Supporting Microfinance During the Pandemic: Lessons From a COVID-19 Response Program

Like other sectors, microfinance has been hit hard by the COVID-19 pandemic. Beyond the health risks posed by the spread of the virus, the containment measures taken by governments have also strongly affected microfinance institutions (MFIs), which have suffered from the crisis in two main ways.

First, the micro and small enterprises typically served by microfinance have been constrained in their economic activities because of lockdowns, mobility restrictions and the decrease in demand for their products and services, especially those working in urban areas or in trade and services. The negative impact on their income and financial resources has been transferred to the MFIs that finance them, which have had to deal with late repayments and default risks. On top of that, MFIs have also had to face operational constraints, as many of them have lacked the capacity to work remotely or manage all operations digitally. As a consequence, they’ve had great difficulty in collecting payments and were unable to disburse loans for a while — especially during the first months of the crisis — which negatively impacted their portfolio in both quality and volume.

As part of our efforts to support the development of inclusive finance, ADA, a Luxembourg-based NGO, quickly designed and implemented a response program to help our partner MFIs overcome the crisis. The core of the program, which ended at the beginning of this year, consisted of providing MFIs with timely technical assistance to help them define a business continuity plan, analyze and manage their portfolios and liquidity, and digitalize some processes. It also included the distribution of grants to cover urgent needs in sanitary supplies, such as masks and hand sanitizer, and digital equipment like phones, computers and software to facilitate remote work for loan officers and other staff. Complementary activities consisted of contributing to survey initiatives with MFIs and their clients to get a better understanding of the challenges both groups were facing.

In total, ADA supported 68 MFIs all over the world with grants and 42 MFIs with technical assistance, with some of them getting both. We’ve drawn several lessons from the experience which could be useful in helping MFIs navigate future crises. We’ll discuss them below.

COVID-19 Has Had Different Impacts in Different Regions

First, COVID-19 has not affected all regional microfinance sectors in the same way. The crisis hit MFIs in Latin America more strongly than in Africa, both in terms of health issues and containment measures. On the other hand, MFIs in Latin America are larger and/or more mature than in Africa, while the level of preparation and capacity to manage risks, in general, is rather low among African MFIs. As a consequence, the support we provided in risk management was relevant everywhere, even though the urgency of the need for these measures was uneven across regions. In addition, beyond the added value of our technical assistance, the organizational and moral support we provided was highly valuable for these institutions, which did not know how to start when the crisis hit, and needed structured guidance.

Client Centricity and Data Analysis are Key Elements of Resilience

Another lesson relates to the attention MFIs have paid to their clients’ needs: Some MFIs made more efforts than others to listen to their clients in this period, and to understand their needs. Those who learned about their clients’ needs and took specific measures to address them reaped the benefits, especially by strengthening their customer relationships.

A related factor that helped MFIs cope with the crisis was their capacity to make informed decisions based on data analysis — either data about their portfolios or about their clients’ perspectives. The MFIs that had the ability to be flexible and responsive in utilizing this data, and to take action and adapt operations quickly, were better able to navigate the pandemic’s challenges.

Nonetheless, the crisis is still severely hurting microfinance customers and the broader economy, especially in Latin America, where MFIs continue to face strong difficulties. Therefore, support for the inclusive finance sector is still needed, to sustainably strengthen MFIs’ capacity in managing risks and answering their clients’ changing needs – while keeping in mind that the resilience of MFIs and that of their clients are interdependent.

Using Surveys to Analyse the Effects of the Pandemic

To complete our COVID-19 response program, ADA, in association with the Grameen Crédit Agricole Foundation and Inpulse, a Belgium-based investment manager, launched multiple rounds of surveys to monitor the effects of the crisis among our partners in the field. In total, we conducted five rounds of surveys in 2020 and one in 2021, collecting information from 70 to 110 MFIs each round. These surveys allowed us to stay informed about the main issues faced by MFIs, including the persistent decrease in portfolio quality due to late repayments, and the decrease in outstanding portfolio. But they also allowed us to learn about opportunities from the MFIs’ point of view, including new products and services they aim to develop (like savings and financial education) or sectors they plan to target more in the future (like agriculture).

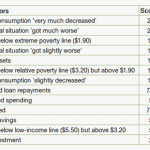

Additionally, to better understand how microfinance clients were affected by the crisis, ADA also supported some of its MFI partners in sub-Saharan Africa, Southeast Asia and Central America in collecting information from their clients, using the client interview tool developed by the Social Performance Task Force. In most cases, the collection of this data has been facilitated by external entities, and sometimes by networks and professional associations. Two main trends emerged across countries from analyzing this data. First, at the peak of the crisis, around 90% of clients declared that their financial situation had deteriorated a little or a lot. And second, the main coping strategy clients adopted was to tap into their savings, even if their borrowing increased over time, raising fears of the risk of over-indebtedness.

In general, these surveys helped MFIs identify which measures to take in order to meet their clients’ needs: Some of them revised their credit policies or payment collection procedures to make them more flexible in this period of crisis, while others identified which client segments to target in restructuring loans. In the end, the MFIs that endeavored to take their clients’ needs and requests into consideration strengthened their relationships with them.

In order to deepen the discussion of the lessons learned from this survey experience, ADA is organizing an online webinar, the Midi de la Microfinance en ligne, (in French with live English translation) on June 9 at 12:00 UTC+2 (6:00 am EDT). Participants will have the opportunity to listen to the experience of Jacques Afetor, Director of Assilassimé, an MFI based in Togo, who participated in this initiative, and Eric Campos, Managing Director, Grameen Crédit Agricole Foundation and Corporate Social Responsibility Director, Crédit Agricole S.A. The webinar will be moderated by Laura Foschi, Executive Director of ADA, and Bruno Dunkel, Chairman of the Executive Committee, Inpulse will provide the closing remarks. Please register here to participate: https://www.ada-microfinance.org/en/events/midis-microfinance.

Mathilde Bauwin is a Research Project Officer at ADA.

Photo courtesy of World Bank Photo Collection.

- Categories

- Coronavirus, Finance