Opportunity International and MyBucks: A Dangerous Partnership Decision?

Editor’s note: The sale of microfinance institutions to fintech companies has broad potential repercussions for both clients and the sector’s overall development. Because opinions differ on whether this impact will be positive or negative, NextBillion is running multiple, comprehensive posts on the topic. The post below was independently authored by former MFTransparency CEO Chuck Waterfield, and provides a critical take on Opportunity International’s sale of six microfinance banks to the fintech company MyBucks. This post, written by Daniel Rozas and Gabriela Erice García at the European Microfinance Platform, presents their own independent analysis of the sale and its ramifications, and was reviewed by Opportunity International and MyBucks prior to publication. Opportunity CEO Vicki Escarra previously discussed some of these issues in this NextBillion interview, and the organization has contributed an additional post addressing Waterfield’s criticisms.

A million poor Africans at risk?

I fell into microfinance 31 years ago. Without knowing anything about lending money, I was tasked with starting a micro-credit project in Haiti. The industry was very young at the time and information was scarce, but I was invited to visit an MFI partner of Opportunity International. I learned from Opportunity as I got started in a new career, and in future years I did a significant amount of training of their staff around the world. For many years, I respected their work and their values. As mutual early-comers to microfinance, we were inspired to offer the poor an alternative to high-priced predatory lenders.

Sadly, my long respect for Opportunity has transitioned into doubt and concern in recent years. What I read and hear in their public announcements doesn’t align at all with what I see in publicly-available data. In hearing their CEO, Vicki Escarra, interviewed by NextBillion, I decided the contrasts were far too great to continue to remain silent. In private conversations with many others in the industry, I know I am not alone in my concerns about the ramification their sale of six Opportunity Banks to MyBucks holds for the clients of those banks as well as for the broader microfinance industry. I feel the industry, as well as the donors, supporters, and clients of Opportunity, deserve a fuller response to the concerns I raise in this blog. The savings and potentially the economic welfare of over a million trusting poor clients in Africa appear to be at risk.

The Quiet November Sell-off

Escarra states that in 2007, Opportunity started a large-scale “Banking on Africa” campaign to set up Opportunity-owned full-service banks across sub-Saharan Africa. Then, last November, Opportunity issued a press release announcing the sale of the majority stake of six of those banks. There was sparse information on why they sold the banks, and many in the industry were puzzled at Opportunity’s decision to give control of these banks to MyBucks, a new fintech company whose leadership has a history in South Africa’s roundly criticized microcredit market, specifically in payday lending.

Until the recent interview with NextBillion, there had been significant silence from Opportunity on this issue. Disconcertingly, what I hear in the interview does not match at all with what I see in my research.

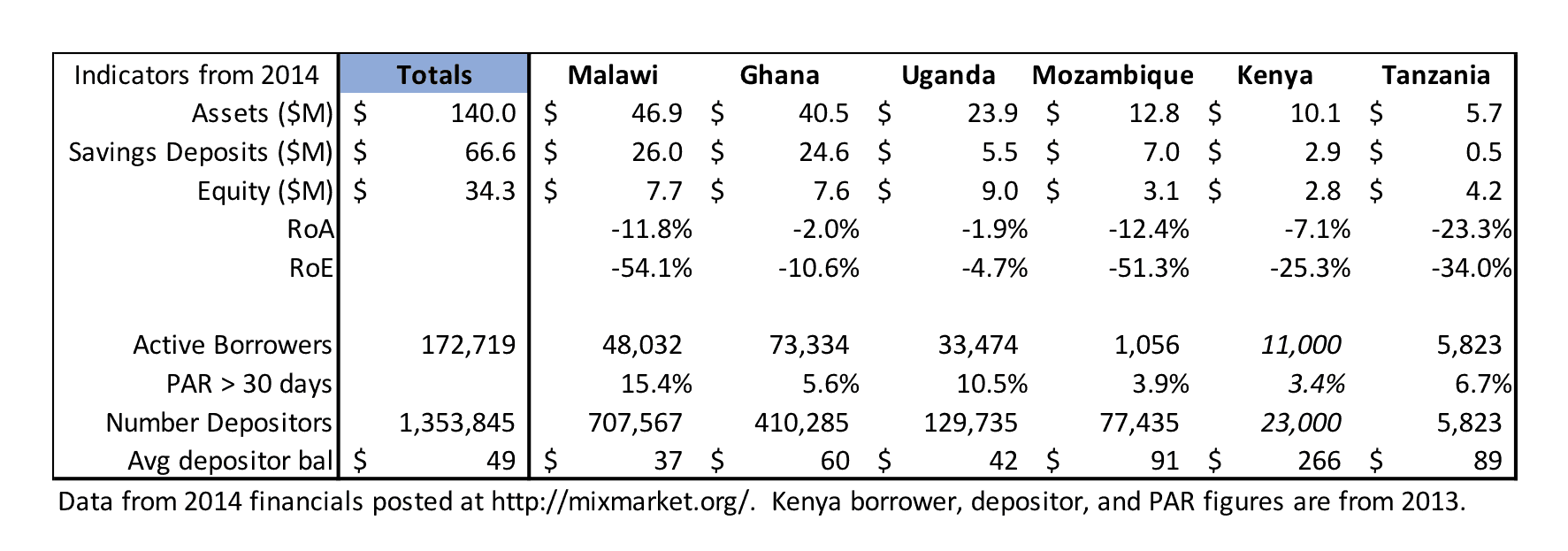

Financial Position of the Banks

Escarra says of Opportunity’s global network of MFIs, “Most of them, in fact, almost all of them are self-sustaining.” The six they sold in Africa most certainly are not. I collected data posted at MixMarket for 2014 (the most recent year available) and see that every one of the six banks had significant losses (see table below). The largest of the six, Opportunity Bank Malawi, lost 54 percent of its equity in just a single year. These are very problematic numbers, indicating serious problems in the financial health of the banks, but Escarra makes no indication of that in the interview, nor is this addressed in the press release.

All six banks are losing money, and the loan repayment is problematic. Four of the six banks have portfolios at risk (PAR) > 30 days higher than 5 percent and as high as 15 percent, while the industry benchmark for this indicator is for it to be under 5 percent. Of greater concern is that these six banks held US $67 million in savings deposits of 1.4 million poor Africans in 2014. If the banks continue their poor performance, these people’s savings are at risk.

Key Financial Indicators for the Six Opportunity Banks, 2014 data

Is MyBucks really the perfect partner?

Escarra says that after screening 12 different buyers, Opportunity concluded this about MyBucks: “Our values and their values match up perfectly.” I and many colleagues in the industry asked ourselves: Who is MyBucks, and why did they receive approval from Opportunity over the other potential buyers? Their financial information is private, as they don’t report to the MIX, and their management doesn’t seem to frequent industry events. I did some research, and the founders’ experience prior to MyBucks raises questions for me. Of even greater concern, however, are the current actions of MyBucks.

First, the past experience: As I mentioned above, both the current CEO, Dave van Niekerk, and the former co-CEO Johan Jonck (whose stated position changed very recently as the company restructured under a single CEO) come from the South African payday lending industry. Both had private lending companies that were absorbed into African Bank, a consortium of 200 payday lenders. My visit to African Bank in 2010 confirmed that their lending rates generally ranged from 200-400 percent APR, when related fees were included. African Bank went bankrupt in 2014 and after a bailout by the South African Reserve Bank arose from the ashes just last month. Of the two leaders, van Niekerk is the main spokesperson for the Opportunity buyout. In addition to his African Bank involvement, he founded Blue Financial Services in 2001 and was CEO until 2010. Although van Niekerk is not directly implicated, there are a number of allegations of financial manipulation and fraud, raising concerns over the directions of this bank.

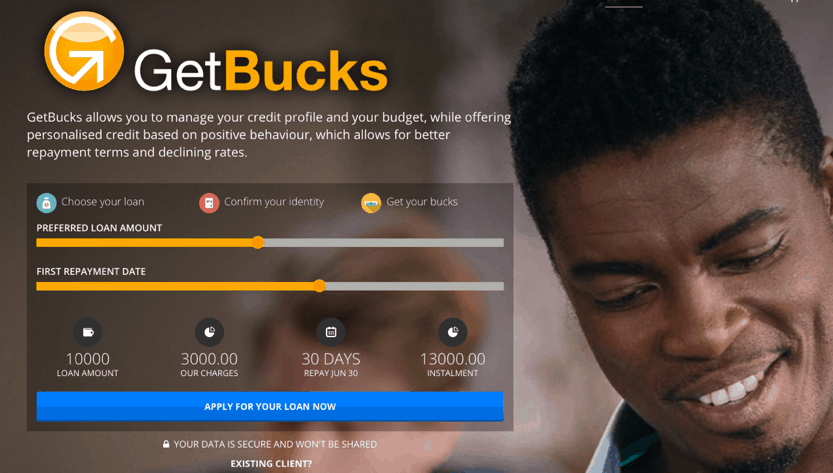

Now for current actions: van Niekerk started lending operations called GetBucks in multiple countries, and the GetBucks entities were then incorporated as MyBucks in early 2014, with ownership shifted to Luxembourg, well-known as a tax haven. GetBucks makes small, short-term loans to those who have proven paycheck-based employment and provide bank account information.

GetBucks has been expanding rapidly into new countries. Its website indicates operations in 11 countries, only two of which (Kenya and Malawi) overlap with the six Opportunity banks. Thus, this buyout gives them active operations in four new countries. The loan products are very clearly shown on the homepage of the website in each country. Following is a screenshot of the Kenya home page, inviting you to borrow KSH 10,000 for 30 days and pay back KSH 13,000. It may be that there are also some hidden fees not shown here, but at a minimum, this is clearly a price of 30 percent a month. In Malawi, the price is even higher, 40 percent a month.

The following table provides links to each GetBucks homepage and shows the prices advertised by GetBucks for their loans as of June 2016. Using the links in the chart below, you will see the loan conditions in each country. Most countries have a default loan term of approximately 30 days. For those with longer loan terms, I used the sliders to convert to a 30-day loan in order to have comparable loan products for the comparison. During my time as CEO of MFTransparency, I learned the challenges of getting sufficient information to calculate a true price (APR). In the case of GetBucks, the true price may indeed be higher than the figures I have calculated, but the price is certainly no lower. For APR, I’ve done a simple multiply-by-12 calculation; a compounded calculation of the annual rate would result in figures in the many-thousands-percent.

|

30-day GetBucks loans as shown on home page of each country’s website (as of June 2016) |

||||

| Country | Loan (local currency) | Cost | Monthly Rate | APR |

| Malawi | 20,000 | 8,087 | 40% | 480% |

| Kenya | 20,000 | 6,000 | 30% | 360% |

| Swaziland | 5,000 | 1,442 | 29% | 348% |

| Spain | 800 | 213 | 27% | 324% |

| Poland | 4,000 | 986 | 25% | 300% |

| South Africa | 4,000 | 841 | 21% | 252% |

| Botswana | 10,000 | 1,910 | 19% | 228% |

| Zambia | 5,000 | 905 | 18% | 216% |

I have spent decades studying prices in microfinance, and I founded and managed the industry’s pricing monitor, MFTransparency. Comparison with the prices at mftransparency.org shows that GetBucks clearly charges prices at least twice as high as even the highest priced MFI in any of the countries for which MFTransparency reports data.

What’s the Attraction?

That’s the data, so now I’ll make my speculations. When asked about pricing in the NextBillion interview, Escarra says that MyBucks’ prices will be below market and they are committed to receiving Smart Certification. All evidence is to the contrary. If committed to fair pricing, why did Opportunity choose a partner with such a clear past and present record of extremely high pricing?

Escarra states that Opportunity was in discussions with 12 prospective buyers. Opportunity’s roots and individual donor base come from the Christian community, and their stated values certainly could find clear alignment with any number of other organizations involved in microfinance, such as World Vision, which recently took control of the seventh bank sold by Opportunity. Why choose MyBucks? The evidence implies that the other prospective buyers may have been unwilling, or unable financially, to turn around the financial position of these six banks. Or perhaps they were unable to outbid MyBucks.

So why, among these 12 potential buyers, would MyBucks be interested in taking over these banks? As Escarra states in her interview, MyBucks is currently operating with more expensive funding sources, because they primarily work with equity investments from investors expecting high returns. She points out that the savings accounts of the poor have a very low financial cost. In the press release reporting the sale, van Niekerk states that MyBucks will recapitalize all the banks. Thus, buying the banks gives MyBucks access to US $67 million of inexpensive savings. If its history is any guide, the company seems likely to start taking the savings of the poor (for which it pays little, if anything, in interest) and potentially lending it out to other poor clients at 30 percent and 40 percent a month.

Escarra points out that Opportunity retained a minority ownership in the banks and holds one board position in each bank. As virtually anyone with a minority position in a business knows, all you can do is try to raise relevant issues, but you can’t control how management acts. At the end of the interview Escarra says, “We should talk again in one year … it will be fascinating to talk and see what success we’ve made.” I’ll be listening in a year, and I really hope I’m wrong in my concerns, but all evidence leads me to the conclusion that any “successes” reported by MyBucks likely won’t be shared by its new stable of poor customers.

Chuck Waterfield was the CEO of Microfinance Transparency, and has over 25 years experience in the sector.

[yop_poll id=”10″]

- Categories

- Uncategorized