Designing a Mobile Wallet for Nonliterate People: A Beginner’s Guide

There are approximately a billion adults in the world who can’t read or write. Yet, they are often successful participants in a thriving economy. Illiterate people comprise what is known in many parts of the world as the “oral” population, which uses a wide range of tools like speech, pictures, tally, cash, etc., for processing and managing information.

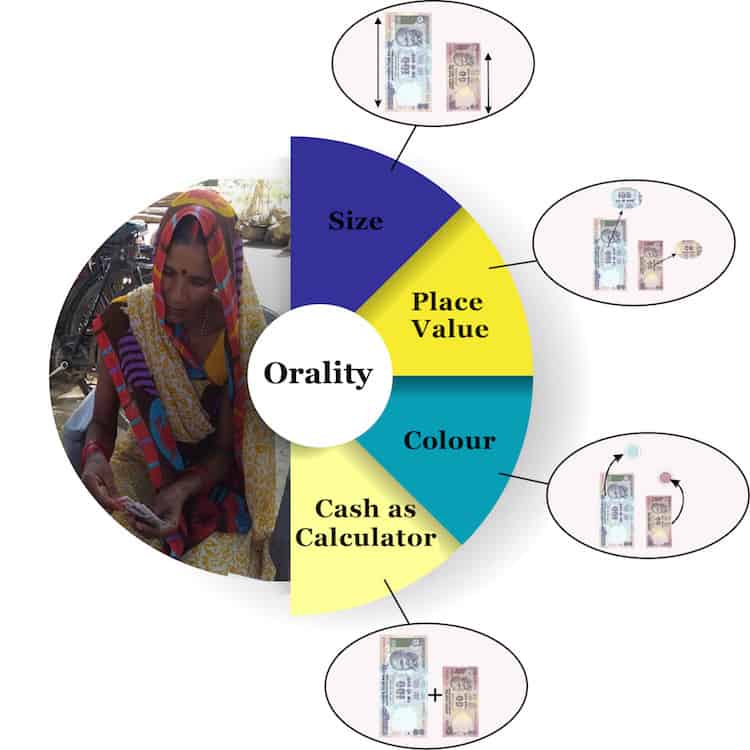

A recent report by MicroSave and My Oral Village explores “orality,” which refers to modes of managing information among people who barely or do not use text. This research not only describes the strength and constraints of illiterate and neo-literate people, but also how to leverage that knowledge to build an effective user interface. It talks in detail about design principles for developing a user interface and gives a new direction to mobile wallet design. Using the research findings, a prototype of a mobile wallet phone app, MoWO, has been developed for people who can neither read nor write. This article talks about the nuances of orality that went into designing this intuitive interface.

What are the Characteristics of Nonliterate People?

A literate person’s mind is developed by repeatedly practising lessons taken at school, but the nonliterate masses apply other methods of learning. Illiterate people may be innumerate and may have a cognitive gap in recognising multi-numeral strings, but they can recognise currency and count with minimal to no mistakes. They rely on colour, relative note size, imagery, the number of zeroes on the currency notes, etc. Taken together, these clues are adequate for them to total the amount. The cash currency system helps them develop an accurate way of counting.

A person’s numeracy skills are based more on his/her involvement with the economy in terms of professional exposure, and even handling household cash, rather than schooling. For example, a vegetable vendor must calculate price-per-quantity of different vegetables bought and sold (including spoilage) and all-in profit margin. A homemaker who handles household expenses must buy groceries for the family, pay electricity bills and calculate/track total household income and expenditure. Schooling or no schooling, the necessity of processing numbers makes them adept at calculations.

Developing ‘Guessability’ in Mobile Wallets

This brings us to the second issue at hand – guessability and learnability of the wallet interface. Guessability is the measure of ease of understanding the information flow and performing a transaction for the first time. The time it takes, and errors that one makes, are among the factors taken into account while gauging this key aspect of user interface design. The better the guessability, the easier it is for the users to learn it and use it intuitively. Because of the issues highlighted above, the guessability of a series of icons and processes is very different for illiterate and literate people.

What are the Lessons for Financial Service Providers?

To begin with, service providers need to acknowledge the existence of illiterate people. Going forward, these providers need a deeper understanding of the oral skill sets, perspectives and cultural nuances, all of which can be absorbed and moulded into an intuitive wallet design. Designing for the masses is best done by factoring all these inputs into the creation process. It’s essential to map the customer’s journey and behavioural barriers to ensure easy uptake and usage. This necessitates careful iterative testing to design interfaces that will work for both literate and illiterate.

Vivek Anand is a manager with MicroSave’s digital financial services – banking and product development domain. Saborni Poddar is an associate in MicroSave’s digital financial services domain. This blog is based on research conducted by MicroSave and My Oral Village in India.

Photos courtesy of MicroSave and Michael via Flickr.

- Categories

- Finance, Technology