How Technology Can Provide Microentrepreneurs With Simple – and Much-Needed – Rules of Thumb

Norma has a small store in the Bago City neighborhood of central Philippines. In the packed interior of her store, Norma sells a variety of household items such as coffee, sugar, chips, bread, eggs, soft drinks, soaps and more. She has big plans for her business – she wants “to expand (her) retail store into a big grocery shop.”

Norma’s high aspirations are not uncommon among the microentrepreneurs the ideas42 team interviewed in the Philippines and India. And like their counterparts around the developing world, these entrepreneurs struggle to manage and grow their businesses and reach their goals.

Microentrepreneurs have the potential to be the engine of growth for developing countries by creating jobs, bringing valuable products and services to communities, and spurring economic expansion. With an estimated 400 million micro, small and medium enterprises around the emerging world, successful small businesses could improve the livelihoods of millions of families.

Despite a huge expansion in microfinance, why has this promise not yet been realized? Because access to finance alone does not make a business successful.

It is crucial for microentrepreneurs to know how to run their businesses correctly. That is why effective business and financial management training for micro-entrepreneurs matters. Classroom-based financial education courses have traditionally been used as a way to bridge this skills gap. Despite their popularity, such trainings have shown limited impact on financial behaviors of microentrepreneurs or the actual performance of their businesses. Small lapses in decision-making and behavior are the culprit: Did micro-entrepreneurs show up for the training? Did they understand how to implement the business advice being taught? Did they follow through on the recommendations? If the answer to any of these questions is “no,” it becomes impossible for micro-entrepreneurs to optimally use the training advice to improve their financial management practices.

ideas42’s Financial Heuristics, a behaviorally designed financial management training, offers an alternative by focusing precisely on closing the intention-action gap that traditional financial education training programs have failed to bridge. From a behavioral perspective, increased knowledge alone does not always translate into improved decisions or behaviors. Our innovative approach simplifies financial management training into easy-to-remember and easy-to-adopt heuristics, or simple rules of thumb. We tested the effectiveness of such classroom-based heuristics training with a randomized controlled trial in the Dominican Republic and found that it not only improved microentrepreneurs’ financial and business management practices, but also increased their business revenues compared to the control group that received traditional financial literacy training.

Our initial work demonstrated the benefits of using heuristics in financial management, but classroom-based training is costly and requires a major time commitment from busy microentrepreneurs. So the question remained: How could we deliver these heuristics to millions of microentrepreneurs like Norma effectively as well as economically?

We believe the answer lies in the use of technology. ideas42’s next innovation on heuristics-based training leverages mobile technology – through an Interactive Voice Response (IVR) based platform – to deliver the training in a cost-effective, scalable way that bypasses the need for a classroom altogether.

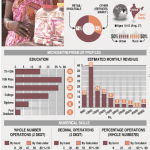

In the second version of our behavioral design, implemented in India, we partnered with IFMR Lead to adapt the heuristics-based curriculum for mobile phones and sent weekly training calls on microentrepreneurs’ mobile phones at their requested times.* Call pickup rates were high, averaging 83 percent. However, the average listenership rate, 48 percent, indicated that a fair amount of participants who answered the weekly training call only listened to a fraction of the three-minute automated voice message. We thus learned that merely using technology to send a standard IVR push call is not sufficient to ensure the success of the training. What we needed was behavioral design to improve the technology solution as well.

To improve pickup and listenership we developed an enhanced technology-based solution in partnership with IFMR Lead, IPA and engageSPARK that is currently being tested in India and the Philippines as version three of our behavioral design. Through qualitative interviews with our microfinance institutional partner Janalakshmi’s clients who had been part of the first IVR-based iteration, we learned that many clients had not thought through when would be best to request their training calls, and thus they tended to be busy at their requested call times. Also, even though clients had access to a free missed call service to listen to previous messages, its complex setup made it hard to navigate the system and listen to training messages at clients’ own convenience. Based on this feedback, we honed in on two ways to improve usage rates: push calls to phones at times of the week when clients are less likely to be busy, and simplify the missed call service so it is easier to navigate to listen to the previous messages.

Through our interviews with the technology platform managers of the first IVR-based iteration, we discovered that they scheduled training calls manually and that real-time performance analysis and troubleshooting were very cumbersome because the platform didn’t provide real-time user activity reports. As a result, we worked with our current technology partner, engageSPARK, to automate call scheduling (including automatic follow-ups if participants did not pick up on the first try) and produce engagement reports with real-time access to key data such as call pickup rates and average time spent listening to messages.

Following the addition of these design changes, initial results are promising and demonstrate positive trends in client engagement with the mobile phone-based heuristics training. We believe that behavioral design has the power to unlock the potential of microentrepreneurs, markedly improve their financial management practices and business outcomes, and in turn lead to the financial well-being of their families. Stay tuned for more results in fall 2017 when we will know the full impact of our improved Financial Heuristics training design on microentrepreneurs’ financial practices and business outcomes. We look forward to seeing how heuristics-based training can help entrepreneurs like Norma achieve their dreams.

*Note: This phase of the study was supported by the Citi IPA Financial Capability Research Fund, within IPA’s Financial Inclusion Program, which supports research on innovative products and programs that aim to improve the financial capability of low-income people in developing countries.

Marina Dimova is a vice president and Mukta Joshi is a project manager at ideas42.

Photos by Marina Dimova

- Categories

- Education