Do You Speak Social Finance? Helping Entrepreneurs and Impact Investors Overcome their Language Barrier

Social entrepreneurs and impact investors struggle to speak the same language. Why so? Entrepreneurs in need of growth capital tend to lack the necessary financial skills, while investors often fail to comprehend the dimension of impact. A new online education platform, the Social Finance Academy, strives to overcome this language barrier.

“Discussions with investors are always good for a surprise,” Felix Schaefer, a German social entrepreneur, says of the process of raising growth capital. “… an important insight is that you have to translate your idea into a language that investors are able to understand.”

Despite the recent hype around impact investing, the social capital markets still display a strong mismatch between the supply and demand of financing. This gap is most problematic for social enterprises in the earlier stages of their life cycles. How can they ever grow and scale? When looking for the root cause of this phenomenon, one reason quickly stands out: Entrepreneurs and investors simply do not speak the same language. But how to overcome the Babylonian confusion?

Today, access to appropriate finance remains the biggest barrier for startups and established social enterprises, as reported in “The State of Social Enterprise Survey 2017” in the U.K. In particular, securing the “right finance at the right time in the right form” presents a huge challenge to organizations pursuing a social mission. In a previous edition of the survey, social entrepreneurs admitted that their biggest skill deficiency is in financial management and capacity to seek external finance. This knowledge gap is not limited to the U.K. Around the globe, investors complain about a lack of investment readiness among their potential investees. What they want to hear is a compelling impact story based on a sound financial bottom line – preferably in a language they can easily understand.

Social entrepreneurs, on the other hand, feel no less misunderstood. In an impact measurement study commissioned by the DCED (Donor Committee for Enterprise Development), social enterprises from various continents reported their very mixed experiences with investors’ approaches to impact. Even impact investors admit that “We still lack a common convention for measuring the impact of impact investing,” as Bridges Fund Management founding partner Brian Trelstad put it. A discussion paper by Oxfam goes one step further: To address the mismatch between capital supply and demand, instead of trying to prove that impact investing can achieve market-rate financial returns, investors should ask themselves: “What kind of skills, support and funding does this enterprise need to be successful, and am I in a position to provide it?” So where are all the investors who really understand impact and know a great solution when they see one?

The vision of the Social Finance Academy is to get both sides together. This free online platform is a one-stop-shop for practice-driven, open online education, combined with targeted, personal on-site trainings.

“Our mission is to educate impact investors, social entrepreneurs and philanthropic funders to successfully attract and invest capital for scaling positive impact,” explains Bjoern Struewer, CEO and founder of Roots of Impact. He incubated the Social Finance Academy out of Roots of Impact after seeing many social entrepreneurs struggle with financing issues in his years as a senior advisor at Ashoka. The academy aims to tackle this issue by enabling investors and entrepreneurs to reach common ground and finally speak the same language – social finance.

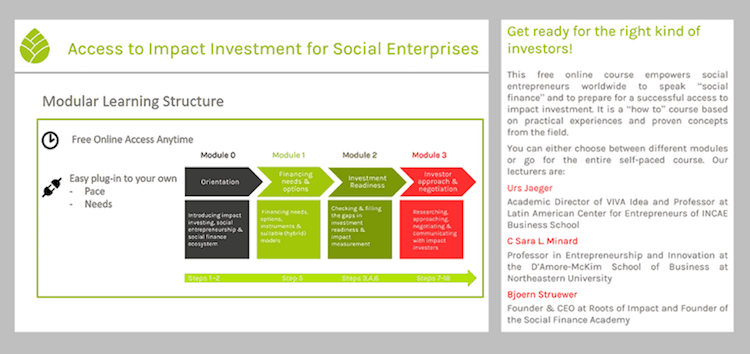

In a first step, the online course “Access to Impact Investment for Social Enterprises,” co-developed with VIVA Idea, is offered as a free, easy-to-plug-in and always-available learning package. Following positive experiences from the first launch with nearly 2,000 registered online users in May 2017 and a combined on-site training pilot with three Impact Hubs and one Social Impact Lab from Europe, Asia and Latin America, the course will now include:

- a modular structure with nine units for a flexible learning experience;

- action-driven tools and features such as lecture videos, worksheets, case studies, templates, online readiness checks, infographics, expert views and “deeper dive” material;

- access to a global community of like-minded social finance learners and peers, and

- a specific focus on investment readiness, impact measurement and financing options.

The course offering is now open for free registration and learning at www.social-finance-academy.org. The new platform is supported by the Swiss Agency for Development and Cooperation, whose mission is to reduce poverty and overcome major global challenges such as climate change, migration flows and access to water. The invitation to learn goes to any impact actor who wants to become fluent in social finance – regardless of where in the world he or she creates impact. The platform is international by design, with current packages offered in English first. Initial feedback from online and on-site users is very encouraging.

But even for social entrepreneurs who feel well-equipped for the capital raising adventure, there is always something to learn. As Schaefer puts it: “In my view, this is a typical syndrome of social enterprises: You firmly believe that your vision is immediately clear to everyone. In reality, it is healthy to step back for a moment and consider the ideal way to communicate your mission to external stakeholders.”

Christina Moehrle is an advisor at Roots of Impact, a specialized advisory firm for more effective impact investing and blended finance. Maxime Cheng is programme manager of the Social Finance Academy at Roots of Impact.

Photo courtesy of Pexels.com

- Categories

- Investing, Social Enterprise

- Tags

- impact investing