Adapting to Survive: New Study Reveals the Importance of Digital Payments to Small and Micro Businesses in Mexico

Small businesses are the backbone of our global economy — the World Trade Organization estimates that 95% of businesses across the world are micro, small and medium enterprises, and they account for 60% of global employment. This past year, we have witnessed the devastating effects of COVID-19 on these businesses; they have been hit the hardest during the pandemic, and some have been completely unable to weather the shocks. In 2020, 1.1 million micro, small and medium enterprises in Mexico — over 20% of registered MSMEs — permanently shut down operations, and almost 80% of MSMEs reported a decrease in income, according to Mexico’s National Institute of Statistics and Geography.

A new study of 750+ small and micro businesses (SMB) owners in Mexico, conducted by 60 Decibels and commissioned by Visa, offers important insight into how digital payments can support the growth of these businesses and help make them more resilient in the face of unpredictable shocks like COVID-19. The data was collected through an online survey of businesses that had begun accepting digital payments at a maximum of 18 months prior and that had made a digital transaction in the last three months. Below, we’ll discuss some of the experiences these entrepreneurs shared, and what they mean for small businesses and the stakeholders that support them.

The Impact of Digital Payments on SMBs During COVID-19

When COVID-19 hit Mexico and all cash payments came to a halt, Rodrigo (names have been changed to preserve anonymity), a small business owner, was forced to pivot: “I was old school, but I needed to adapt to change,” he said. “Accepting digital payments enabled me to keep the doors open…” At the height of the pandemic, 90% of Rodrigo’s transactions were digital payments compared to just 10% before he set up an online presence.

Rodrigo’s situation is not unique. A large majority of the businesses 60 Decibels surveyed (81%) reported negative impacts to their businesses due to COVID-19. However, over a third of the entrepreneurs spoke about an increase in accepting digital payments since COVID-19, demonstrating that digital payments can play an important role in recovery. A similar proportion had increased delivery and/or online sales to cope with the pandemic.

What’s more, the business owners who use digital payments spoke about the positive impact on their top line. Overall, 75% of respondents reported revenue increases driven by digital payments — and among those who reported revenue increases, the average increase was 22%. Seventy-two percent of all respondents said that their customers were spending more, and 76% had seen an increase in the number of customers due to digital payments. Beyond the monetary impact, business owners reported improved business management because of digital payments, in part due to increased security and visibility into payment activity. The study helped demonstrate how digital payments can support SMB growth and resilience in Mexico, particularly in the context of the pandemic.

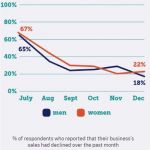

The research also uncovered an interesting nuance around digital payments and gender. The study showed female business owners were more likely to emphasize the safety and security of digital payments as a primary driver for satisfaction and were more likely than their male counterparts to recommend accepting digital payments to other SMB owners. Females, however, cited more frequent technological issues with digital platforms than male business owners, highlighting a need (and opportunity) for targeted onboarding and troubleshooting support.

The Human Stories Behind The Digital Payments Data

Beyond the impact of digital payments on SMBs’ growth and business operations, the study captured the human stories behind the data through in-depth interviews to illustrate how business owners are taking more risks, becoming tech-savvy and increasing resiliency because of digital payments.

For instance, Ana Rosa, who runs a convenience store and restaurant in Chiapas, expressed the peace of mind digital payments offer her family and business. When she took over the family business, her priority was to implement a digital payment system, and since then her sales have nearly tripled.

María José, who has operated a convenience store with her husband on the outskirts of Acupulco for 27 years, reported similar benefits. Two years ago they started accepting digital payments. Her store now has a competitive advantage by being the only local “abarrote” that currently accepts digital payments. “People are shocked and say we’re just like a convenience store chain because we accept card, utility payments, and facilitate recharges,” she said.

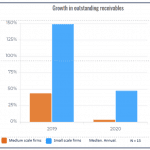

However, despite the overwhelming benefits of digital payments, roughly 66% of total transactions are still being conducted in cash, according to the business owners we interviewed. While this might reflect the payment preferences of customers, it also points to a need to increase consumer awareness around the benefits of digital payments. This research suggests that business owners who accept more than half of their transactions digitally experience greater benefits than those who use digital payments less frequently. Digital payments are also an on-ramp to digital financial inclusion, a point of entry that unlocks other benefits of digitization and financial services. Boosting usage of these payments can provide support to both business development and financial inclusion efforts.

The data and perspectives from the 60 Decibels’ research contributed to a Visa analysis resulting in a set of actionable insights for policymakers, financial service providers and other stakeholders to support the expansion of digital payment acceptance among small businesses. You can find more information in the full report.

Devin Olmack is a Senior Associate and Ashley Speyer is head of global Research Operations at 60 Decibels.

Photo courtesy of USAID Digital Development.

- Categories

- Coronavirus, Finance