Why are Investments Surging in Off-Grid Energy? A Q&A with Wood Mackenzie’s Benjamin Attia

Investments in the off-grid energy sector are surging in emerging markets. Everyone agrees about that, but it doesn’t really tell us a whole lot. Exactly how much the space is growing, what’s fueling it and who’s benefiting are topics of much discussion – and some debate. For some answers, we turned to one of the authors behind some new research that’s getting substantial attention. In February, Wood Mackenzie in partnership with Energy 4 Impact, released “Strategic Investments in Off-grid Energy Access: Scaling the Utility of the Future at the Last Mile,” which can be downloaded free here. Among the headlines, the research found that total annual investment in the off-grid energy access sector surpassed $500 million in 2018. I spoke with Benjamin Attia, a research analyst at Wood Mackenzie Power & Renewables and an African solar PV markets expert, to get a closer look.

Scott Anderson: First off, can you give an overview on the study, the methodology and its goals?

Benjamin Attia

Benjamin Attia: Wood Mackenzie conducted this study in partnership with our friends at Energy 4 Impact with two main goals. The first was to paint a live data picture of the corporate investment landscape for off-grid energy access, and the second was to use this data to contextualize and understand the participation, approach, and long-term strategies of top-down investors — European utilities and IPPs (independent power producers), oil and gas majors and tech OEMs (original equipment manufacturers), among others –in the sector.

We did this by collecting, cleaning, and analyzing nearly 700 corporate-level transactions from 2010 to 2018 across equity, grants, multiple forms of debt, and blended finance offerings into over 150 companies deploying pico PV, solar home systems, nanogrids, solar containers, mini-grids and PAYG (pay as you go) infrastructure to enable off-grid energy access globally. We believe we have constructed the most comprehensive live data picture of the investment landscape for energy access available. We also conducted nearly 40 interviews with key stakeholders across the investment landscape and the pay-as-you-go supply chain to gain insights into the activity and strategies of top-down investors and their ramifications for the growth of the sector.

To sum up our findings most simply:

- There’s a lot of corporate-level investment flowing into the space ($1.7 billion in disclosed deal value), but future capital deployments face some risks from the capital concentration in the market by technology, geography, company and business model.

- Most classes of ‘strategic investors’ have highly customer-centric long-term interests, hoping to grow their customer base with off-grid households and evolve the utility business model beyond basic electricity service provision.

The study was designed to call attention to, spur conversation around and prompt informed strategic planning around these trends, namely the volumes and character of investments in this space, increasingly driven by strategic investors with customer-centric interests.

SA: Let’s talk about investments in off grid energy access. The report notes 2018 was a ‘banner year’ for energy access investing crossing the $500 million mark with energy access and cumulative totals neared $1.7 billion USD equivalent. Can you help us understand what is driving these numbers in terms of the types of deals and types of ventures being funded?

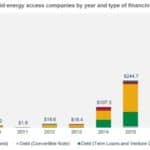

BA: Indeed, 2018 was a very big year for energy access investing. Besides the $500 million annual milestone, 2018 also brought 22 percent year-on-year growth in disclosed investment totals, as well as a stabilization in the debt-equity balance. The sector’s investment landscape increasingly shows signs of maturation. Over the last two years, capital composition has shifted towards over 50 percent debt and average deal size has grown over 5x, signaling increasing creditworthiness and scale for leading companies.

The investment landscape also shows clear leaders. Companies deploying solar home systems (SHS) have attracted 81 percent of total disclosed investment, and those deploying PAYG business models have attracted 91 percent. In fact, $1.1 billion of total capital deployed has gone to the top 10 solar home system companies, many of which have adjacent operations in East Africa using similar business models and technologies.

SA: Your study notes that the top ten off grid energy deals, which involve some names that will be familiar to many NB readers – such as d.Light and Greenlight Planet, make up some $564 million, or roughly one third of total investment to date. When I saw that number, I was a little discouraged by the concentration – is that the wrong take?

BA: Particularly in recent years, we’ve seen some of the biggest market leaders raising successively later stage capital in greater volumes. Many of these market leaders are now highly-capitalized and a few were likely overvalued in those rounds (though many of those valuations have returned to reasonable levels). Part of the problem is that many were valued based on over assumptions of the true size of the commercially addressable market (i.e. without subsidy). Particularly in the SHS sector, scaled players have faced increasingly tricky balance between navigating market dynamics on the ground and investor (VC) expectations for market share. As they start to run up against the limits of their low-cost addressable market, they will continue to face this question of “going deep vs going wide,” where they need to balance growing market share (acquiring customers) and getting profitable (cutting operating expenses, boosting repayment rates, tightening credit requirements, and deepening customer value). With few successful exits to date, private investors may exhibit more short term caution, leading to the possibility of a dip in 2019 deployments, alongside some value chain segmentation. (Exits are a good metric for a healthy investment landscape.) Investors are increasingly interested in the so-called ‘PAYG 2.0’ wave of startups, particularly those that are unbundled.

SA: The growth of mobile money infrastructure is a key marker of where capital investment is flowing, with East Africa leading all other emerging market regions by far. What does that portend for the sector in terms of deployment of off-grid companies and customer access?

BA: Correct. They PAYG business model depends on mobile money access and a robust payment processing infrastructure, and more broadly, reliable and broad rural GSM coverage in order to unlock the PAYG business model and allow SHS providers to monitor systems remotely. In short, it means that PAYG solar companies need to follow mobile money rollout in order to access those customers, and ideally work far more closely with telcos as channel partners, distribution partners, and customer acquisition partners in the future.

SA: The study also explored trends in different types of business models, and to no one’s surprise, pay as you go systems completely dominate the landscape courting 91% of investment dollars for nearly the last decade. Can you explain why that is?

BA: The PAYG business model allows end customers to finance their small-scale systems through a lease-to-own model, lowering the threshold for customer affordability and increasing the gross margin over cash sale businesses because it also includes a margin on the asset finance value stream of the business. However, PAYG is ultimately more financeable, as prepaid platforms can collect and monetize customer data, independently assess credit risk, and cultivate long-term customer relationships that can be leveraged in other sectors.

SA: The study also focused on the trend of strategic investors entering the off-grid energy sector. Why are some of these global corporates entering the energy access markets, and how are they participating?

BA: Indeed, the sector’s growth has increasingly been driven by strategic activity from European utilities and IPPs, oil and gas majors, and OEMs, who have made direct investments into energy access companies, invested in funds and financial intermediaries that invest in this sector, and made partnerships and joint ventures with distributors on the ground.

While most of their early activity in the off-grid space was born out of corporate social responsibility activities in emerging markets, readers may be surprised to hear that 75% of their activity is commercial in nature, and is driven by long-term strategic interests in the next billion customers, their evolving needs and their data. They see real commercial value in this market, particularly as a pathway to the rural consumer.

Off-grid households lack access to a long list of services, not just electricity. And as next generation rural utilities of the future are customer-centric, decentralized, interoperable and flexible service providers that can own much more of the customer value chain than a basic electricity connection. So for the customer-centric utility-minded investors, there is a keen interest in stacking additional value-add goods and services on top of the existing customer relationship brought on by a pay-as-you-go electricity connection.

SA: Based on what you’re seeing through this study and your work as an analyst, can you offer some predictions on what challenges and opportunities lie ahead for the energy access market in the next few years?

BA: I think the biggest challenge coming for the PAYG space in particular is a bit of an identity crisis. Are they energy service providers? Rural utilities? Consumer finance companies? Retail product sales? All of the above? And more importantly, how can you get the investment community to see that differently? In line with that last point, I also think this trend towards unbundling is a huge opportunity for the profitability of the sector, but also opens a lot of questions around future investment, consumer behavior, customer acquisition costs, etc. I think the space will need to innovate around this question in 2019 most critically.

On the question of value stacking and deepening customer value, we’ve barely scratched the surface, but there’s a lot of experimentation to try to determine how deep ARPUs really are, how to stimulate demand, and how to stack value on top of existing customer relationships through partnerships, value add services, etc. So I think that’s going to be a really exciting opportunity in the next year or two to see what kinds of new products and services are offered to rural households in tandem with electricity access.

In terms of the investment landscape, I do expect public sector capital to make significant contributions to the sector in 2019, particularly in the mini-grids space, and I do think we’ll see more investors come to the table, but the gap isn’t going away in 2019, and in fact may structurally actually grow a bit, even if more capital is flowing. I also expect that we’ll see more strategic investors follow their peers and enter this market, perhaps in new geographies or through more creative means.

Ultimately, this is a really resilient sector that may have some growing pains in the short term, but has a really fascinating long-term outlook increasingly led by innovative companies and supported by strategic investors with a long-term vision for the utility of the future at the last mile.

Scott Anderson is a contributing editor at NextBillion.

Photo courtesy of Russell Watkins / DFID.