Rapid Growth = Equitable Access? Is Ivory Coast’s financial sector expanding enough to reach full inclusion?

Five years after the bloody post-election crisis, Ivory Coast has achieved political and economic stability, though complete national reconciliation remains a major challenge. With an annual growth rate of 9 percent over the last three years, Ivory Coast is also one of the fastest-growing economies on the continent, driven by a high performing agricultural sector and foreign investments to support the rebuilding of local infrastructure.

Behind these positive macroeconomic trends, we find a dynamic, innovative and rapidly evolving financial sector. But is the country progressing toward financial inclusion for all Ivorians? How is the microfinance sector faring in the clean-up process that the government started a few years ago? And how is the rapid expansion of mobile money impacting the overall financial access picture?

MIX is launching an updated version of our initial Ivory Coast workbook release from 2013, which explores some of these key questions.

The expansion of the banking sector

In the last two years, the banking sector has seen a rapid expansion of its activities in terms of access and products. New companies, mainly African holdings, acquired licenses to operate in the country and set up branches. There are now 24 banks active in Ivory Coast, with the number of access points jumping from 255 in 2013 to 318 in 2015, a growth of 21 percent. Similar to other countries in the region, the bank access points remain highly concentrated in the capital, Abidjan (55.7 percent), and main cities such as San Pedro, Bouake, Gagnoa, Daloa, Yamoussoukro and Korhogo (all together accounting for 14.7 percent). Low population density and unreliable means of personal identification in rural areas are the primary reasons why banks focus on urban areas.

The expansion of the banking sector is also led by innovative partnerships with mobile network operators. A great example of this is the “Cardless” service, a collaboration allowing MTN Mobile Money users to withdraw their e-wallet money through ATMs at CNCE (a major retail bank) using only their phones. This partnership, the first of its kind in West Africa, shows a banking sector that’s evolving – not only in terms of physical presence, but also of pioneering a new approach to reach more customers.

The contribution of microfinance institutions to greater financial access

Ensuring sustainability in Ivory Coast’s microfinance sector is a work in progress. The clean-up process led by the microfinance supervision body at the Ministry of Economy and Finance is underway, and several microfinance institutions (MFIs) have had their licenses revoked in the last two years, leading to the closing of financial access points. While 62 MFIs have retained their licenses as of 2015, nine of these have suspended their activities, eight are no longer considered viable, and a few others are in the process of license withdrawal.

We gathered information on the 28 largest MFIs, which account for 251 points of service. Unsurprisingly, we found that there is a relatively high concentration in Abidjan; 30 percent of access points are located in the capital, serving urban clients. Nevertheless, MFIs are also able to provide access to financial services in underserved and rural areas of the country, especially in the east and northwest regions.

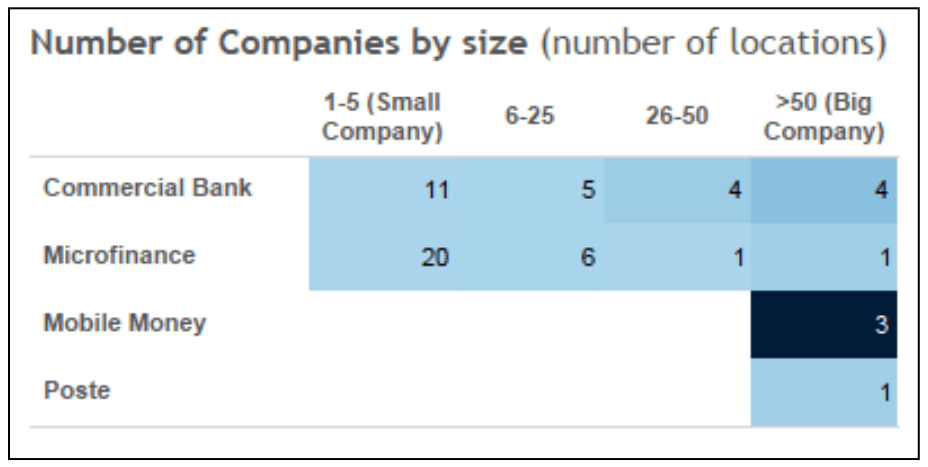

Institutional size is a key attribute that greatly affects the opportunities and challenges of the microfinance sector. The majority of MFIs in Ivory Coast are small-sized (1 to 5 access points) and are not able to leverage economies of scale to become more sustainable or develop a full range of appropriate financial services. (See Figure 1, below.)

Figure 1

Though the general operating indicators such as number of clients, deposits, gross loan portfolio or loans disbursed are consistently growing, risk indicators remain high (for instance, Portfolio At Risk > 30 days is over 10 percent). An additional risk factor that may affect microfinance access is that the largest provider, UNACOOPEC-CI, the only company accounting more than 50 access points in the chart above, has been under temporary administration since 2013. The government recently launched a recovery plan for the company, to support its restructuring and recapitalization and ensure stability in the sector.

The microfinance sector has also shown a desire to develop innovative strategies that expand access. In our first release, we wondered whether there was potential in Ivory Coast for MFIs to partner with other actors to reach underserved people. And so far, the answer is yes. MFIs have started establishing partnerships with mobile networks and money transfer operators to expand their reach. For example, MicroCred-CI is partnering with Wari to allow their clients to deposit money in their MicroCred-CI saving accounts using any of Wari’s over 2,000 access points. Advans-CI clients enjoy a similar service through MTN Mobile Money’s distribution agent network. AdvansCI is also working with cocoa cooperatives to set up digital payments to producers.

Still, much remains to be done to ensure a sustainable microfinance sector with viable and strengthened institutions offering services to low-income clients. To this end, the updated FINclusionLab dashboard for Ivory Coast serves as an analytical tool to evaluate the impact of the clean-up program, the decrease in the number of institutions and access points, the risks of having one outsized MFI with enormous market share, and the current distribution of points of service across the country. Understanding these various aspects of the market can help decision makers identify and address the underserved areas.

The digital financial services ecosystem

According to a Central Bank of West African States (BCEAO) report, Ivory Coast is the largest digital financial services market in the West African Economic and Monetary Union (WAEMU) in terms of number of accounts (over 9 million); bill payments (over 3 million transactions); and e-wallet recharges (over 47 million transactions). The Ivory Coast market represents over 50 percent of the activity in the region for these three activities.

Though we were unable to collect access point data for two large players, Orange Money and MTN Mobile Money, we were successful in gathering data on 3,102 points of service across the country from Moov, a mobile network operator, and Celpaid and Qash Services, two e-money issuers. These figures confirm how quickly the digital finance landscape has evolved in the last two years (we mapped only 847 access points in 2013). To understand how the digital financial services market has become the cornerstone of the Ivorian financial system, we examined certain institutional characteristics.

Our data collection shows that digital finance providers are by far the most prevalent type of financial provider across all the districts.

On the other hand, the fast expansion of digital finance providers has happened mainly in Abidjan, where 63 percent of all the country’s access points are found. In Abidjan there are 4.1 digital finance access points per 10,000 inhabitants, whereas only 9 out of the 107 other departments have more than one point of service per 10,000 people.

The most common transactions, as in many other countries, are cash-in and cash-out, person-to-person transfers, bill payment and airtime purchases. However, mobile network operators are also developing new products and services by partnering with banks and MFIs, as discussed above, and offering intra-regional money transfers between Ivory Coast, Burkina Faso, Mali, Benin and Senegal, where some of the mobile network operators also have operations. Additionally, Ivory Coast has recently made it possible to pay school registration fees via mobile, which highlights the collaboration between government and operators.

The digital financial services market is growing rapidly in Ivory Coast, with innovative products and services and an enormous market share in terms of access points (estimated at over 15,000 points of service) as compared to banks and MFIs. The recent political and economic crises have affected Ivorians’ trust in the traditional financial system, and partly explain their preference for these newer digital options. However, the sector faces some challenges moving forward. Providers are looking to continue diversifying their products and making them more accessible to a broad range of clients. They will also need to focus on usage, as client inactivity remains quite high, with over 50 percent of clients not using their accounts within 90 days.

Conclusion

In the last two years, we have seen significant growth in the number of financial access points across Ivory Coast. However, the reality may drastically differ depending on where an Ivorian lives, as the districts with large number of access points are not necessarily the districts with best access. While financial inclusion in Ivory Coast is clearly improving, geography still plays an outsized role in determining an individual’s access to services. But the expansion of the country’s digital finance ecosystem, combined with initiatives like its person-to-government payments service, may show the way forward to reaching its national financial inclusion goals.

Photo credit: jbdodane, via Flickr.

Felipe Martin is an analyst for MIX, a nonprofit data analytics organization that promotes financial inclusion through data and insight.

- Categories

- Uncategorized