A Sector in Ruins or ‘Building Back Better’? Findings From e-MFP’s Covid-19 Financial Inclusion Compass

It was in the aftermath of World War II and the planning for what would become the United Nations that Winston Churchill famously (and possibly apocryphally) remarked that one should “never let a good crisis go to waste.” This idea – repeated in countless contexts since then – has become virtually axiomatic: Crises present opportunities that are inaccessible in normal times, when inertia and the gravitational pull of the status quo prevent meaningful, positive change.

There’s no doubt that the world is now facing not one but two historic crises: a novel virus that spreads like wildfire, and a global recession and mounting debt sparked by the resulting economic shutdown. In developing economies this dual crisis is especially acute, threatening the livelihoods of hundreds of millions of people who are uniquely vulnerable to shocks, and whose livelihoods are disproportionately dependent on human mobility, international trade and tourism. Many of these countries lack the means or infrastructure to distribute emergency cash transfers to protect people whose incomes have collapsed. And if that weren’t enough, within the financial inclusion sector the combination of clients suddenly unable to repay loans, the pressure to repay maturing debt to investors, and the need to protect staff and ensure access to savings has put many financial services providers in a liquidity and solvency crunch from which many will surely not survive.

So, where’s the opportunity in this crisis, Winston? How do we avoid letting it go to waste, before it has laid waste to decades of progress in protecting and serving the bottom billion?

The Covid-19 Compass: Charting the Greatest Crisis in Financial Inclusion’s Modern History

Since 2018, the European Microfinance Platform (e-MFP) has published an annual Financial Inclusion Compass – a cross-sector, mixed-methodology survey looking at current trends, future new areas of focus, and sector stakeholders’ perceptions of challenges and opportunities. Clearly, this year’s Compass survey happened at an extraordinary time, so e-MFP decided to re-purpose it for this critical moment, asking: How severe are the various challenges facing different stakeholder groups? What should the sector’s priorities be in the medium-term – both to recover from this crisis and put in place measures to mitigate the next? And how will this year transform the sector – for better or worse?

To this end, e-MFP ran the repurposed survey this summer and has now published the Covid-19 Financial Inclusion Compass, a special edition of the Compass series specifically focused on the current challenges, medium-term priorities, concerns, opportunities and forecasts for a sector facing probably the greatest crisis in its modern history.

The Covid-19 Financial Inclusion Compass survey was open for two weeks in June 2020, and was available in English, Spanish and French. The survey had two sections, with the first section having two parts. In section 1A, respondents were asked to score various challenges facing different stakeholder groups on a severity scale of 1-10 (though they could also answer “I don’t know”). In section 1B, respondents were asked to rate the importance of various medium-term priorities for different stakeholder groups (again on a 1-10 or “I don’t know” scale) and offer comments. Section 2 was entirely optional, and involved three open-ended questions on concerns, opportunities and forecasts.

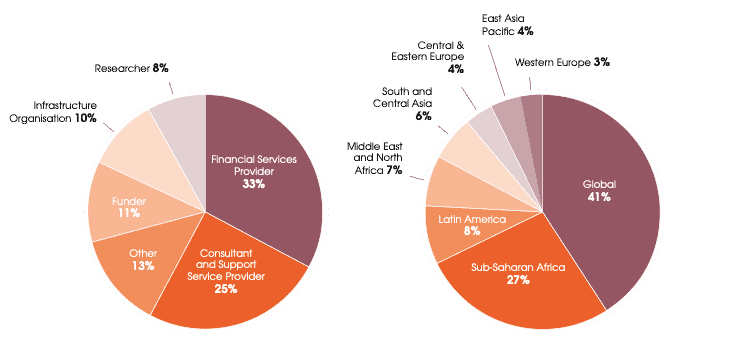

There were 108 complete responses to the Covid-19 Financial Inclusion Compass from 44 different countries. The pie charts below show the distribution of respondents by stakeholder category (on the left) and primary geographical region of focus (on the right).

All the scores in section 1 on challenges and priorities were disaggregated by respondent type too, revealing interesting variations in perspectives. Respondents provided hundreds of comments as well, and expanded upon them in section 2, which comprised open-ended questions about concerns, opportunities and forecasts for a post-Covid-19 sector.

Tentative Hope – And Widespread Anxiety

Like CGAP’s Global Pulse Survey of Microfinance Institutions (which suggests that the worst case scenario of widespread liquidity crises among providers may not come to pass, but that there are immense challenges ahead), the Compass results paint a mixed picture. The responses show real fears for the future of financial inclusion and the clients it serves – yet these are interspersed with some tentative hope for how the crisis could catalyse positive change as well.

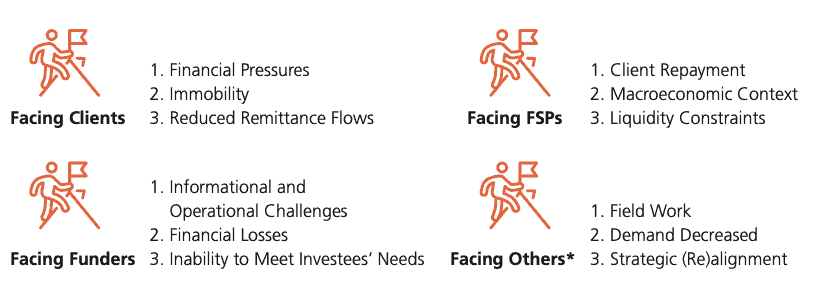

Overall, respondents were quantitatively and qualitatively more concerned about the current challenges facing clients than those facing providers, funders or other stakeholder groups, with financial pressures on clients a clear top challenge. For providers, client repayment (a corollary of financial pressures, of course) was seen by respondents as the most significant challenge, with the macroeconomic context and liquidity issues also highly concerning for most respondent groups. The inability to conduct field work was the most significant challenge for technical assistance providers, infrastructure organisations and other support providers.

Most Significant Current Challenges Facing Different Stakeholder Groups

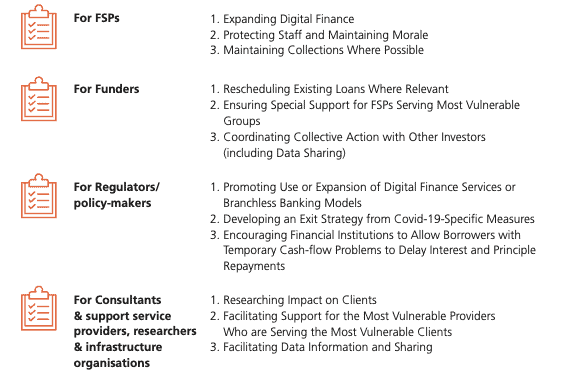

On the topic of medium-term priorities for different stakeholder groups, respondents continue to be bullish on the catalysing effect the crisis can have on the expansion of digital financial services: According to respondents overall, this should be a top priority for both providers and regulators/policy-makers. The report also examines some interesting and stark differences in perspectives between different respondent groups on the various priorities for financial services providers, funders and support providers.

Most Significant Medium-Term Priorities for Different Stakeholder Groups

Overall, though – and this is particularly clear from the open-ended questions in section 2 of the survey – there is a sense that the financial inclusion sector is highly anxious about the consequences of the pandemic. These concerns are especially driven by the economic downturn, and they’re focused on liquidity-starved providers and investors – but most of all on clients. There is palpable anxiety that this crisis may be the death knell for the sector, undoing decades of progress.

Helping the Sector Weather the Storm

How can those working in financial inclusion ensure that client protection is maintained among those providers that weather this storm? What will the sector look like after the consolidation that appears to be inevitable? How can you prepare for eventualities in a context so riven with macroeconomic and microeconomic uncertainty? The various and comprehensive answers to the survey question on stakeholder concerns makes for sobering reading.

But with a nod once more to Churchill, there is also a clear sense that this crisis must not be wasted – that once the more acute consequences pass, there will be opportunities to leverage unprecedented sector collaboration and energy to “build back better,” as Mayada El-Zoghbi put it on a recent webinar to present the Compass findings. (Her thoughtful response to the Compass findings is well worth reading too). Is this a chance, after several market crises and the steady creep of consumer finance and digital credit into financial inclusion, for a re-think about the sector’s purpose? Many Compass respondents think so, and their ideas are presented at length in the “opportunities” section of the paper.

Nevertheless, the respondents are not monolithic; there are real differences in opinions both between and within respondent groups. Overall, if there is agreement on one point throughout the entire Compass survey, it is that Covid-19 will profoundly change the entire business of financial inclusion. Some financial providers will undoubtedly go bust. Some will see consolidation. Possibly millions of small businesses will not recover. Donor funding may be threatened. Progress in client protection may be undone – or even given new impetus. And the coronavirus itself may linger for years, causing untold human misery. Some of these eventualities are outside the control of those working in financial inclusion. But many of the consequences of this crisis – on clients and providers especially – are clearly still in flux, and will turn on the courage, vision, sacrifice and energies of all types of people. Much depends on what paths they take next. We hope that this compass is a useful navigational guide.

The Covid-19 Financial Inclusion Compass and previous Compass editions are available on e-MFP’s website.

Sam Mendelson is Financial Inclusion Specialist at e-MFP and the lead author of the Compass series.

Photo courtesy of Sergey Sokolov.

- Categories

- Coronavirus, Finance, Investing