The Ins and Outs of Launching a Digital Savings Product in Kenya: Regulatory Guidance for Fintech Startups

In an effort to protect consumers, regulation in financial services is often extensive and detailed. However, most regulations were designed with traditional, brick-and-mortar financial institutions in mind, so they can be burdensome for digital providers. As the world shifts towards digital financial services, such regulatory approaches are increasingly outdated and in need of revision. Unfortunately, as authorities update their approaches, fintech startups often serve as test cases and must bear the brunt of delays, learning processes and indecision.

At Catalyst Fund, we have observed countless startups that faced regulatory challenges ultimately close shop, alter their approach or exit a country. Even within our portfolio of 50+ companies, founders cite navigating regulation as a critical challenge to setting up their entities. These challenges are not just because of burdensome regulations, but also because startup founders rarely have the regulatory and policy expertise needed to understand these complexities (while also doing everything else that founders do).

To aid founders in navigating regulatory environments, we recently launched a set of guides in partnership with the Cambridge Centre for Alternative Finance. The guides help fintech startups that are just starting out to launch new products or enter new markets in Kenya, Nigeria, South Africa, Mexico and India. They provide high-level overviews of each country’s regulatory environment, describe key regulations related to each type of financial product, make suggestions on how to engage with regulators, and provide a mapping of the key regulators.

Navigating Regulatory Challenges to Offer Digital Savings in Kenya

Kenya is among the most advanced markets in the world in terms of fintech innovation and digital financial services thanks to the dominance of mobile money. But this innovation has yet to extend to some types of financial services – including digital savings.

Given that the regulatory environment around digital savings is still uncertain, startups need to be creative in establishing their legal status to avoid regulatory censure while still staying lean. Below, we discuss a number of ways we’ve seen startups that are hoping to offer a digital savings product approach their regulatory status.

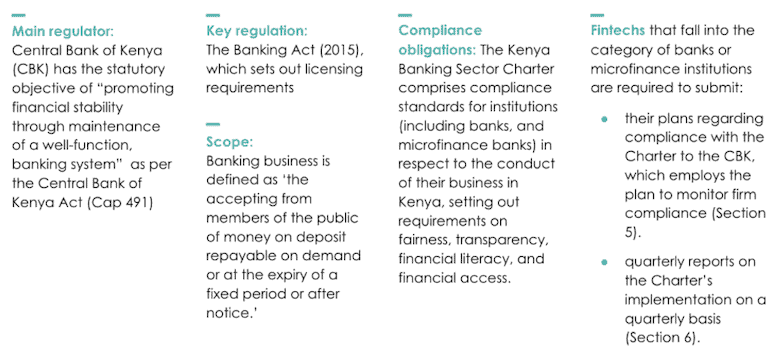

Approach 1. Register as a banking institution, which includes microfinance institutions

A fintech startup looking to offer traditional credit and savings products would most straightforwardly fall under the Central Bank of Kenya’s (CBK) banking regulations. For a pure digital savings startup, such designation would allow them full capabilities to take deposits, set product terms and expand their offerings into other financial products. Being a bank would also give them direct oversight and ownership of customers, with significant credibility and deposit insurance to protect customers’ deposits.

Although this status would provide the most opportunity and flexibility for a digital savings startup, the application process requires significant time and cost investment, including a feasibility study, organizational structure, business development plans, significant core capital reserves and more. Even after approval, the entity must actually be set up with established systems, processes and staff for a final approval by CBK before it can start operating.

For fast-moving, capital-constrained fintech startups, this lengthy timeline and these extensive setup costs are not feasible. Furthermore, reporting and capital requirements change frequently, which, while positive for the evolution of banking regulation, can leave a lean fintech startup at a disadvantage relative to incumbents.

Alternatively, fintech startups can consider becoming technology partners of regulated financial institutions and leveraging a Software as a Service (SaaS) model. In this case, the licensed financial institution would apply for regulatory approval of the technology partnership and the new product that the institution intends to launch in the market. This approach allows fintech startups to work with multiple financial institutions and go to market faster than they would if they applied for the license themselves. The consequence of this approach is the added complexity of serving end-users alongside a partner – which we discuss further in approach four.

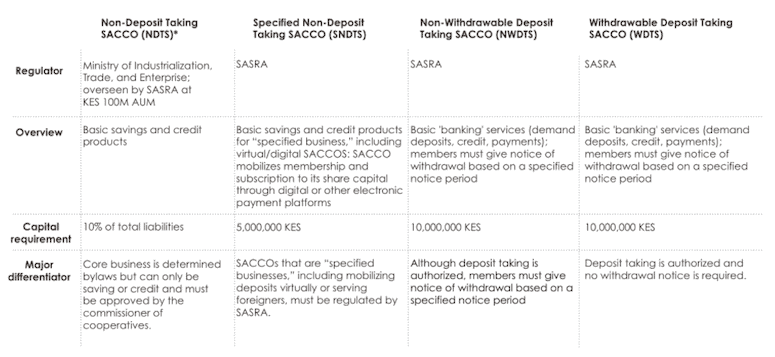

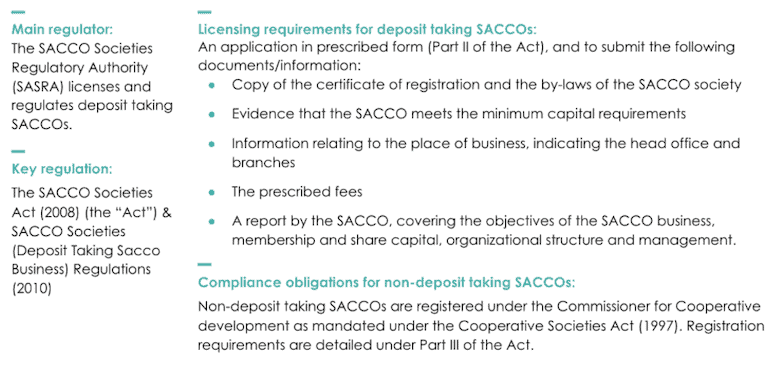

Approach 2: Register as a cooperative

Savings and Credit Cooperatives (SACCOs) are considered banking institutions, but they are community banks intended to offer limited credit and savings products to members. They are either regulated by the Ministry of Industrialization, Trade and Enterprise Development or the SACCO Societies Regulatory Authority. There are four key types of SACCOs, but all are intended to offer basic banking services including savings, credit, payments, and in some cases, investments.

In January 2021, the Specified Non-Deposit Taking SACCO was launched as a unique license for non-deposit-taking SACCOs that mobilize membership through digital or other electronic payment platforms. This new SACCO license could be a more viable option for digital savings startups because the requirements are less stringent than a full banking license, the process is shorter, and it eliminates partnership risk.

However, the obligations for startups are still extensive. When joining a cooperative, Kenyans expect the standard offerings, including credit, and historically, SACCOs have brick-and-mortar locations that offer community banking. The organization’s name must also include “SACCO,” which can add specific connotations and expectations to a startup’s brand if they have a digital-first offering.

Approach 3: Register as a payments provider, specifically an e-money issuer

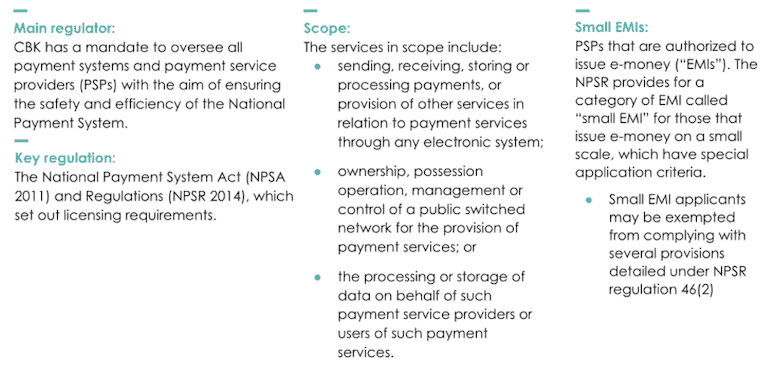

Registering as a Payment Service Provider under the CBK would give a startup the ability to send, receive, store and process payments, as well as provide other services related to payment through any electronic system. This designation could be appealing to a digital savings startup because it allows for the transfer and storing of funds, and also has less onerous reporting requirements than deposit-taking banking options. Leveraging an existing payment aggregator’s license could be an even faster pathway to market, because then the startup wouldn’t have to go through the registration and licensing process itself. However, this path leads to partnership risk if a startup’s entire business model relies on one partner. Furthermore, offering digital savings as a small e-money issuer is a regulatory gray area. Since the real intent of the regulation is for payments providers, it’s possible and likely that the regulator would eventually recommend a full banking license for a digital savings company leveraging payment regulation.

Approach 4: Register as an asset manager or agent of an asset manager

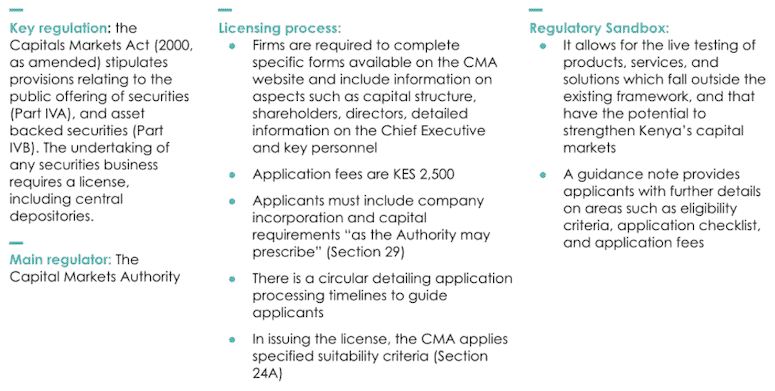

Companies offering securities – i.e., asset managers – are regulated by the Capital Markets Authority (CMA). For a digital savings startup, being a licensed asset manager would allow the organization to take deposits and invest the funds to generate returns. But if there is no plan for the savings startup to invest the deposited funds, then this license would not be appropriate.

Timelines to obtain a license can be long, but the CMA has a sandbox that gives innovative products that could strengthen Kenya’s capital markets temporary authority to operate. This temporary status creates a pathway toward obtaining a full license and gives the CMA a way to consider changes to existing regulations that they deem necessary to effectively oversee new models.

If a startup can quickly find a partner to become an agent of an asset manager – meaning they contract with an existing asset manager to leverage their license to bring the digital savings product to market – they can begin to operate more quickly. This could be the fastest way to launch a product in the market. In this option, as with the approach to becoming a technology provider to financial institutions, the startup must relinquish some degree of ownership of the customer, depending on the agreement, and must align communications, messaging and branding with the partner. Aligning with an incumbent can be challenging for startups, which are accustomed to faster, leaner decision-making. They must also establish strong alignment on operational processes and customer service between the partnering organizations.

Despite complexities, regulators are highly engaged with fintech innovators

Despite the lack of a straightforward approach to launch a standalone digital savings product, Kenyan regulators are generally supportive and encouraging of innovation and fintech, particularly with the objective of promoting financial inclusion. The authorities have taken a test-and-learn approach in the past, and we see this attitude in the adoption of initiatives such as the CMA regulatory sandbox and the letter of no objection issued by the CBK and Competition Authority to Safaricom in the early days of M-Pesa.

Close relationships with regulators among fintechs – and a test-and-learn approach on the regulator side – ultimately benefit both startups and financial sector innovation at large. The National Payment System Act and its associated regulations were enacted after the government had established an understanding of M-Pesa, to provide a formal framework for the regulation of payments systems and Payment Service Providers. But since there isn’t a designated regulator specifically for digital savings platforms, nor a regulation framework specifically for fintech, what is the way forward for digital savings innovations to find a place in the Kenyan market?

According to Michelle Hassan, Kenya Country Manager and a Principal Consultant at BFA Global, “For Kenya to really offer inclusive savings products, we need more flexibility and sandboxes across regulators. The scene is huge with ample opportunity to grow in ways that would bring more needed solutions to the underserved.” This is great advice for Kenya, but also for authorities looking to promote digital financial inclusion around the world. In the meantime, startups looking to navigate the complexity of regulation can use our guides as a starting point.

Abby Butkus is a Senior Consultant at BFA Global and Senior Program Manager of Catalyst Fund.

Photo courtesy of lau rey.

- Categories

- Finance, Technology