Cutting Edge Agriculture: How Artificial Intelligence, Satellites and Big Data are Transforming Farmers’ Access to Finance

Editor’s note: This post is part of NextBillion’s series, “High Tech Buzzwords: Hype or Real Impact?,” — one of several topics we’re covering through special series this year. Click here for more details on our 2018 series.

It is often said that there is more “tech” than “fin” in fintech innovation. But when it comes to the oldest sector in the world, agriculture, this dichotomy isn’t sustainable: Both a financial and a technological revolution are necessary to meet the burgeoning demand.

The latest World Bank estimates suggest the demand for food is expected to rise 70 percent by 2050 to feed an estimated 9 billion people. Agricultural finance, therefore, is not just an enabler of farmers’ success – it has become an imperative for everyone’s existence. Bridging the $450 billion gap in financing, of which roughly 3 percent is met, is a gigantic task. It will require a new synergy between financial and technological tools – and fortunately, this transformation is underway.

Lending Constraints

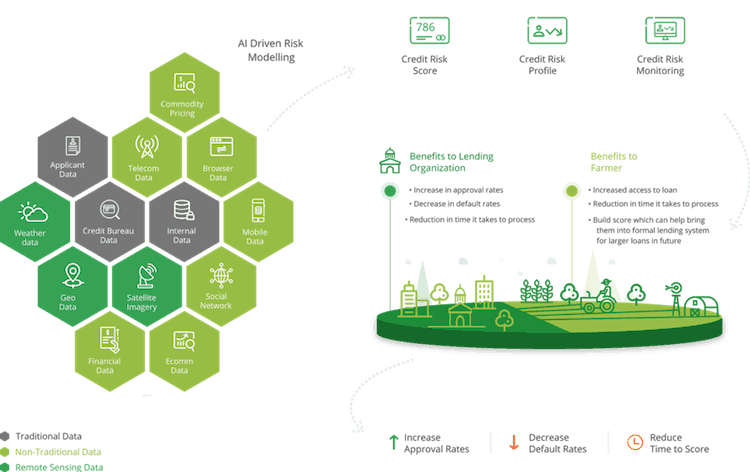

There is a long list of reasons for the deficit in financing, but many stem from a massive data asymmetry, and lending institutions’ inability to monitor their clients and their loans. A bank or a microfinance institution (MFI) needs to have a good estimate of a farmer’s likely income — not just how much they will earn, but when will they earn it and the risks associated with different income streams — to decide whether to extend a loan.

For most farmers, the best assessment of cash flows is directly related to what is growing on the farm. If there were a way to detect activities on the farm, measure changes and predict outputs, this – alongside market prices – could provide tremendous insights that could allow financial institutions to offer better products, and serve their customers (farmers) much more efficiently. So how can we track, measure and distill all this information into actionable insights – and do so at scale?

Technology to the Rescue

Advances in satellite imaging data and machine learning are facilitating huge improvements in this space. Data on soil and weather conditions and cropland management practices are increasingly available, even in extremely remote regions. Today, advanced technology allows satellite images to indicate live vegetation and plant-to-water content at all times, which can be used to monitor crop growth, health and status throughout the growing cycle, and to assess crop damage and drought threats. The number of satellites capturing data on a global scale is increasing exponentially, resulting in more frequent data capture, higher-resolution image quality and more importantly, lower costs. The high resolution and public availability of these satellite images will allow agriculture stakeholders to monitor yields remotely, even on very small holdings of land.

This provides a unique opportunity to drive massive scale in rural finance. Using advanced data analytics and machine learning techniques, crops planted can be identified on different parcels of land without having to visit thousands of farms. Models can be built to ascertain the likely monetary value and timing of harvests, and also to predict the likelihood of default for large populations of farmers. Crops’ progress can be tracked through the growing cycle and can be compared with historical satellite data to provide an early warning system for any factors that could lead to loan defaults.

Meanwhile, artificial intelligence (AI)-based algorithms, due to their growing sophistication, have proven to be viable alternatives to traditional credit risk assessment models. For example, in Uganda, a lack of effective risk assessment mechanisms has led to limited and inefficient loans to coffee farmers. Harvesting Inc., in a project we undertook with CGAP in the country, found that these loan decisions were costly, slow and difficult to scale. But by using an AI-backed credit model, we were able to prepare accurate credit scores for farmers in a pilot project, using historical transaction and alternative datasets. We plan to deploy this solution soon in production, in collaboration with a partnering MFI.

Tech Responses to the Challenge of Monitoring

But while the usage of AI and alternative data sets such as estimated crop yield empowers lenders to perform better credit risk assessment, financial institutions face the limitations of monitoring loan utilization. For instance, in Nigeria, like many other agrarian emerging markets, government-subsidized agriculture loans were being used for non-agriculture purposes, resulting in a trust deficit as well as negative returns on investment.

In response, remote sensing satellites now enable continuous monitoring of cropland, allowing lenders to intervene, in a cost-effective way, with corrective actions to ensure loans are utilized for their intended purpose when non-agriculture activity is detected. The satellites also empower institutions to react to shocks before they cause farmers any financial distress. For example, satellite monitoring allows them to detect any initial indication of crop damage or inadequate irrigation, and to alert farmers to take immediate corrective action before the damage becomes a major issue.

Democratizing Agriculture Data for Smallholder Farmers

Most of the issues faced by 500 million smallholder farmers across the world boil down to a data deficit between farms/farmers and other stakeholders in the agriculture value chain, be they financial institutions, crop insurance firms or even storage and logistics providers. For the first time, technology is now growing quickly enough to fill in these information gaps on a global scale. This has the potential to solve many of the core issues that not only impact these farmers and their families, but also have direct implications for the future well-being of the human race.

Ruchit G Garg is the founder and CEO of Harvesting (www.harvesting.co), a company focused on connecting finance with small farmers in emerging markets.

Photo by Harvesting, Inc.

- Categories

- Agriculture, Technology, Telecommunications