Financial Inclusion that Works for Women: The European Microfinance Award 2022

Lending to women clients has been at the center of microfinance since its modern inception. When Dr. Muhammad Yunus loaned his first $27 in 1976, it was to a group of women in Bangladesh who planned to start a bamboo stool business. To this day, most microfinance clients are women.

Organizations across the sector talk a good game when it comes to women’s empowerment and autonomy, and they’re happy to publicize the number of women clients the sector serves. And they are right – a generation ago, few would have seen low-income women in developing countries as investable borrowers, let alone savers, senders of remittances or insurance policyholders. And while these stereotypes broadly persist, there has undoubtedly been progress in promoting women’s financial inclusion, with more low-income women having access to financial services than ever before.

Nevertheless, despite this progress, a myopic focus on outreach (i.e., the number of women clients served) too often undermines the enormous opportunities that can be tapped by genuinely understanding the specific barriers women face – at home, in business and in the workplace. Without a clear understanding of how those barriers limit women’s opportunities and aspirations, it’s harder for the financial inclusion sector to know what to do.

This is why we at e-MFP, as co-organizers of the European Microfinance Award, are pleased to announce that the theme of the 2022 European Microfinance Award is “Financial Inclusion that Works for Women.” We believe that this focus, combined with the Award’s large exposure and strong reputation for rigor and transparency, can provide real impetus to innovation and learning in this field, at a time when many of our partners and colleagues in the financial inclusion sector are recognizing that having women clients, and actually meeting their needs, are not necessarily the same thing.

Understanding and meeting women’s needs

Key to understanding and meeting women’s needs is recognizing that women comprise a group of clients with a diverse set of situations and circumstances that are often quite distinct from men’s – and from each other’s.

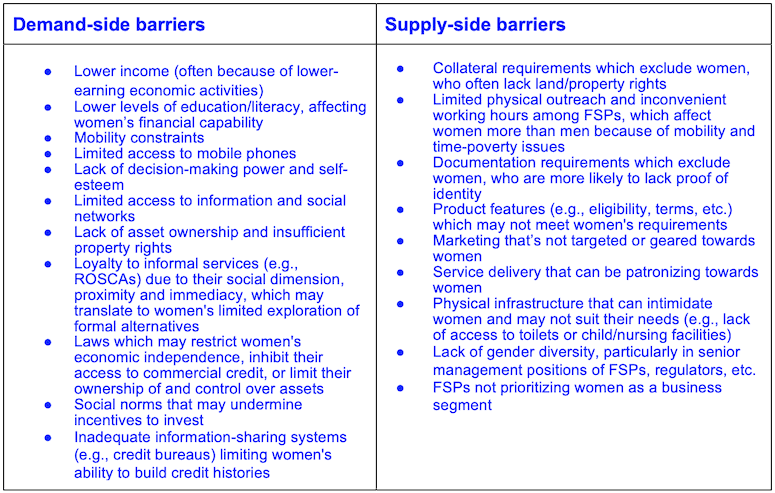

When financial products and services are introduced in a market, they arrive in an ecosystem of deeply rooted informal (social norms, beliefs, stereotypes) and formal (laws, policies, regulations) frameworks that govern clients’ lives. When it comes to financial inclusion, women face multiple, compounded barriers at multiple levels of the ecosystem – including supply and demand barriers that often originate from outside the financial sector. A list of some supply and demand-side barriers can be seen in Table 1 below.

These barriers are often anchored in social norms which limit women’s financial inclusion, resources and economic opportunities, thereby impeding their economic empowerment prospects. That said, despite the sector’s evolving understanding, these social norms are often neither fully understood nor adequately tackled in the financial inclusion space – an issue which has impeded progress towards greater inclusion among women. The complexity of the factors driving women’s financial exclusion and the need for comprehensive, multi-level solutions may explain the persistent gender gap.

Women need a range of financial and non-financial products and services to meet their diverse needs. These include products and services for their own personal use and needs (e.g., their own health insurance and personal savings), for the diverse needs of their households (e.g., their children’s education and health, household improvements, and accessing basic services such as clean energy), and for their business needs. When it comes to business activities, women’s needs vary depending on their economic profile – for example, the needs of high-income, formally employed women are quite different from those of women-led small- and medium-sized enterprises, which in turn differ from the needs of low-income informal workers, microentrepreneurs or smallholder farmers.

Moreover, serving women clients isn’t limited to providing a specific set of products. FSPs must pay close attention to how those products are delivered, how they are communicated and how they engage with women clients more broadly. Even a well-designed product may miss the mark if the loan officer expects a woman client to take two hours to show up at the branch, leaving behind business and household responsibilities. Furthermore, providers’ efforts to serve women cannot succeed if they ignore the other half of the population. In other words, FSPs need to engage men in this process – including staff and clients’ family members – to build a shared understanding of the barriers women face and how they can be overcome.

However, making financial inclusion work for women cannot be limited to focusing on just the clients. Women remain woefully underrepresented in leadership and governance positions across the sector. To be effective at serving women, FSPs can and should embed a gender-focused strategy within their organization – and this “gender mainstreaming” should ensure genuine promotion opportunities for women, along with their representation in decision-making roles. It should also provide women with flexible work options, while ensuring and promoting a culture of respect and fairness in all aspects of the organization’s operations. Of course, this should apply not just to staff, but to agents and other external partners as well, and it should include efforts to monitor the implementation and outcomes of these gender-focused strategies. And it’s not just the job of FSPs to develop and build financial services that work for women: All financial inclusion stakeholders have important roles to play – from funders and policymakers to researchers and technical assistance providers. As the saying goes, “It takes a village.”

The EMA2022: Towards a new landscape of financial inclusion for women

Launched on March 14, the European Microfinance Award 2022 on “Financial Inclusion that Works for Women” seeks to highlight organizations working in financial inclusion that aim to understand and meet women’s challenges and aspirations in order to go beyond traditional gender outreach strategies.

There are four components in this topic that applicants should aim to demonstrate:

- Understanding women’s challenges and aspirations: Applicants should have a deep understanding of the specific social, cultural and economic barriers facing women, as well as the aspirations of their women clients, staff and partners.

- Responding to women clients: Applicants should serve women clients through a range of financial and/or non-financial products and services, which are designed and delivered with their specific needs and aspirations in mind.

- Mainstreaming gender within the institution: Applicants should have relevant strategies and policies in place that are conducive to women’s equitable participation and engagement within the organization (including staff, agents and partners).

- Monitoring: Applicants should have systems in place to monitor the effectiveness of their gender-focused strategies – covering both clients and staff – and which are used to improve the design and implementation of these strategies.

To be eligible, organizations must be: active in the financial inclusion sector, fully operational for at least two years, and based and operating in a Least Developed Country, Low Income Country, Lower Middle Income Country or Upper Middle Income Country, as defined by the Development Assistance Committee for ODA Recipients.

The call for applications is open until April 12, and the evaluation process culminates with the winner of the €100,000 prize (plus the two runners-up, who each win €10,000) being announced during European Microfinance Week in November. All information on the topic, eligibility requirements, and application and evaluation processes can be found on the European Microfinance Award website.

In order to reply to any questions that applicant organizations may have when applying to the Award, e-MFP is organizing three Application Guidance sessions this month: an English session on March 21 (register here); a Spanish session on March 22 (register here); and a French session on March 23 (register here).

We look forward to receiving applications from a diverse array of organizations in the financial inclusion sector that are building a real understanding of the needs and aspirations of women clients, staff and partners, and responding to them with vision and purpose. And we hope the initiatives that apply for this year’s Award will serve as beacons that guide other organizations’ efforts to go beyond outdated assumptions and genuinely serve women’s real needs.

Note: The authors would like to acknowledge the considerable support from Sally Yacoub, a gender and financial inclusion advisor who put together much of the material on which this article draws, and recently published an e-MFP guest blog for International Women’s Day.

Joana Afonso is a Financial Inclusion Specialist, Gabriela Erice is a Senior Microfinance Officer, Sam Mendelson is a Financial Inclusion Specialist, and Daniel Rozas is a microfinance consultant at the European Microfinance Platform (e-MFP).

Photo courtesy of European Microfinance Platform (e-MFP).

- Categories

- Finance