How Can the Financial Inclusion Sector Serve the World’s Growing Number of Refugees and Forcibly Displaced People?

Displacement and migration permeate the history of humanity. For millennia, peoples have come and gone from their homelands, and much of that movement was forced, whether by war, lack of food or resources, or other factors. After all, aside from a small minority of dreamers and explorers, when given the choice, most people prefer to stay where they are, in the land of their birth, among those they grew up with.

Displacement is — and has always been — a part of the basic cycle of life. And so, since the purpose of finance is to help people navigate that cycle of life, it should also play an important role in addressing the enormous shocks and challenges of displacement.

That’s why e-MFP is pleased to announce the launch of the European Microfinance Award 2024, which will focus on “Advancing Financial Inclusion for Refugees & Forcibly Displaced People.” The goal of this year’s award is to highlight organizations active in financial inclusion that help forcibly displaced people build resilience, restore livelihoods, and live with dignity in their host communities.

What is forced displacement?

According to the United Nations High Commissioner for Refugees (UNHCR), forced displacement occurs when individuals flee as a result of “persecution, conflict, violence, human rights violations or events seriously disturbing public order.” These individuals may include refugees, asylum seekers and internally displaced people. Other interpretations are broader: For instance, the Global Partnership for Financial Inclusion also includes natural disasters and climate change as drivers of forced displacement. These are ultimately legal and definitional questions, but the underlying idea is the same: When people migrate out of necessity rather than choice, they become forcibly displaced people, or FDPs.

This is a growing global phenomenon, with over 108 million people worldwide estimated to be forcibly displaced at the end of 2022. Moreover, while people fleeing to wealthy destinations like the U.S. or EU countries receive much of the international media coverage, most FDPs are either internally displaced (58%) or seek refuge in neighbouring countries (70% of cross-border FDPs). As a result, three out of four FDPs are located in low- and middle-income countries.

With growing global uncertainty and proliferation of the various causes of displacement, these figures are likely to increase further. Moreover, displacement has become more protracted and complex in nature, often involving multiple movements both internal and external to the country of origin, with displacement camps or cities as the most common destinations. Such forced displacement impedes the achievement of the UN’s Sustainable Development Goals (SDGs) and other international commitments to respect human rights and offer protection, assistance and development to vulnerable populations.

Financial inclusion for refugees and FDPs

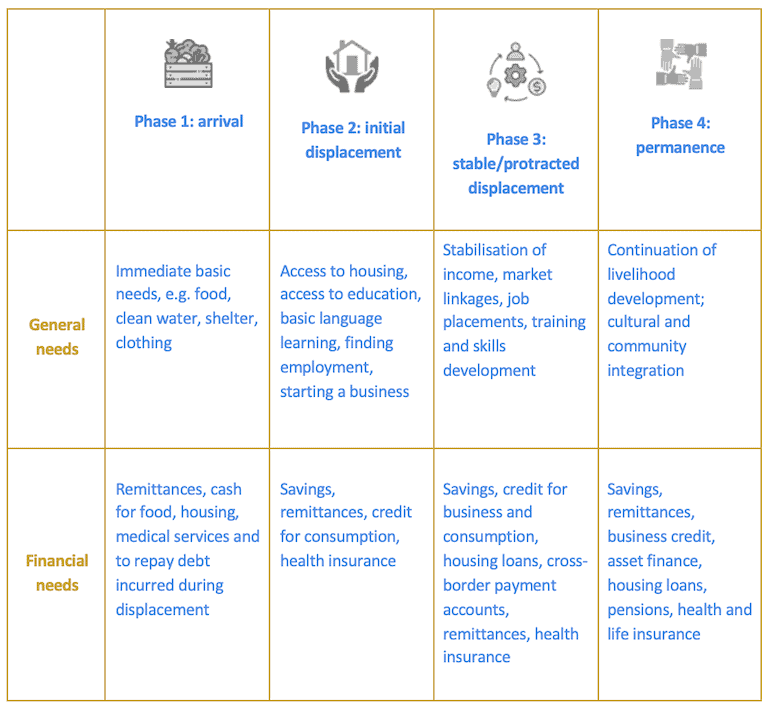

FDPs face unique needs and vulnerabilities, requiring the adaptation of existing (or the creation of new) financial and non-financial products and services. Financial service providers (FSPs) must also work with partner organizations and host community groups to support FDPs in building resilience, restore FDPs’ livelihoods, help them live with dignity in host communities, and — when appropriate — facilitate their return or resettlement. According to the UNHCR-Social Performance Task Force report “Serving Refugee Populations – The Next Financial Inclusion Frontier: Guidelines for Financial Service Providers,” FDPs’ needs typically vary according to the phase of their displacement:

Source: Adapted from UNHCR-SPTF – Serving Refugee Populations – The Next Financial Inclusion Frontier: Guidelines for Financial Service Providers

Each phase entails different financial needs and financial services. These don’t always require providers to offer a separate suite of financial products and services aimed specifically at FDPs, but they do require them to understand that FDPs encompass a diverse range of groups and individuals, with hugely different needs depending on their origin, language and phase of displacement. And beyond those, the needs of FDPs differ greatly based on who they are themselves: Women refugees, for example, have particular needs that relate to issues of gender-based violence and sociocultural norms that may limit their financial independence, among others.

Addressing the barriers to the financial inclusion of FDPs

While understanding the needs of FDPs is important, recognizing — and addressing — the barriers they face is the greater and more essential challenge. These barriers fit into four main categories: familiarity barriers that come with not knowing the local language or practices, or the different services available; “newcomer” barriers that come with being a recent arrival, such as the lack of a financial track record, viable loan collateral or other financial resources; legal barriers, such as the absence of legal status, lack of appropriate identification to meet Know Your Customer (KYC) requirements, or restrictions on movement (such as being in a refugee camp); and finally, cultural and political barriers that come from host communities viewing arrivals with suspicion or bias.

Addressing these barriers is where financial service providers and the broader financial sector can make the biggest difference for FDPs. To address familiarity barriers, providers can make changes in their sales and outreach channels to make FDPs feel welcome and make their services more accessible. This can be done through proactive efforts to reach out to FDP communities, providing information in their language, and hiring staff or representatives from those communities themselves.

To address the “newcomer” barriers, FSPs can focus on traditional microfinance techniques of building a credit history from scratch or using guarantors as an alternative to collateral. They can even seek to recover FDPs’ lost credit history by gaining access to credit records from the clients’ home countries. No less importantly, providers can focus on non-credit products that can help facilitate FDPs’ settlement into a new community, such as effective and cost-efficient payment and remittance services, as well as appropriate insurance and savings.

For FSPs that aim to serve these clients, the legal barriers may seem insurmountable, and some certainly are. But legal barriers may sometimes be more flexible than they seem. For example, KYC regulations that require FSPs to collect identifying information about the customer are often interpreted to require specific types of ID that FDPs may not have. But a more flexible approach that allows alternative — but no less valid — forms of ID can often meet legal KYC requirements using documents FDPs are more likely to possess.

Financial institutions can make some of the most meaningful progress in meeting FDPs’ needs by addressing cultural and political barriers. Longstanding institutions have deep ties to their own communities — they employ hundreds and even thousands of staff and serve even larger numbers of clients. By focusing on messages that address the common biases and negative stereotypes of FDPs, providers can play a key role in bringing down these walls. After all, successful FDPs who build local businesses and contribute to the local economy can be some of the most effective messengers of the value that FDPs bring to the host community — and institutions that have clients in both the FDP and host communities are excellent vehicles for channelling this message.

Finally, ensuring effective financial inclusion often requires complementary non-financial services — for instance, financial literacy training and local cultural sensitization, mentorship, language lessons, and paralegal services, among many others. Many of these services are beyond the capacity of financial institutions, and require them to partner with NGOs, international refugee organizations such as the UNHCR and others, as well as local government and community organizations. And partnerships don’t stop there: Providers can work together via industry associations and networks to engage with regulators to address legal barriers (such as KYC requirements), and also to engage with the broader policymaking community — for example, to advocate for temporary or fast-track business registration or work permits for qualified refugees.

Inclusive finance organizations can and do play an important role in improving the lives of forcibly displaced people. We hope that the European Microfinance Award 2024 will highlight those contributions and showcase the positive impact the sector can have on this pressing issue.

The European Microfinance Award 2024

The European Microfinance Award 2024 on “Advancing Financial Inclusion for Refugees & Forcibly Displaced People” was launched on March 14. It seeks to highlight organizations active in financial inclusion that help forcibly displaced people build resilience, restore livelihoods, and live with dignity in their host communities.

To be eligible, organizations must be active in the financial inclusion sector, fully operational for at least two years, and based and operating in a Least Developed Country, Low Income Country, Lower Middle Income Country or Upper Middle Income Country, as defined by the Development Assistance Committee List of ODA Recipients.

The call for first-round applications is open until April 15th, and the multi-stage evaluation process will culminate with the winner of the €100,000 prize (plus the two runners-up, who each win €10,000) being announced during European Microfinance Week in November. All finalists and semi-finalists will be featured in the annual e-MFP Award publication and can benefit from an enormous amount of positive exposure over the course of the process. All information on the topic, eligibility requirements, and application and evaluation processes can be found on the European Microfinance Award website.

In order to reply to any questions that applicant organizations may have when applying to the Award, e-MFP is organizing three Application Guidance sessions: an English session on March 25th (register here); a French session also on March 25th (register here); and a Spanish session on April 3rd (register here). We look forward to receiving applications from a diverse array of organizations in the financial inclusion sector.

NOTE: The European Microfinance Award was launched in 2005 by the Luxembourg Ministry of Foreign and European Affairs — Directorate for Development Cooperation and Humanitarian Affairs. It is jointly organized by the Ministry, the European Microfinance Platform (e-MFP), and the Inclusive Finance Network Luxembourg (InFiNe.lu), in cooperation with the European Investment Bank (EIB).

Sam Mendelson is a Financial Inclusion Specialist, Fernando Naranjo Galindo is a Program Coordinator, and Daniel Rozas is a Senior Microfinance Expert at e-MFP

Artwork by Camille Dassy, courtesy of e-MFP.

- Categories

- Finance