Avoiding the ‘Ick Factor’: Four Easy Steps to Align Your Investments With Your Values in 2018

I get it. You’re a social entrepreneur struggling to get the bills paid. Or maybe you’re a social justice advocate focusing on maximizing your philanthropic contributions – or even just a busy parent or professional with good intentions, but little time to spend pondering your investment strategy. Whatever the reason, when it comes to investing, you can’t always be 100 percent consistent with your values 100 percent of the time.

But as you come into a new year, are you feeling the “ick factor”? That is (as defined by me, not Webster’s): The icky feeling when you believe in certain values (social justice, environmental progress, etc.), but know that your money is supporting all the things you hate (sweatshops, private prisons, fossil fuels, etc.). Synonym: steel plate in the head syndrome (ie: keeping your social values on the left, investments on the right).

I’ve spent the past 17 years influencing more than $150 billion from asset owners excited about the prospect of aligning their values and their money, and I’m thrilled to see so many options available – not just for millionaires but for those of us with more limited resources. I wanted to share some of my experience with you to help kick off 2018, which I further outline in my new book “Real Impact: The New Economics of Social Change”.

Even if you’re deeply concerned about social issues, I’ll speculate that the investment portfolio you have now — whether it consists of a savings account at a big-name bank and a 401(k) invested in mutual funds selected by your employer, or trusts, stocks, bonds, college savings plans or a mortgage — probably doesn’t align with your values. This is not your fault; you’re simply invested in the same things as anyone else who walks into a financial institution looking for guidance. The problem is that once you understand how your financial institution is using your money, the “ick factor” sinks in and it’s very hard to remove it from your awareness.

And if you’re a social entrepreneur raising money — let’s say for a solar company — it’s kind of uncool to say “invest your money in solar, but I’ll keep mine invested in a fossil fuel-loving bank in the meantime.” It’s time to start fighting for what we love without tripping over our shoelaces.

But fear not — you can realign your money with your values simply by moving your money.

Below, I outline four steps that can help get you well on your way to an ick-free 2018. These suggestions are intended to provide an educational overview of options available in the universe of social investment. This is not financial advice and is not meant to endorse any particular product, service or firm. But I hope it inspires you to explore the course of action that works best for your particular needs.

Step 1: Break Up with Your Bank

Chances are your money is sitting at a big-name bank — and it is likely funding things you wouldn’t agree with. For instance: J.P Morgan Chase is the No. 1 funder of fossil fuels, and has put $3.1 billion into tar sands, one of the most environmentally problematic sources of energy. Wells Fargo wound up paying a $1.2 billion penalty to the federal government for its poor practices contributing to the mortgage crisis (and thousands of Americans losing their homes). And … I could go on, but the point of this article is to get you excited about our opportunity to do better – not depressed about the current state of affairs.

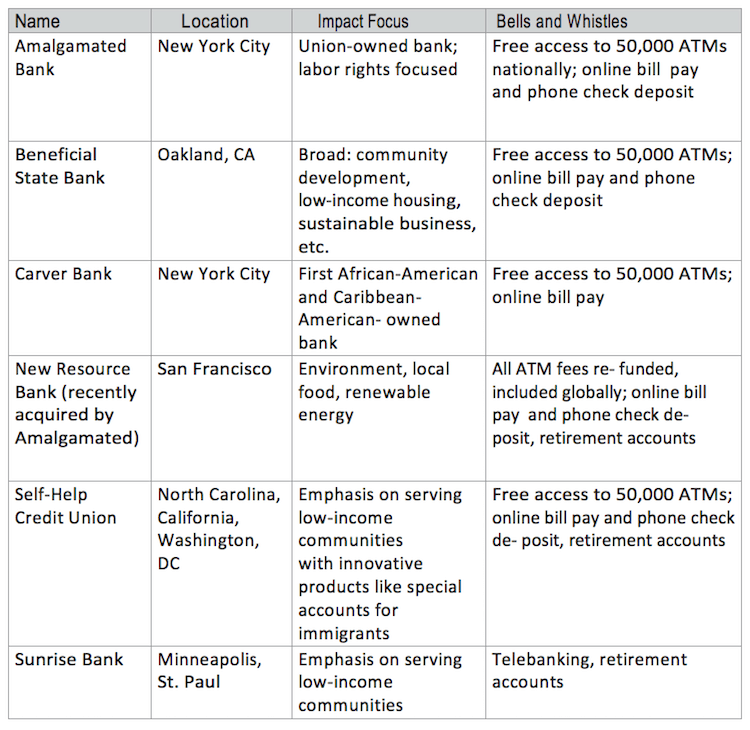

The good news is that there are a number of community banks that can provide all the things you’d typically want — free checking and savings, free ATMs, depositing checks through your cell phone, etc. – while investing customer deposits in a more socially responsible way. Most importantly, they are insured by the Federal Deposit Insurance Corp. (FDIC), meaning that your money is just as secure as it would be at a major bank.

Check out the following social banks to get started. Or to find a community bank, credit union, or co-op in your local area, check out the Opportunity Finance Network for listings.

Step 2: Optimize Your Rainy-Day Fund

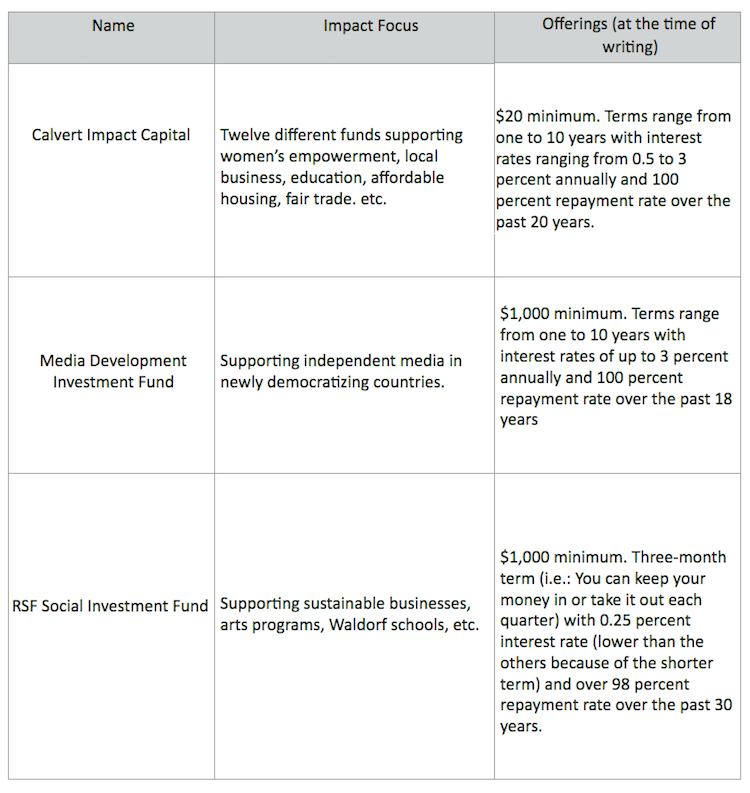

With savings accounts offering less than 0.1 percent interest these days, it can be worthwhile to put some money into a longer-term instrument, called a private debt fund, that could earn you 2 percent or more. As an added benefit, these funds often provide a variety of options for boosting the social impact of your savings.

Most of these longer-term offerings come with some layer of philanthropic money from foundations serving as a guarantee against losses, similar to (though not quite as secure as) the way the FDIC protects banks. The following organizations provide higher interest rates than a bank. They also offer you the ability to stipulate that your money be used for a much more targeted impact if there is a specific area of social change you want to support.

Step 3: Clean Up Your Stocks

You may have stocks that you manage yourself through a platform like Fidelity, or you may pay a financial manager at a firm like Morgan Stanley to make those choices. Often, they simply ask your risk level, and then provide extremely limited information about where your money is actually invested. As the CEO of New Resource Bank likes to say, you should “know where your money spends the night.” If you don’t, presume it’s not where you’d want it to be.

Below are a few choices that you can simply invest in yourself. You also can provide your financial advisor with this list as an educational example, in addition to asking what social platforms his or her firm already offers. Once again, these are just a few of the many options available — from mutual funds to REITs (real estate investment trusts) to ETFs (exchange-traded funds). Work with your advisor to determine a plan that works best for you.

Step 4: Retire with Impact

If you have an employer-provided retirement account, it may offer a social impact investment fund already (such as TIAA-CREF’s “Social Choice” options, for instance). But a variety of other social options could be added to an employer plan, such as Social(k) or Green Retirement, Inc. These can be great choices to recommend to your human resources manager. They are very cost effective, even for small organizations or nonprofits, as a platform for retirement funds – and can deliver returns that are comparable to more traditional funds.

If your job doesn’t offer a retirement plan or you’re an independent contractor, you may want to start an IRA or Roth IRA through your financial advisor or bank. These retirement funds can be managed in a social fashion as well. You can open your account at one of the social banks listed above, or simply ask your financial advisor to explore social and environmental options.

Making banking and investment decisions may seem arduous or intimidating, but each of these four steps can be completed quickly and painlessly – often online, or via a brief meeting with a financial advisor or bank representative. So once you work up the will, you could be just a few hours away from an ick-free life.

Editor’s Note: This article was adapted from “Real Impact: The New Economics of Social Change.”

Morgan Simon is managing director of Candide Group and the author of “Real Impact: The New Economics of Social Change” (Nation Books; October 2017).

Image courtesy of https://www.emojirequest.com