Financial Inclusion During – And After – COVID-19: The 2021 Compass Survey Reveals the True Scale of the Challenges Ahead

COVID-19 has caused countless challenges for everyone around the world. But the crisis has been especially tough for the poor and financially excluded in low-income countries — and for those that try to shield and serve them in such difficult times. The pandemic has upended the financial inclusion sector, presenting immense new challenges to low-income  clients, their households and businesses, providers, funders, and the broader sector ecosystem. The full extent of these impacts won’t be known until COVID-19 finally subsides, but in the meantime, a clearer picture is emerging. So it’s never been more important to “take the pulse” of the sector and ask a broad cross-section of stakeholders in which direction they see these increasingly complex issues trending — and what they’d like to see in the future.

clients, their households and businesses, providers, funders, and the broader sector ecosystem. The full extent of these impacts won’t be known until COVID-19 finally subsides, but in the meantime, a clearer picture is emerging. So it’s never been more important to “take the pulse” of the sector and ask a broad cross-section of stakeholders in which direction they see these increasingly complex issues trending — and what they’d like to see in the future.

Back in 2018, we at e-MFP launched the first Financial Inclusion Compass, an annual publication series that collates stakeholder opinions on emerging short, medium and long-term trends in the financial inclusion sector. The Compass series leverages e-MFP’s unique role as a supra-national network of practitioners, investors, donors, academics and support service providers, among others, giving them and other stakeholders the opportunity to evaluate and describe the importance of various current trends, rate and give opinions on new areas of focus, and provide open-comment qualitative input on the expected (and hoped-for) direction of financial inclusion progress.

Recently, e-MFP published the English language version of the Financial Inclusion Compass 2021. This fourth edition of the series reverts largely to the methodology of previous versions while building on last year’s special edition Covid-19 Financial Inclusion Compass to present a qualitative section on the perceived impact of the pandemic, the changing roles of various stakeholders and opportunities for “building back better.”

The survey was open for three weeks during May 2021, and we received 125 complete responses from 39 countries. A plurality of respondents were financial service providers (FSPs), followed by consultants/support service providers, infrastructure organisations, funders and researchers. In characterising the main geographic focus of their work, a plurality of respondents selected “global,” followed by sub-Saharan Africa, Asia, and Latin and Central America. Below, we’ll take a look at some of the findings from this year’s survey, and what they say about the financial inclusion sector’s evolving focus as the pandemic continues.

Tracking Shifts in Financial Inclusion Trends and Priorities

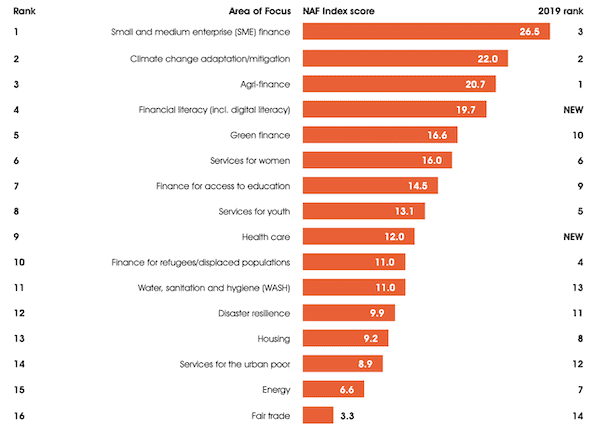

The survey had two main sections: In Section 1, respondents rated from 1-10 the current importance of each item in a list of 20 trends and evaluated a list of 16 future “New Areas of Focus” to rank their highest five in terms of future significance. They were invited to provide optional comments on each response. Section 2 had three additional optional and open-ended questions.

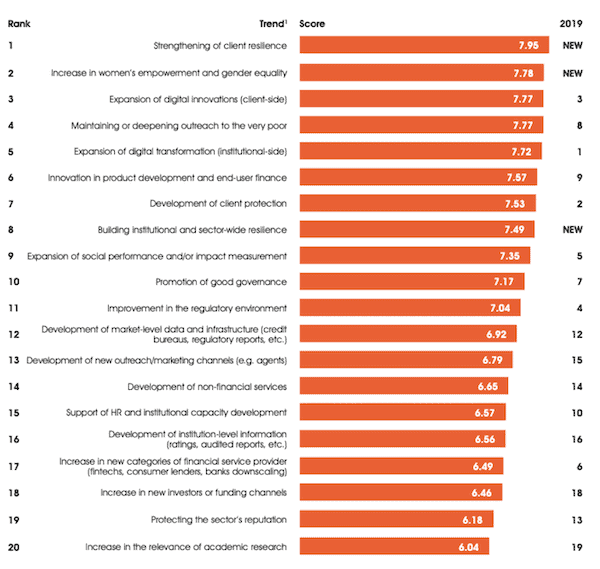

Compared to 2019, the last time a trends ranking was included in the survey, respondents put three new entrants among the 20 most important financial inclusion trends today. Their responses also reflect several other significant changes from the 2019 survey.

As the table shows, “Strengthening of client resilience” and “Increase in women’s empowerment and gender equality” are new entries, and their high positions overall (and the extensive comments around these entries) reflect how much the pandemic has changed stakeholders’ priorities.

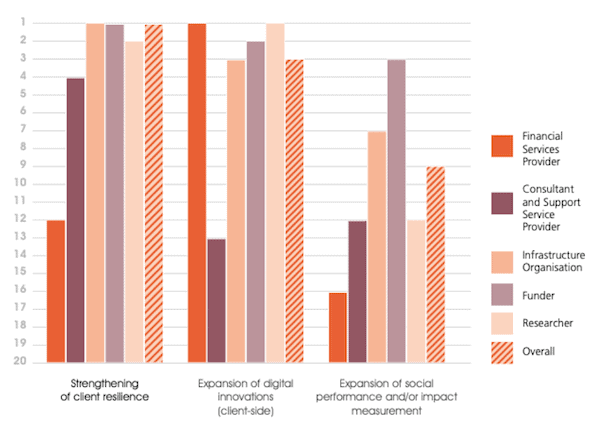

However, there are clear differences between respondent groups. For instance, the full group ranks “Strengthening of client resilience” as the top trend this year. But as the graph below reveals, FSPs on average rank it only as the 12th most important trend — perhaps because they’re reassured by the actual resilience of the clients they see so closely. In contrast, they are very positive about the importance of “Expansion of digital innovations (client-side),” reflecting the catalysing effect lockdowns have had on the roll-out of digital finance services — whereas funders express a far greater focus on “Expansion of social performance and/or impact measurement.”

Elsewhere in the trends section, consultants and support service providers believe “Promotion of good governance” is much more important than do other respondent groups. Researchers rank “Maintaining or deepening outreach to the very poor” a lowly 15th, versus 4th overall. Both funders and infrastructure organisations rate “Increase in women’s empowerment and gender equality” considerably lower, in 7th place, than respondents overall, who place it in 2nd place. FSPs rate “Increase in new investors or funding channels” much higher than other respondents, and consultants and support service providers give high priority to “Promotion of good governance.” Meanwhile, researchers rate “Increase in new categories of financial service provider (fintechs, consumer lenders, banks downscaling)” much higher than other respondent groups.

Assessing New Areas of Focus for the Sector

In the section on “New Areas of Focus,” in which respondents are asked to look to the medium to long-term future, there was a lower variance between areas of focus than in previous surveys. Considering the distribution and tone of the comments, this may reflect increasing complexity, uncertainty and change within the financial inclusion sector, with more areas of focus for stakeholders to devote resources to, many of which are increasingly interrelated.

The top three focus areas are the same as in both 2018 and 2019, the last times this section was included — but their order continues to alternate. In this year’s survey, there are increases in the rankings for “Green finance” and decreases for “Housing” and “Energy.” “Financial literacy (including digital literacy),” a new entrant, is in a high position at 4th place, but the overall rankings are broadly consistent with those of previous years. FSPs are extremely positive on the future significance of “SME finance,” but consultants and infrastructure organisations are much less so. By contrast, FSPs rate “Climate change adaptation/mitigation” as much less important than other respondent groups, especially consultants and funders. Finally, “Services for youth” are of strong interest to FSPs — but of no interest to researchers, none of whom gave this focus area a single score.

Three Key Questions for the Financial Inclusion Sector Today

Finally, in the optional qualitative section of the survey, which generated over 40,000 words of submissions, respondents were asked three questions:

What are the most significant challenges facing the financial inclusion sector today, and what will stakeholders need to do to meet them?

Respondents are clear on the importance of financial inclusion in tackling the health, financial and economic impacts of COVID-19. They are very concerned about the exacerbation of poverty because of the pandemic, with continued uncertainty about its full impact, and with bleak overall forecasts. They believe that client resilience (especially that of women) is growing in importance, and they recognise the close interconnection between client, institutional and sector-level resilience and the feedback loops that exist between them — including how efforts to strengthen resilience at one level can undermine it at another. Respondents also argue for better coordination and partnerships, especially between providers and governments/regulators who will have to continue to play a larger role than before. And they observe the need to manage the inevitable growth in digital products and channels, catalysed by the pandemic, and the likelihood of many low-touch, branchless delivery models becoming permanent. This march toward digitisation continues to divide respondents, many of whom still see digital as a threat to the sector’s social mission and, particularly after the closure of the Smart Campaign, to client protection.

How has your role, individually or as an institution, changed since the beginning of the COVID-19 pandemic? What lessons have you (or your institution) learned from it?

There has been, for many, a considerable challenge in retaining value and productivity through a year of remote working and travel restrictions which have made certain technical assistance and research activities challenging or even impossible. However, respondents cited gains too — from virtual events bringing in new participants to support providers in training local experts to the (less tangible) sense of “shared focus.” This has been visible in many places, including the welcome collaboration among funders to meet shared challenges. And there is hope that this can remain in the post-COVID-19 sector. Responses also made it clear that it’s important to remember the human cost of the pandemic and those who have suffered the most. For FSPs in particular, it has been a year of stress, anxiety and in some cases, grief. For them and others, an enduring lesson to take from this crisis has been the value of flexibility and institutional agility: the need to think and move fast — but to ensure that what is being done has value, and to be cautious about conflating “activity” with “impact.”

What changes (including because of the effects of the pandemic) would you most like to see in the financial inclusion sector in the next several years? How can we “build back better”?

The phrase has become ubiquitous, but the question of how we can “build back better” remains essential. To that end, respondents hope for reforms in markets and data sharing to increase the sector’s responsiveness to future crises, including via regulation. They want to see a renewed focus on client-centricity, acknowledging that the impact of the pandemic on poor households and businesses is not fully known, but will be enormous. And while the growth of digital may well be both a threat and an opportunity, respondents recognise that it is best met by strengthening strategic alliances between traditional FSPs and fintechs, which must be seen as partners not as adversaries. Finally, they see opportunities for a wholesale “re-think” of the entire financial inclusion system: making it more demand-oriented, flexible and responsive, getting back to the roots of financial intermediation to develop a sector that works for more people.

This article represents just a short summary of what is a hefty report, drawing on tens of thousands of words of submissions from respondents, as well as thousands of further scores and rankings. We offer our thanks to everyone who took part and assisted in getting this paper published. And my colleagues at e-MFP and I hope that this encourages you to dive into the publication itself, and the rich array of insights provided by the respondents who generously gave their time to contribute.

Sam Mendelson is Financial Inclusion Specialist at e-MFP and the lead author of the Financial Inclusion Compass.

Photo courtesy of e-MFP.

- Categories

- Coronavirus, Finance