Financial Capability isn’t Built in a Day: Can a secured credit card help entrepreneurs build credit and positive financial behaviors?

Can a secured credit card help entrepreneurs build credit and positive financial behaviors? At FIELD, we wrestled with this critical question as part of an 18-month initiative called the Asset Building through Credit pilot. Why does building credit matter for small businesses? In our work with organizations that finance and provide training to microbusinesses throughout the U.S., we have seen that having a low credit score limits entrepreneurs’ ability to grow their businesses.

Take, for instance, a small contractor who participated in the pilot who we met in Los Angeles. His business faltered, and nearly shuttered, during the housing crash. The slow business environment severely affected his personal credit profile; until then, he had used personal credit lines to manage his business purchases. Although business has recovered over the last two years, he wanted to address his credit issues because they posed a barrier to the future growth of his firm. Although he had new projects in the queue, he was unable to even secure a contractor’s credit card for building supplies. For entrepreneurs like him, having a low score – or no score – either means paying more to access credit at very high rates, or simply stunting potential growth as they struggle to manage with available cash.

Funded by the Citi Foundation (which is a sponsor of NextBillion), the Asset Building through Credit pilot worked with six organizations to offer a secured credit card together with credit education and coaching to entrepreneurs looking to build or rebuild their credit. One aspect of our evaluation focused on understanding whether clients improved their credit scores. Indeed, they did: 71 percent of participants improved their credit scores over the 12-month pilot period. The evaluation also looked at the cardholder’s behavior in using and managing the card, with the goal of understanding whether those behaviors indicated the small business owners were acquiring some measure of financial capability. The concept of financial capability moves beyond providing financial education and increased client knowledge regarding financial topics, to focus on whether clients illustrate positive financial behaviors through use of financial products. As the folks at the Center for Financial Services Innovation aptly noted: “If financial literacy is what you know, financial capability is what you do”.

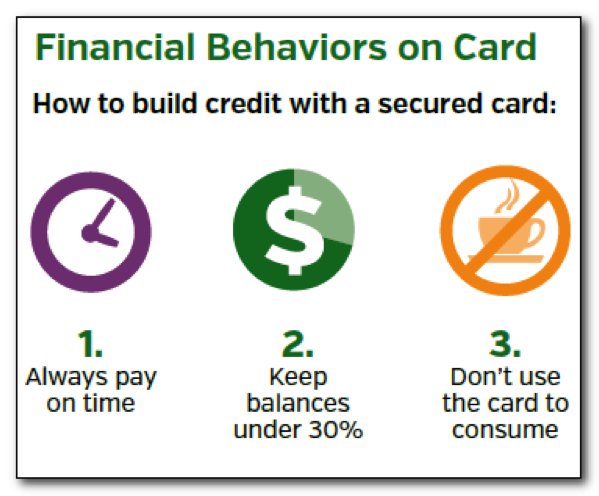

We saw promising signs in this area. In addition to helping clients with budgeting and overall financial and business advice, the six organizations coached participants on the three golden rules of building credit with a secured card: always pay on time, keep balances low (generally at 30 percent or less of the credit limit on the card), and use the card as a credit-building tool and not for general consumption. After 12 months with the secured card, a significant portion of participants increased their access to credit (more trade lines were added), and had lower debt loads.

We saw promising signs in this area. In addition to helping clients with budgeting and overall financial and business advice, the six organizations coached participants on the three golden rules of building credit with a secured card: always pay on time, keep balances low (generally at 30 percent or less of the credit limit on the card), and use the card as a credit-building tool and not for general consumption. After 12 months with the secured card, a significant portion of participants increased their access to credit (more trade lines were added), and had lower debt loads.

(Click on the image to the left for an infographic on the program.)

But not all signs were positive. Though the majority of cardholders paid on time, most (81 percent) did not keep balances on the card low. While we certainly do not have all the answers and recognize that people’s financial lives are complex, we did hear from participants we interviewed about the challenges they faced in maintaining a low balance. Some used the small credit line for unexpected personal emergencies, while others used the entire line to take advantage of a business opportunity like a good-priced inventory purchase.

Some of the findings were rather counterintuitive. As we parsed the data, we found that clients who came into the program with no credit score behaved differently than those with existing scores who were trying to rebuild their credit. The data suggest that clients who start without a credit score seem to need less guidance – or are perhaps more amenable to adhering to credit building principles regarding low balances (and timely payments). This may be because they are building new behaviors, rather than trying to improve existing ones. Conversely, it appears that clients who start with low existing scores may need more intensive guidance and reinforcement regarding use of the card, especially during the first six months of card use.

At FIELD, we believe there is an opportunity to continue learning about best practice in the area of financial capability. Pilots like these — that blend timely delivery of financial coaching with a product to put that knowledge to use — will be important in improving clients’ financial capability. As the saying goes, “Rome wasn’t built in a day,” and the important work of instituting positive financial behaviors to manage financial resources effectively must continue.

Joyce Klein is director of the Aspen Institute Microenterprise Fund for Innovation, Effectiveness, Learning and Dissemination (FIELD). Luz Gomez is a consultant with the Aspen Institute Economic Opportunities Program.

- Categories

- Uncategorized