NexThought Monday: Closing China’s Credit Gap

Between 2011 and 2014, 180 million adults (aged 15+) became new bank account holders in China. Yet in 2014, only 9.6 percent of Chinese adults, or less than 110 million, actually accessed credit from a financial institution, which includes credit unions, microfinance institutions and cooperatives as well as banks. The incongruity across such statistics highlights both the progress made and the challenges remaining on China’s path to a more financially inclusive economy.

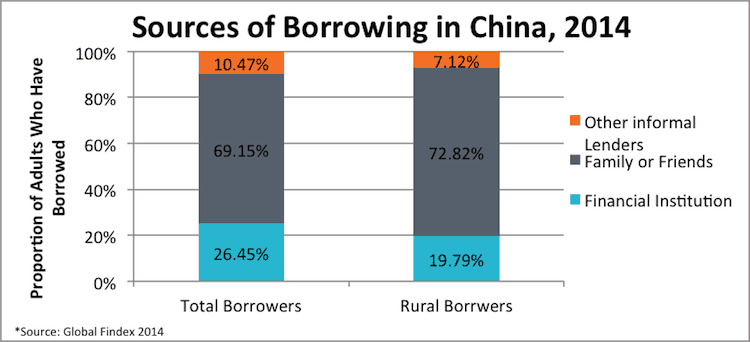

The need for reform is as important as ever with China’s growing credit industry. During its economic slowdown, China has looked to spur growth through consumer spending and should continue to see consumer lending steadily grow. The rigidity and costliness of China’s financial institutions, however, have hindered addressing consumers’ growing credit demand, leaving a discernable credit gap. Instead, in a big way consumers have resorted to informal and nontraditional sources of loans. This largely holds true for both urban and rural borrowers, with roughly a third of Chinese adults borrowing in 2014.

Among China’s informal lenders, family or friends are still the most common for financing individual loans, but “shadow banking” institutions, most notably P2P and online lending companies, have cropped up in recent years to try to capture this untapped market. As less regulated institutions, these shadow banks almost uniformly offer higher-risk, high-interest loans, rather than provide a sustainable and transparent alternative to banks.

The reliance on informal and nontraditional sources of lending in part reflects more young, high-risk consumers looking for credit, but it also is a symptom of a lack of available information. Lenders often have no access to the borrower’s financial history much less their reasoning for borrowing money.

Solving the credit gap through online data

Closing China’s formal credit gap requires a scalable system for credit evaluation. China’s current solution of the Credit Reference Agency, a centralized credit agency, falls short. While it has profiles of over 800 million individuals, many are reportedly filled with no more than basic information such as names and ID numbers. In fact, only 350 million – less than one third of the over 1 billion Chinese adults – have credit records. By comparison, 89 percent of the adult population in the U.S. has a credit score.

As the flag-bearer for China’s internet finance and mobile payment movement via its Alipay service, Alibaba-affiliate Ant Financial is trying to provide an innovative solution. By leveraging its IT expertise, Ant Financial is trying to do to credit scoring what it has done to payments. Its solution: Sesame Credit.

New credit scoring businesses have been cropping up around the world recently. What sets this new credit score apart is the scale and depth of Alibaba’s e-commerce data to which Ant Financial has direct access. The big data gathered from these e-commerce and payment platforms are far more insightful for credit-based decision-making than what most other nontraditional businesses are claiming to achieve with social media or other forms of non-economic, online activity.

Tapping into the Alibaba ecosystem gives Sesame Credit access to data on over 400 million annual active users and 37 million small businesses that buy and sell via its online marketplaces, as well as payment histories of over 400 million annual active Alipay users. This expertise in cloud and data management is then coupled with other traditional credit scoring information sources such as bank and government records. That Ant Financial can further utilize data from Alibaba’s many other businesses, capitalize on the group’s expansive human and IT resources, and leverage its China gravitas to win important, strategic partnerships means it has real potential in bolstering China’s future credit infrastructure.

Is it a tool for the underserved?

Sesame Credit has shown early promise in its ability to expand access to credit. Ant Financial has already been providing loans to businesses showing strong sales performance on its platforms, and “Sesame scores” are clearly an attempt to standardize and expand on this model.

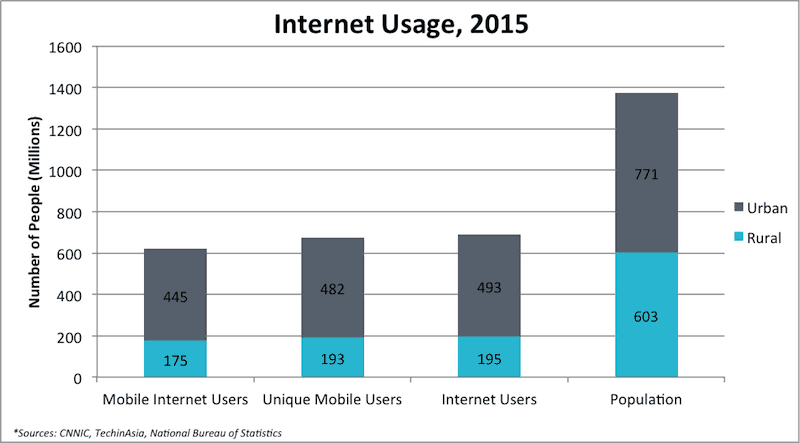

Of course, a good Sesame Credit score is contingent on adequate use of one or more of its data-generating services, most of which fundamentally require ownership of a smartphone or computer. Rural residents are thus at an inherent disadvantage when it comes to Sesame Credit, as just one third of the countryside are online and only 32 percent own a mobile phone, according to KPMG.

Nevertheless, Ant Financial has shown its intent to build a rural user base by investing in the countryside’s data generation. Its investment into the Postal Savings Bank of China (PSBC), which has the largest network of branches in China, will provide the credit reporting with vital financial information on rural users.

Further, an expansion of its businesses to rural areas should only equate to more data-crunching possibilities to better serve this population. Alibaba, still the key party behind Sesame Credit’s data network, has heavily invested in rural infrastructure to expand its market potential to increasingly rural and remote locations. For instance, it is has built rural service centers in over 14,000 villages and has even developed a rural-focused online shopping platform “Rural Taobao.” These service centers help deliver products within villages and are outfitted with computers, providing greater access to the internet. To meet the logistics burden of reaching rural residents, Alibaba’s related business arm formed a strategic alliance with China Post, allowing online shoppers to collect packages from 5,000 postal outlets. Within the next three to five years, Alibaba hopes constructing more such centers will expand its services to over 100,000 villages. After developing a history using these services, rural residents may then gain newfound opportunities to borrow and invest as the integrated businesses funnel customers to Ant Financial.

Too soon to tell

The sum of Ant Financial and Alibaba’s advantages may soon make it one of the most powerful success stories in global financial inclusion efforts. But it will likely never be a magic bullet – not everyone can be plugged into Alibaba’s businesses. At this point, it remains hard to imagine what Sesame Credit will ultimately become. Sesame Credit has already innovated into non-financial uses that are simultaneously novel and concerning: a visa processing tool, a matchmaking moniker, and flight and hotel booking perks, among many others. This gives Sesame Credit the look and feel of a gimmicky loyalty program for Alibaba customers. Further, little information in the public realm can firmly prove that Sesame Credit scores are actually providing much insight into credit worthiness beyond what Ant Financial had already directly provided in terms of discerning credit worthiness of e-commerce businesses.

Adding to the complexity of the topic, there is also much fear and speculation that the government will fashion Alibaba’s work on scoring into a surveillance scheme. Plans for a more centralized credit scoring system are already in the works, and some signs point to Alibaba having no choice but to assist in this process. What is clear now, however, is that Sesame Credit must first prove itself effective and reliable before any of the extenuating circumstances become too relevant. The potential for positive change is there. Now Ant Financial must try to realize it.

Timothy Tsang is a research fellow at Positive Planet China. This blog is being published simultaneously by the Center for Financial Inclusion.

Photo by Robert Scoble, via Flickr

- Categories

- Uncategorized