Something Doesn’t Add Up: Improving Basic Math Skills Among Microentrepreneurs in Rural India

No matter where you’re from, running a business requires a number of skills. From building or growing a product, through negotiating prices, and even knowing where to market and sell your goods – entrepreneurs wear many hats. Part and parcel of helping rural entrepreneurs run financially successful businesses is understanding where their weaknesses lie. Are they unable to get to a market where their goods command the highest value? Does lack of resources make production a constant struggle? Do they struggle to save due to community pressure to spend their money on others’ emergencies? Or perhaps it is more simple: How are their math skills?

Running any business requires a basic knowledge of arithmetic. Entrepreneurs need to calculate change due on a sale, profits and loss, commissions on product sales, and interest rates on loans. If rural entrepreneurs are unable to execute these basic calculations, they will struggle to run a profitable business.

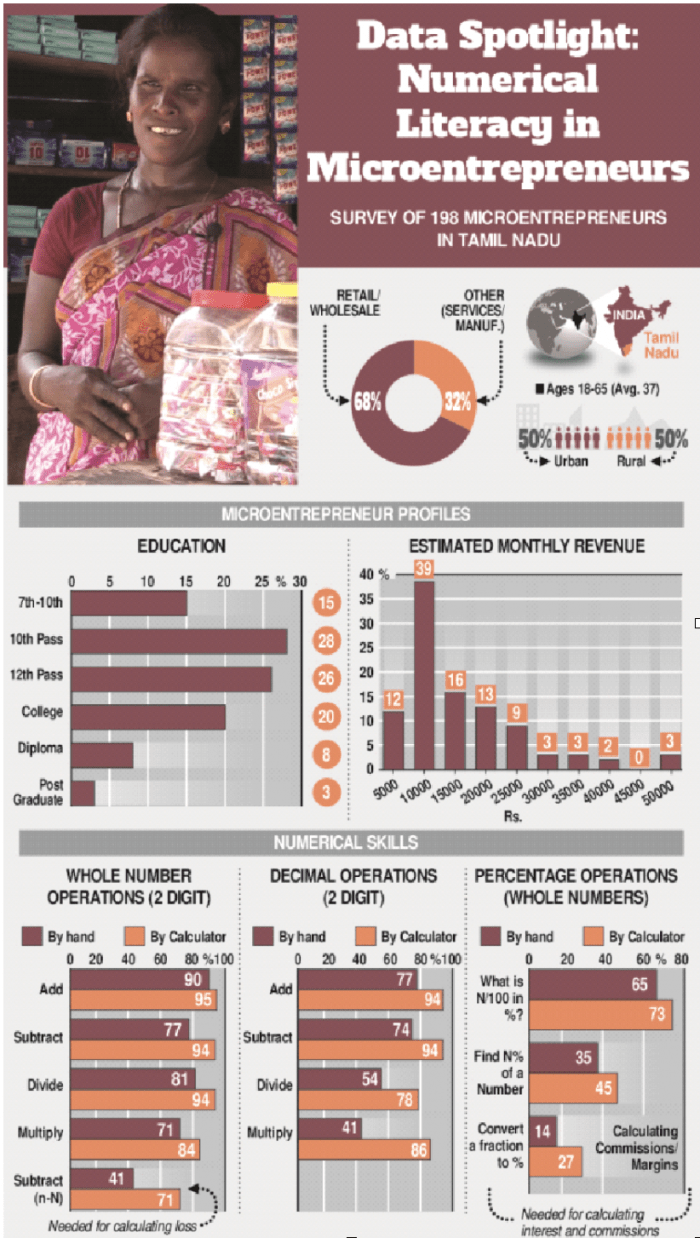

As part of a study to identify whether basic math skills contribute to entrepreneurial success in rural India, Madura Microfinance conducted a study on the numerical capabilities of microentrepreneurs. Of the 198 microentrepreneurs surveyed, 85 percent had completed a tenth grade education or more. The test covered basic arithmetic operations with and without decimals. The test was done first by manual calculation (by hand). Then participants were given time to repeat the exercise with a calculator. We were surprised by the results, and you might be too.

Given the relatively high level of education attained by our microentrepreneurs, we assumed that most would have these basic math skills. Some did, but the skill level was quite far removed from what one would expect from their educational demographic.

The first skill tested was adding whole numbers with multiple digits such as 23+45. Given that this is a skill typically taught early in elementary school, the expectation might be that everyone would get this right. They did not. Still, 90 percent could successfully add whole numbers without a calculator, and this rose to 95 percent once a calculator was added into the equation. Beyond this basic operation, however, skills were less homogenously displayed. Only 77 percent could subtract without a calculator.

When it came to subtracting a larger number from a smaller number (such as 3-10), only 41 percent were able to solve the problem. This kind of operation is essential for calculating whether you have a profit or loss. Even with a calculator, a full 30 percent were unable to successfully solve these problems. Decimal operations came with substantially more error. Calculating correct change relies on this skill.

The concept of percentage however was most poorly understood. Only 14 percent could convert a number like 3/12 into a percentage. Percentage is an essential computation when it comes to taking loans or calculating sales commissions and suggests that the relatively low sensitivity to interest rates in microfinance among low-income borrowers may simply be due to an inability to understand its meaning.

Solving the problem of financial literacy among our clients is a major initiative, and not a trivial task. One-off training or video seminars are not enough to improve math skills. These microentrepreneurs need to practice, but it is challenging to show them the financial benefits to be gained. Asking for so much input without clear increases in profits in sight is a tough sell. Madura is on the ground as we speak, developing tools to help motivate and successfully teach financial literacy to our clients.

On a macro-scale, our results are a poor reflection on the education system in India. Education level was only weakly correlated with both numerical literacy scores and income. It would be interesting to see the results of similar studies in other economies. Is this an educational outcome of poverty everywhere, or are some countries able to better prepare their rural poor for the mathematical necessities of entrepreneurship?

Tara Thiagarajan is the founder, chairman and managing director of Madura Microfinance, a rapidly growing rural-focused microfinance institution with 200+ branches serving more than 7,000 villages in Tamil Nadu, Maharashtra, Karnataka and Kerala.

Photo: a vendor carving cucumbers for sale in Katraj (near Pune), State of Maharashtra, India. Credit: JanetandPhil via Flickr.

Homepage photo: Ken Teegardin, via Flickr.

- Categories

- Education