Going Digital Sustainably: How microfinance providers can balance business needs, technology constraints and the customer value proposition

One challenge institutions providing microfinance services often face is how to reach even more people while remaining sustainable. Digital financial services (DFS) can help them do this, but since they imply both upfront investment and ongoing costs, these services must yield strong returns, and fast. In the Grameen Foundation Accelerator project, obtaining buy-in from our partners, Centenary Bank and Pride MDI, required us to show them a commercial model that balanced business needs, technology constraints and value to customers. Here are some of the key considerations we think any organization that wants to go digital should adopt.

Clear understanding of business needs

Going digital – or allowing customers to access their bank accounts through a mobile money (MNO) agent infrastructure – provides cost benefits by migrating traffic from banking halls to agents using the wider MNO agency network.[1] It also presents a new revenue opportunity, both by providing access to previously unreachable customers and enabling existing customers to transact more frequently. But though the digital channel reduces distribution costs by decreasing the need for infrastructure investment, it also creates new costs to invest in and maintain these changes.[2]

As such, it is vital to have a clear understanding of the impact of connecting to a digital system. Grameen Foundation worked with internal stakeholders from different business units at Centenary and Pride to estimate the benefits and costs of the digital system provided by Cellulant, the DFS platform provider in our project. Marketing and Human Resources gauged the cost of training staff and internal change management, and Operations helped identify the ongoing processes needed for digital financial services. Information Technology assessed the cost of integration with the core banking system, and Finance guided approaches for reconciliation and monitoring. The result was a view of the whole cost structure of this new service in relation to the financial institution’s internal operations. Organizations considering a move into digital services should perform a similarly detailed assessment.

Good gauge of technology provider requirements

The digital financial services system introduces new technical partners that also bring new costs. For example, Cellulant requires an upfront joining cost, and an ongoing usage-based fee consisting either of transaction fees or a minimum monthly payment, whichever is lower. (Other DFS providers would operate similarly.) This pricing structure provides an incentive for the financial institution to drive transactions and for the platform provider to maintain platform uptime.

Many financial institutions already have mobile banking products that enable customers to conduct basic transactions (balance inquiry, account to account transfers, etc.), and these relationships include pre-existing revenue share agreements. For example, Centenary and Pride both had pre-existing relationships with other providers for basic mobile banking services. As such, those providers receive a fee for each charge levied on transactions through CenteMobile and/or Pride Mobile (our partners’ mobile banking products). This adds cost to the system.

The partnering MNO also impacts the final cost of the service to the customer – both through mobile money fees and fees for the USSD channel that is used to interact with the system. (USSD is a global system that facilitates communication between cell phones and the service provider’s computer.) For example:

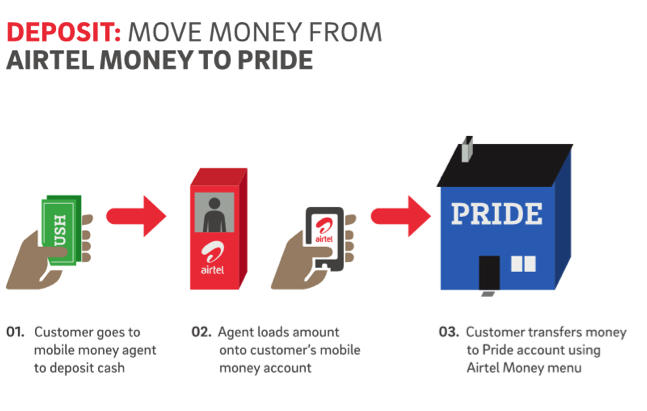

When money is pushed (deposited) from the wallet to the bank account: MNOs control fees to push money into the system. In Uganda, it is free to deposit cash into the wallet provided by MNOs, but there is a transaction fee to push money from the wallet to the bank. Some operators also apply a USSD session fee. An institution will need to take this into account to know the full price incurred by the customer.

Figure 1. The process for getting cash into the bank via the phone

Source: Grameen Foundation 2015

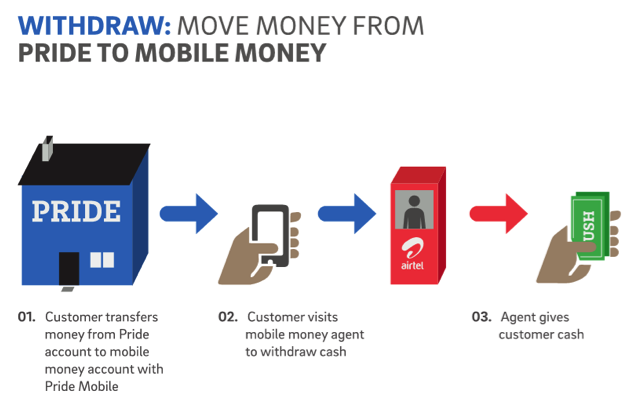

When money is pulled (withdrawn) from the bank account to the wallet: Financial institutions will levy account withdrawal fees. The MNO will not charge for this transaction but does charge standard withdrawal fees to access cash at the agent. A USSD session fee is also applied by the MNO because pull transactions are handled by USSD menu sessions that connect the customer to the bank’s menu.

Figure 2. The process for getting cash from the bank via the phone

Source: Grameen Foundation 2015

Setting a suitable price for the customer is critical to sustainability. The fee levied by the MNO to bring money in – the first important step – impacts whether and how often clients will deposit funds. Financial institutions must work with MNOs to ensure that they maintain reasonable prices, so as not to deter customers from depositing money. The USSD is an additional cost that is negotiated between the institution and the MNO; the institution can choose to absorb the fee (which Centenary did, for example) or pass it on through increased prices to customers.

Strong customer value proposition

The resulting customer pricing must a) be affordable for the poor to encourage usage while balancing the various costs across the ecosystem, and b) drive high-volume behaviors to realize desired benefits.

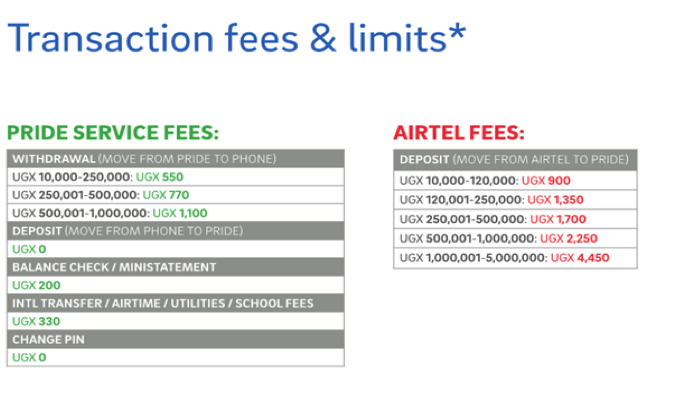

To encourage initial usage, we recommend that financial institutions levy no charges to deposit, just as our partners did. To drive transactions, including small-value transactions, both Centenary and Pride adopted tiered rates. This approach allows the poor to transact in smaller amounts and be charged a smaller fee that is essentially subsidized by the slightly higher fee charged on larger transactions. Figure 3 (below) shows a sample of fees per tier that allows for a broad range of users to enjoy the service.

Figure 3. The tiered fees by the bank or MFI for withdrawals to the phone versus the tiered fees by the MNO for deposit into the bank

Source: Grameen Foundation 2015

Initially, our partners were concerned that customers would simply empty their accounts if they were given more convenient access to their funds. This fear was dispelled once customers began using the system. The average push (deposit) transaction amounts are larger than the pull (withdrawal), though the frequency of withdrawals is about two times greater. This behavior may suggest that users store up funds and send larger amounts to bank accounts infrequently (saving up on the wallet – a free transaction – before incurring a charge from the operator to push to the bank). It may also suggest that they withdraw smaller amounts to meet specific needs rather than withdrawing the full amount and having it all on hand. Future research will dig further into these user behaviors.

Ultimately, it is important to remember that going digital is the addition of a new channel to existing products, not a product itself. While customer fees may cover costs, this service will not be a stand-alone profit center. A strong DFS commercial model will reduce distribution costs and increase revenue, but it requires an understanding of the full implications of the new service as well as a strategy to encourage behaviors by customers that will yield a successful investment.

[1] Per company websites, Centenary has 63 branches and 45 stand-alone ATMs; Pride has 31 branches. In comparison, MTN has more than 30,000 agents.

[2] This cost impact varies with the type of agent management model the institution (and the legislation in the country) favors and/or enables. Legislation on agent banking in Uganda is such that banks cannot use non-bank staff to sell bank services. They instead rely on MNO agents. If agency banking were an option, the bank may decide to invest in bank agents directly.

Joel Muhumuza is the commercial lead for Grameen Foundation’s financial services initiatives in Uganda.

- Categories

- Uncategorized

- Tags

- microfinance