Maintaining a Critical Link To Last-Mile Customers: Challenges and Opportunities Facing Financial Service Agents During COVID-19

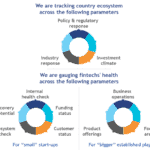

Agents are a critical last-mile link to financial services for lower-income households and micro- and small enterprises, registering new customers and providing cash-in and cash-out services (i.e.: loading value into the mobile money system, and then converting it back to cash again). Depending on local regulations and the broader digital financial services ecosystem, agents may provide other services, too. While agents are not normally direct employees of financial service providers (FSPs), they are often the primary access point for customers. They can help build customer trust in the FSP’s products, and bridge the gap between the cash and digital worlds.

As the COVID-19 crisis has spread globally, limiting people’s mobility, it has had a profound effect on how agents and FSPs operate. On one hand, in many countries, agents are not considered an essential service provider – so the lockdown restricted their working hours, which limits their ability to serve customers. On the other hand, because agents are now sometimes the only interface between customers and their money, they are now taking on extra responsibilities beyond cash-in and cash-out. Below we’ll explore the recent report by Mastercard Foundation’s Savings Learning Lab and Savings at the Frontier, “Leveraging High Performance Agent Networks to Deliver Customer Value,” outlining challenges faced by agents, discussing how they have responded, and highlighting opportunities going forward. We’ll also share how Savings Learning Lab partners are responding to the COVID-19 crisis.

Challenges for Agents and Financial Service Providers

Agents and financial service providers are facing a number of challenges, including:

Reduced transaction volumes and commissions: To take just one example, in March 2020, the government of Kenya issued a directive to waive transaction fees on bank to mobile wallet transfers, cutting the commission paid to agents. While these directives were put in place for public health reasons, it meant that agent transactions and commissions were reduced to half or less. In other countries in East Africa, agents saw fewer transactions – often of larger value – as people were trying to limit their number of visits to an agent to reduce exposure to the COVID-19 virus. These larger transactions in turn created liquidity challenges (see below).

Float management and regulation challenges: Several governments in Africa have announced government-to-person transfers to support their citizens during this pandemic. As a result, the increased use of digital channels caused by these payments has created pressure for agents to rebalance their float more frequently – several times a day in many cases. (Float refers to the balance of e-money, physical cash or money in a bank account that an agent can immediately access to meet customer demands to cash in or cash out electronic money.)

Agents are at a greater risk of exposure to the coronavirus: As the COVID-19 pandemic spread, the World Health Organization warned governments to limit cash transactions, given their potential to transmit the virus. However, agents have been forced to physically handle banknotes, with little or no guidance on appropriate precautions, or access to personal protective equipment (PPE).

Responses by Agents and Financial Service Providers

There are a number of ways agents and providers are addressing these challenges, including:

Revisiting fees and commissions: FSPs are revisiting their agent commission and fee structures. In the Savings Learning Lab’s research, we‘ve seen at least one case where the FSP has started paying its agents a salary plus an additional financial incentive based on their previous commission history, to encourage them to stay on as agents instead of seeking safer or more lucrative work. Using the data and transaction history of agents can help FSPs create a pandemic-specific financial plan, and allow them to develop a short-term coping strategy. In addition, in response to float management challenges, some FSPs have increased the float balance of super agents (who often manage a group of agents in a specific geography) by up to five times, to support the frequent float rebalancing requests coming from field-based agents.

Providing Personal Protective Equipment: The pandemic has increased the cost of doing business for many agents, as they now need to have masks, hand sanitizer and other PPE to ensure they provide a safe transaction space to their customers. Given the decline in commissions, this is not always a viable option for agents. We found several examples of FSPs that are now providing their agents with PPE, along with guidance on how to safely conduct transactions.

Adapting service models: FSPs are being forced to adapt their service models and expand the role of their agents. Two recent examples include:

- Increasing visibility and providing PPE training: Many agents who collect daily savings from customers have increased their visibility and level of interaction with savers, to maintain confidence that their business was still up and running. On the FSP side, many now empower agents to play the role of community trainer – e.g.: to guide the customers about the proper use of masks, sanitizers and hygiene measures, alongside their routine savings collection.

- Use of technology to circumvent gathering rules: Another example of service adaptation comes from Zambia, where the government limited the number of people gathering in a place to 20. In response, one of the financial service providers working with local savings groups (which usually have 20+ members) informed the group members that they could either pay digitally before the group meeting time into the agent’s account, or they could pass their weekly savings to another group member – thus reducing the number of people who would need to be present for the group meeting.

- Remote agent management: Some FSPs are calling their agents more frequently, and using communication channels such as WhatsApp to monitor their liquidity needs and address any other business challenges in a timely manner.

Opportunities going forward

As outlined in our recent report, the increased use of technology offers considerable opportunity for managing and supporting agent networks, especially as providers adapt to respond to the challenges of the COVID-19 pandemic. Some specific opportunities include:

Remote training and performance management to support agents: Even before the pandemic, FSPs were increasingly turning to technology-based solutions for agent management, such as e-learning apps for training, WhatsApp for agent communication and monitoring, and real-time data dashboards for liquidity and performance management. These solutions have proven to be essential in the current context, where FSPs’ staff travel and contact with agents has become limited, but the need for agents to cash in and cash out has grown. They also offer a unique opportunity for FSPs to adopt a data-driven approach to managing and growing their agent networks and delivering value to customers.

Information sharing and quick adaptation to support clients: In many cases, government regulations around both social interactions and payments are changing rapidly. FSPs have an opportunity to proactively communicate with agents, to make them aware of these changes and help them provide the right support to customers. Some FSPs are leveraging existing agent communication platforms such as WhatsApp or SMS to provide information on new regulations, revised fees and COVID-19 prevention tactics.

The pandemic has accelerated the shift to mobile money across sub-Saharan Africa, but it threatens to leave behind the most vulnerable customers and communities. Agents have proven to be an essential link to serving these customers – they are embedded in the communities and have a close relationship with them. Investing in developing and maintaining a robust agent network could be key to building a digital financial ecosystem that is not only resilient, but truly inclusive.

Want to know more?

“Leveraging High-Performing Agents to Deliver Customer Value” provides an overview of how agents are an essential component of delivering value to informal savers and other excluded populations. Drawing on the experiences of FSPs partnering with Savings at the Frontier in sub-Saharan Africa, the paper offers guidance on key strategies for building and managing high-performing agent networks – including selecting and recruiting agents, training and monitoring them, and designing incentives to motivate them.

Additionally, if you want to learn more about solutions for managing agent liquidity, our partner Savings at the Frontier recently produced this excellent “How To Note” on liquidity management, with an informative blog on the specific difficulties presented by COVID-19. In addition, for practical examples on agent banking pricing strategies and technology solutions for agency banking, we invite you to read these case studies from our partner Scale2Save.

Nisha Singh is an Independent Contractor and James Robinson is a Principal Consultant at Itad.

Photo courtesy of World Bank.

- Categories

- Coronavirus, Finance, Technology