Winning the Low-Income Market: Assessing the State of Product Development in the Nigerian Financial Service Industry

Nigeria’s financial inclusion targets remain unmet, and any progress has been endangered by the COVID-19 pandemic. Among low-income Nigerians where exclusion is highest, financial service providers (FSPs) are yet to achieve product-market fit due to, among other factors, poor market knowledge.

Our 2017 research work at the Lagos Business School concluded that there is a dearth of insight and understanding of the intended consumers of digital financial services, particularly at the bottom of the pyramid. These unbanked individuals are not in any database, and hence their behaviors and traits are largely unknown. To successfully include these individuals, providers need to know who they are and what problems they have that may be addressed by financial services. This lack of consumer insights and poor product-market fit continues to plague financial services adoption to this day.

As financial inclusion advocates, one of our priorities is to close this knowledge gap by enhancing product development insights and capacity. One key part of generating these insights is to better understand the current practices of financial service providers. To that end, the learnings below represent findings from a study of product development practices among FSPs which we conducted in 2020. We also surveyed several financial service providers to identify the leading inhibitors impacting their ability to develop and launch great products.

Traditional product development practices among providers are lacking

The quality of financial products and services being delivered to consumers is determined by providers’ end-to-end product development process – i.e., the tools and methods they use to conceptualise, design and launch financial products.

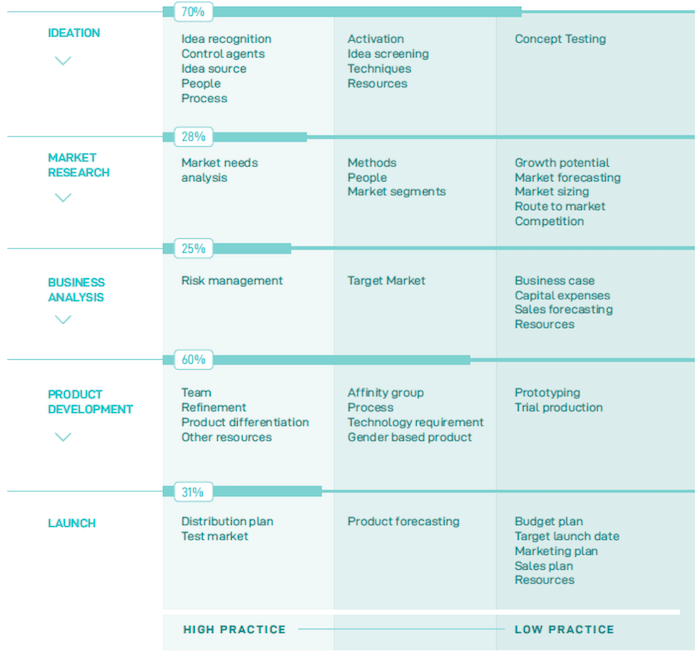

Our exploratory assessment of product development practices among commercial banks, microfinance institutions, mobile money operators, switching companies and insurance providers revealed that, by and large, FSPs use the traditional five-stage product development process (ideation – market research – business analysis – product development – launch) to varying degrees. The illustration below summarises their practice levels:

We found that providers are well-versed in executing ideation and product development activities. The gap areas we identified centered on activities linked to customer-centricity and understanding the market/business model– i.e., market research, business analysis and product launch activities:

- Market research: Market research offers providers a better understanding of consumers, competition and existing market dynamics. We observed that FSPs do not seem to prioritise market exploration, and this affects their ability to accurately estimate product growth potential and overall inflows over the product lifecycle. The prevalent practice in the industry also involves leveraging existing routes and channels rather than harnessing new ones.

- Business analysis: Business analysis reveals the potential profitability of a product to be launched. It allows providers to identify their break-even point, forecast sales volume and determine a minimum sale price, among other important indicators. While the study found that FSPs practice risk management, they were lacking in adequate sales forecasting, capital expenses determination and even the adoption of a clear business case during product development. (This reflects a tendency among commercial banks in Nigeria to develop new products based on imitation and industry trends, rather than adequate customer research.) Adopting business cases in particular would have been useful to determine the feasibility and viability of the product, and also to identify compelling value propositions that meet market needs at a competitive cost.

- Product launch stage: This is where the new product is delivered to the market, making it generally available to the target customers. One of the prevailing launch activities we identified was test marketing. Test marketing aims to explore consumer response to a product or marketing campaign by making it available on a limited basis before a wider release. We found that test marketing is widely practiced in the financial services industry, but in different ways. For technology-linked products that are offered by payment switches, mobile money operators and traditional (i.e., not digital or microfinance) banks, providers adopt internal testing, in which only a small group (sometimes comprised of select employees of the organisation) are engaged to test a product in a closed-door setting. However, this kind of testing cannot adequately predict product success or failure due to the extremely limited sample size. Thus, results from test marketing are not projectable.

Product Innovation Inhibitors

There are a number of inhibiting factors that impact FSPs’ ability to develop and successfully launch great products. These factors include cumbersome regulations, high turnover of talent and manpower, cost and security of IT infrastructure, and executive buy-in:

- Cumbersome regulation: With regulators adopting new approaches to policy formulation, an enabling environment that encourages innovation which can move the financial inclusion needle is still lacking. For example, uncertainty about the regulatory environment, due to changing and sometimes conflicting policies, poses concerns for providers considering rolling out new products. Providers also highlighted the challenge of regulators’ long approval cycles, which extend their time to market and limit their ability to meet customer needs at the right time.

- Talent and manpower turnover: Developing new financial products requires talent, either internally sourced or delivered through partnerships. Getting the right talent is a limiting factor for smaller ecosystem actors (like microfinance institutions) with limited financial resources, as they are unable to recruit high-quality talent and also miss out on learning and capacity development opportunities which are often capital intensive. Talent scarcity also results in high turnover rates within the industry.

- Cost and security of digital infrastructure: The lack of adequate infrastructure, such as power and mobile network connectivity, adversely affects the customer experience –particularly in rural and remote regions and last-mile agent locations. The inability to leverage existing agent networks and digital infrastructure (or extend this infrastructure sustainably to remote regions) has also limited providers’ ability to expand to more consumers in a sustainable and viable manner. Another factor related to the availability and quality of digital infrastructure is their security, in areas where they are prone to theft (e.g., by people who steal and sell parts from power transformers, cell towers, etc.).

- Executive buy-in: Financial inclusion is a long-term effort that requires patient capital from investors and providers. However, access to long-term capital remains a challenge for providers – particularly those targeting the bottom of the pyramid. The inability of providers to present a strong business case also limits stakeholders’ willingness to invest long-term in order to reach the lower-income customer segment.

These supply-side insights form the basis for the solutions we offer to FSPs. For example, to address the challenge of product-market fit, we propose customer-centric design processes. Our core solution is a product development lab that not only fosters customer-centricity but also embeds business and management concepts that help providers build the business case for their products while piloting them.

Design thinking is a human-centered, iterative process that organisations utilise to understand their customers, challenge their own assumptions, redefine problems and create innovative solutions which they go on to test. Design thinking practices are common in diverse domains, and have proven successful for FSPs in other markets like Rwanda, India, Bangladesh and Latin America. We strongly believe these practices will make a difference in Nigeria as well.

There are more insights from the survey in our Digital Financial Services in Nigeria: State of the Market Report 2020. We hope this research will advance the state of product development and other practices among the country’s financial service providers.

Olayinka David-West and Ibukun Taiwo are members of the Sustainable and Inclusive Digital Financial Services initiative of the Lagos Business School.

Photo courtesy of USAID Digital Development. Homepage photo courtesy of UN SG’s Special Advocate for Inclusive Finance.

- Categories

- Finance