learned from embedding listening as a practice that influences investment strategy. We’ll explore how Acumen weaves impact management into every stage of the investment process, setting clear expectations with our investees and working alongside them to turn insights into action — for both Acumen and the companies we support.

Why listening matters in impact investing

When you think of impact measurement, “listening” can sound deceptively simple. Many imagine a checkbox exercise: Send out a survey, collect responses, publish a report and move on. But listening alone isn’t enough; its value lies in what follows — the decisions, pivots and strategies it enables at both the company and investor level.

While many businesses listen to customers for product or service feedback, investors like Acumen can help companies capture deeper, more structured insights on customer experiences — the good, the bad and the unexpected — to understand how company decisions affect people’s lives in ways that are often invisible to operational teams. These insights reveal opportunities to strengthen links between operations, products and real-world impact.

Across the impact investing field, the conversation on embedding listening is growing louder. For instance, the Global Impact Investing Network encourages investors to create feedback loops — structured processes for communicating performance insights across the investment chain to manage impact. Impact Frontiers highlights the importance of including the perspectives of affected people as a core part of reporting norms — a sign that listening is increasingly seen as fundamental to impact management. Lean Data tools, such as those designed by impact measurement firm 60 Decibels, capture these lived realities at scale, providing actionable insights in weeks rather than years. Listening is no longer a “nice to have” — it’s a defining feature of credible impact management.

Listening before we invest

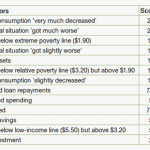

To understand how well companies are meeting customer needs, Acumen embeds listening from the start, incorporating it into the due diligence process. We conduct lean data surveys in partnership with 60 Decibels to validate whether a business is reaching people living in poverty, uncover operational gaps and identify ways to strengthen the company’s business model.

Consider WamiAgro, a recent Acumen investment that supports smallholder farmers in Ghana across several key areas, from planting through market access. A Lean Data study conducted in 2024 during due diligence reinforced the alignment of WamiAgro’s business model with our investment thesis. They were reaching people living in poverty — 77% of their customers live on less than $3.65/day — and their services were creating additional income, with 64% of customers reporting improved earnings.

The study also pointed to opportunities to improve farmer engagement, based on the Net Promoter Score. While WamiAgro’s customers valued access to better farming techniques, some reported delays in the delivery of inputs and extension services, and inadequacy of these extension services overall, which disrupted their planting seasons.

Here, the customer voice helped Acumen listen, prompting our investment team to ask deeper questions about the company’s operational priorities and risks. Following customer feedback, the investment team discussed ways to strengthen WamiAgro’s infrastructure and address potential risks.

Post-investment, and with new insights in hand, WamiAgro is setting up a dedicated service delivery unit to better meet customers’ needs and improve reliability and customer retention — changes that could enhance both its growth and impact. For investors like Acumen, this kind of response is critical: It demonstrates a company’s willingness to act on insights, and informs where we deploy additional support or capital.

Listening after we invest

Once capital is deployed, listening becomes even more critical. For example, we partner with our portfolio companies to monitor impact through Lean Data studies at key moments — often six months to a year after deployment, or during major product or operational changes. This helps identify operational gaps early, track whether impact is materializing and provide credible evidence for limited partners.

Take Zeraki Analytics, a Kenyan ed-tech company that was initially focused on providing a desktop administrative tool and an e-learning platform. These tools struggled to take off, as schools were hesitant to recommend a product that was not already embedded in their systems. Through customer feedback with a school administrator, the team realized schools needed tools to manage operations and track student performance more effectively. With this knowledge, Zeraki pivoted to develop a school management platform that is now used by thousands of schools.

For Zeraki, customer feedback was not just validation; it was a roadmap to stronger product-market fit, and it allowed the company to address a key pain point: teachers spending up to half their time on administrative tasks. For Acumen, this feedback offered insight into how our capital could be deployed more creatively, with listening as a priority input to inform further investment decisions, and to help us guide business model refinements in our existing investees. Building on this approach, we are exploring innovative instruments such as performance-based financing to further unlock the impact potential of our portfolio companies.

Far from being incidental, these pivots show how actively incorporating feedback guides companies toward strategies that balance growth with deeper, sustainable impact.

Deploying technical assistance

Listening also guides the kind of technical assistance (TA) and capital we provide. Without this connection, customer and employee feedback risk becoming static data from a particular moment in time rather than fuel for continuous business model iteration.

In Acumen’s “Pathways to Growth” report, we shared how listening uncovered gender-related barriers in the customer base of our portfolio company Koolboks — particularly in women’s access to and ability to afford their solar freezer products.

In response, we supported the company with TA to integrate gender-inclusive product design, pricing and distribution strategies. The insight was clear: Women weren’t excluded due to lack of demand, but because of the structural design of the product and payment systems that were offered by the company.

With tailored TA, Koolboks adapted their financing terms and product features to make refrigeration more accessible to the women entrepreneurs who comprise its customer base. These interventions came directly from customer feedback, refined through dialogue and aligned with business goals. The changes helped strengthen Koolboks’ market access, deepen customer trust and drive inclusive growth.

Listening at the portfolio level

Each year, Acumen reviews portfolio-wide patterns: where companies thrive, where they struggle, and the trade-offs between the breadth and depth of a company’s impact.

For years, our measurement efforts focused on scale. But today, our measurement strategies around workforce development and climate resilience offer richer insights into depth of impact, informing portfolio construction and strategies that pursue scale while ensuring meaningful impact.

Over time, listening has also reshaped the questions we ask. Our early evaluations focused on the breadth of impact, e.g.: How many lives were reached? That quantitative lens helped us understand the scale of our impact and that of our investees, reaching both a company’s customers and its employees. Today, our impact and investment teams also focus on depth, e.g.: Are people experiencing measurable improvements in their quality of life? Are they more resilient to climate shocks?

These aren’t academic questions. They influence whether we double down on a company in our portfolio, how we provide follow-on capital and technical assistance, and what risks we monitor during investment committee reviews.

Making impact with, not for, portfolio companies

Listening creates insights that influence company business models, investor portfolios, and the broader impact investing ecosystem of investors and limited partners. Companies design around customer needs; fund managers embed insights into decisions and support; and partner convenings share learnings with other funders. This is why we work to bring customers, companies and capital providers into the same conversation — so insights aren’t just heard but acted upon.

Impact isn’t just a number reported at the end of a measurement process; it’s an ongoing conversation. When we treat feedback as infrastructure, we build systems that convert insight into coordinated action across companies, funders and communities.

For Acumen, the conclusion is clear: Listening is not a peripheral tool. It is the strategy that allows impact capital to adapt, stay relevant — and deliver change that lasts.

Taanya Khare leads the development and implementation of impact measurement systems working as a Senior Associate at Acumen.

Photo credit: Jacob Wackerhausen

- Categories

- Investing, Social Enterprise