Failure to Thrive: Nigeria’s Digital Financial Services Industry is Struggling – Can These Policy Solutions Help?

Compared with other emerging economies, Nigeria has a high number of licensed mobile money operators – 21 in all, the most in the world. But the country’s low adoption rates of digital financial services (DFS) – primarily by the underbanked and unbanked – has long been a matter of concern to industry players and development professionals. Though many see the growing ubiquity of mobile devices as the key to changing this dynamic, the nature of the Nigerian ecosystem and several failed efforts by the government have proven that there’s no magic wand for deepening financial inclusion.

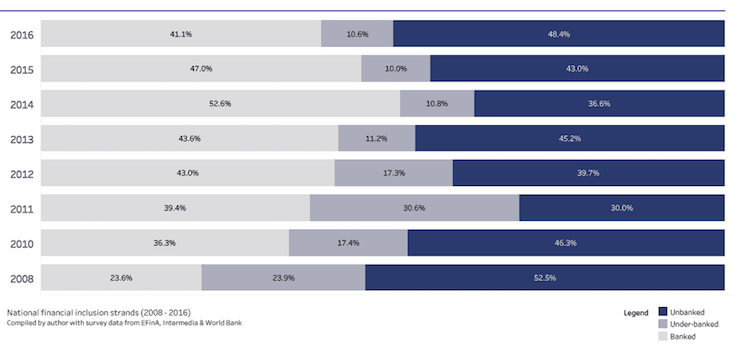

In 2012, the National Financial Inclusion Strategy was launched, an ambitious document that explained the goals of the Central Bank of Nigeria to reduce financial exclusion to 20 percent by 2020. Not long after, a three-tiered know-your-customer (KYC) regime was introduced, which enables financial service customers who are unable to satisfy all KYC requirements to still access financial services – albeit with limited transaction thresholds. In spite of these measures, exclusion has increased rather than decreased. Several factors are responsible for this, including the fact that a majority of the unbanked population resides in rural and remote regions, (Nigeria is about 51 percent rural). An underdeveloped mobile money and banking agent network and a general distrust of the financial services industry on the part of customers also contribute to this exclusion.

It has become obvious that the problem is cross-sectional and multidimensional, requiring us to look at the various issues like an onion and peel it one layer after the other.

In 2016, the Sustainable and Inclusive Digital Financial Services (SIDFS) initiative of the Lagos Business School published the first DFS State of the Market Report, which focused on two pillars of digital financial inclusion in Nigeria – the demand and supply perspectives. By profiling under-banked and unbanked consumers, we identified key characteristics of the underserved market, profiling customer segments to enhance supplier know-how and aid product development. In December 2017, we released a new State of the Market Report, which expanded on these themes and provided insights into the institutional frameworks necessary for financial inclusion. It identifies market-enabling policies that could allow DFS to thrive in Nigeria, and provides recommendations for new legislation, policies and regulations aimed at supporting the business environment in the country.

Below are some of the issues and insights the report highlights:

Consumer Constraints to DFS Adoption

From the consumer’s perspective, the lack of adoption of DFS can be attributed largely to economic factors: Consumers lack access to money as a result of unemployment and under-employment, therefore they feel they have limited need for formal financial services. Lack of knowledge of these services is another factor, demonstrated by low awareness of the various DFS options available. Thirdly, despite high mobile penetration levels, many of the unbanked lack access to digital devices of any kind.

Providers Don’t Understand Customers

In the case of the suppliers and providers of digital financial services, some need to go back to the drawing board. At the point of market entry, many providers are misguided by the apparent size of the total addressable market without realizing that market size may not necessarily translate into high adoption rates. Hence, providers and operators need to develop products and services for target groups of customers that address specific pain points.

But this presents another problem – there is a dearth of insight into and understanding of the intended consumers of digital financial services. These unbanked individuals are not in any database, and hence their behavior and traits are largely unknown. To include these individuals, providers need to know who they are and what problems they have that may be addressed by financial services.

How Regulators Can Help

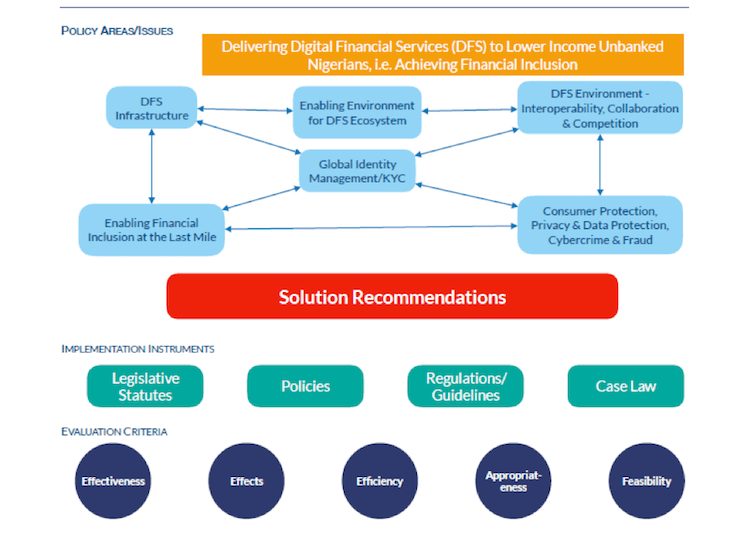

As for regulators, the policies guiding the provision of DFS is another key issue to consider. Is the market environment conducive for DFS operators and the consumers of their financial products and services? Our research suggests that the answer to that question is no, and it identifies six key policy areas in need of regulatory attention.

- The first involves global identity and know-your-customer regulations. We’ve found that the multiplicity of identification systems and their low enrollment numbers are limiting financial inclusion. In these cases, the industry needs policies to increase the enrollment capabilities of both Nigeria’s National Identity Number (a centralized identification system for every Nigerian citizen, similar to the social security number in the United States) and the Bank Verification Number (a centralized biometric identification system for the banking industry).

- The second policy area is consumer protection. By this, we refer to the systems and processes that build consumer adoption, utility and trust. This includes issues relating to pricing, complaints and dispute resolution, cybercrime, data protection, and so on. While the consumer protection issues in Nigeria are diverse, one of our recommendations includes the use of mobile money and banking agents as first-level support specialists. Since agents are the first and sometimes only interface some customers have with a financial institution, empowering them to resolve complaints and disputes on behalf of the institution – rather than having customers travel great distances to a bank branch – improves the customer experience. Other recommendations involve a proposal for a centralized “financial ombudsman” – an independent body established by the government to settle disputes between financial service institutions and their customers, similar to what is provided in the U.K. – and the education of law enforcement and judicial workers on cybercrime, enabling them to facilitate better enforcement. The country’s Consumer Protection Bill, which is currently awaiting presidential sign-off, would be helpful in achieving a safer ecosystem.

- The third policy area focuses on the DFS supply environment. This covers issues like supporting interoperability between different mobile money networks, and enabling collaboration and cooperation among the different providers and regulators within the ecosystem. The lack of a unified agent framework or regulations guiding agents’ provision of financial services prevents them from delivering services that go beyond basic banking.

- The fourth policy area involves the enabling environment for a thriving DFS ecosystem. Issues to prioritize in this area include the development of a harmonized tax regime across Nigeria’s three tiers of government – federal, state and local. Currently, agents who are micro and small business owners are constrained by multiple statutory obligations and often-indiscriminate tax/fee requirements across these three tiers. Also, there is a need to implement the March 2013 National Executive Council resolution on right-of-way. In a bid to enhance mobile reach, quality and access, telecommunications providers need to deploy infrastructure across the nation. The need for right-of-way permits granting access to road ducts is under the control of state governments, but each state has different pricing tariffs. This lack of standardized pricing remains an issue.

- Finally, discussions on financial inclusion cannot be complete without addressing lapses in the telecommunications infrastructure and strategies to effectively reach consumers where they live. The passage of the national critical infrastructure bill will enable the demarcation of telecommunications infrastructure as “national and critical,” which should help deter vandalism. Also, more focus is needed on the expansion of telecoms infrastructure to rural locations, or locations that don’t yet have a proven business case for commercial investment. This is something that could be accomplished using specialized intervention funds such as the Universal Service Provision Fund, which was established by the federal government to facilitate universal access to information and communication technologies in rural, unserved and under-served areas in Nigeria.

These are just some of the policy issues we identified and analyzed: The report explores them in much deeper detail while providing insights into the institutional frameworks and policy changes required for DFS businesses to thrive. Guided by existing laws, the report concludes by proposing market-enabling policy solutions. You can learn more by downloading it here: Digital Financial Services in Nigeria: State of Market Report 2017

Sustainable and Inclusive Digital Financial Services (SIDFS) is a research and advocacy initiative of the Lagos Business School, established in 2015 with the support of The Bill & Melinda Gates Foundation.

Olayinka David-West is a senior fellow in the Operations, Information Systems and Marketing Division of Lagos Business School (LBS) and a member of the LBS Management Board.

Ibukun Taiwo manages content and communications for the Sustainable and Inclusive Digital Financial Services initiative of the Lagos Business School.

Photo courtesy of the Sustainable and Inclusive Digital Financial Services initiative of the Lagos Business School.

- Categories

- Finance, Telecommunications