The Emergence of ‘Resilience Credits’: How a New Asset Class Can Unlock Investment in Climate Resilience — And Why Impact Measurement Will be Key to its Success

There’s an unfortunate reality at the heart of the discussion on climate justice: Investments aimed at building the resilience of climate-vulnerable communities are falling woefully short — and the private sector is almost entirely absent, with just a 2% share of these investments. The UN’s Adaptation Gap Report finds that the amount of investment needed for developing countries to adapt to the changing and uncertain climate is 10-18 times greater than what is currently flowing, creating an estimated annual adaptation finance gap of US $194 to $366 billion.

Innovative approaches are clearly needed to stimulate investments in climate adaptation and resilience (A&R) from both the private sector and the households that can benefit from these measures.

To help enable this investment, our teams at the International Fund for Agricultural Development (IFAD), the Egyptian Ministry of International Cooperation and Duke University, together with the NDC Partnership, are spearheading an initiative to measure and monetize climate resilience, which will be developed and tested over the upcoming year in an effort to establish a “resilience credit.” This new asset class aims to align public and private capital to deliver investment into projects and businesses that are addressing social, economic and environmental drivers of vulnerability, in order to increase the ability of households and communities to cope with or recover from the impacts of climate change.

As we know from the current challenges facing carbon offset markets, where studies have raised doubts about whether the credits being exchanged actually represent genuine carbon reductions, the success of any tradable credit scheme starts with effective impact measurement. Whether the aim is to sequester carbon in forests, conserve biodiversity or enhance resilience, the ability to accurately gauge the improvement of a system after an intervention is crucial for establishing the necessary standardization and transparency to instill investor confidence in an asset class.

A resilience credit is just one of many potential game changers that could emerge from a firmer understanding of the impact of A&R interventions. Effective measurement is also the gateway to more equitable, evidence-driven policymaking, and key to scaling other innovative data-dependent financial instruments, like carbon credits with resilience co-benefits and resilience bonds. In the following article, we’ll provide a brief overview of the current state of the A&R impact measurement landscape and contextualize our approach within this framework.

Approaches for Measuring Resilience

The UN defines resilience as “The ability of a system, community or society exposed to hazards to resist, absorb, accommodate, adapt to, transform and recover from the effects of a hazard in a timely and efficient manner, including through the preservation and restoration of its essential basic structures and functions through risk management.” Under that widely accepted definition, resilience can be observed at the individual, household or community level.

However, there is no single indicator or measure that fully captures resilience. Instead, resilience is often assessed through proxies such as education and income levels, livestock ownership and food security (among other variables).

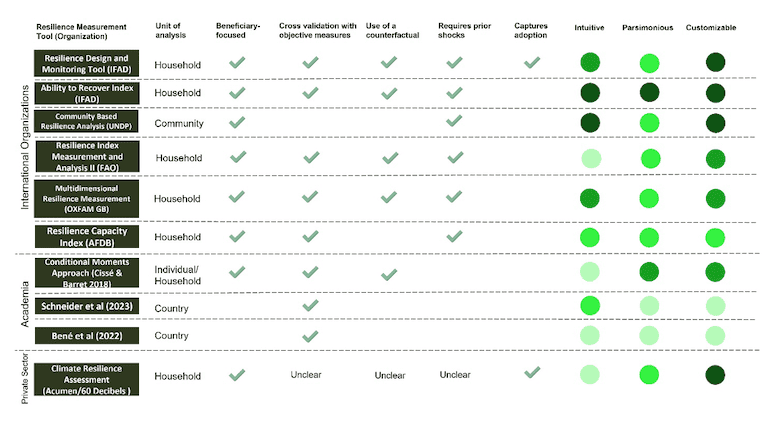

Various groups have developed different measures to assess resilience. Figure 1 below presents an overview of these resilience measures, and compares them based on attributes related to objectivity and usability.

Figure 1. Resilience measurement tools and approaches

Note: The chromatic scales in the final three columns depict how well each methodology complies with each criterion; darker shades signify greater compliance. Source: Duke University.

As Figure 1 illustrates, these impact measurement approaches are being pursued by different types of entities, including international organizations, academia and the private sector. Looking first at approaches led by international organizations: IFAD’s Resilience Design and Monitoring Tool consists of household surveys regarding the adoption of behaviors related to resilience, as well as the results of such adoption, which are weighted to create community indexes that can be compared with other communities whether targeted by the intervention or not. IFAD’s Ability to Recover (ATR) index evaluates how effectively communities bounce back from climate-related and other shocks, based on resilience surveys and comparisons between regions with and without resilience investments.

Similarly, the UN’s Food and Agriculture Organization has developed the Resilience Index Measurement and Analysis II method to target low resilience areas. Their measure is defined at the household level, and employs econometric regression techniques to correlate observed variables with underlying resilience drivers. OXFAM’s Multidimensional Resilience Measurement index, also defined at the household level, blends objective socioeconomic data with subjective indicators of well-being. The African Development Bank’s Resilience Capacity Index uses statistical methods to identify key resilience components. By measuring and evaluating these components, it helps policymakers and development practitioners identify areas of vulnerability and prioritize interventions to enhance resilience across the continent. Focusing on community-level resilience, the United Nations Development Programme’s Community Based Resilience Analysis uses the Household Economy Approach, measuring resilience through a mix of objective and subjective indicators like infrastructure availability and perceptions of well-being.

In academia, scholars like Cisse and Barrett (2018) have developed the Conditional Moments Approach to assess individual-level resilience, using surveys and econometric techniques — specifically conditional moment functions. This method provides insights into the factors that contribute to individuals’ ability to maintain economic stability in challenging circumstances. Others, such as Schneider et al. (2023), propose a country-level food system resilience measure, drawing on secondary data and expert interviews to define resilience indicators across five categories and aggregate them into an index using weighted means. Béné et al. (2022) also focus on country-level food system resilience, using a global food system sustainability index to estimate resilience across four dimensions, forecasting food system sustainability as countries develop.

Within the private sector, 60 Decibels has developed a proprietary household-level resilience measurement tool that examines perceived resilience, realized resilience, and available resources and enablers.

Which Impact Measurement Approach Suits a Resilience Credit?

Each measure presented in Figure 1 has advantages, but falls short in other dimensions. The first dimension we consider is whether a measure focuses on the actual populations whose resilience is being supported by investments. The micro-indicators (i.e., those focused on the household or community level, which includes eight of these 10 measures) satisfy this essential requirement. This is in contrast to the aggregate measures of Schneider et al. and Béné et al., who analyze resilience at a country level. These offer broad assessments that lack detailed information about the specific individuals and factors driving resilience within particular contexts.

A second important dimension is whether a resilience methodology relies on purely subjective assessments or is supported or somehow validated with objective measures. On this front, different approaches once again offer advantages and disadvantages. Consider for example IFAD’s Ability to Recover index. While it examines program participants’ perceptions relative to previous shocks that impacted them, ATR is a simple measure that can only be assessed against objective outcomes insofar as additional program data are collected to confirm those perceptions. On their own, subjective reports of recovery from shocks that are detached from a program-specific context are insufficient to shed light on the mechanisms that lead to enhanced or weakened resilience.

The third dimension we consider is whether an approach accurately estimates a “no investment” counterfactual — a process that, though challenging, is vital for demonstrating what actually changed because of the investment. Many of the resilience measurement models mentioned above use robust survey-based methods to estimate this counterfactual (which is not directly observable), using this data to assess how the investment has changed resilience. By focusing on a representative sub-sample of observations within a resilience investment portfolio, informed by the likelihood and severity of shocks, the costs of conducting such impact evaluation surveys can be managed, and valid portfolio-level conclusions can be drawn. Counterfactual estimations are also employed to gauge additionality, such as in evaluating credits from REDD+ investments — a method favored by numerous international impact measurement and reporting systems.

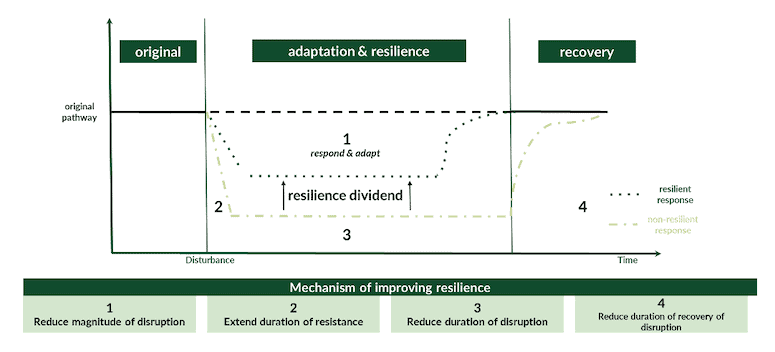

Most measurement of resilience is done after a shock occurs, and the impacts of a shock can be acute and immediate or prolonged and/or chronic. Figure 2 below disaggregates the timeline around a shock into three periods: the pre-shock period, the time in which the shock occurs and the post-shock recovery period.

Figure 2. Illustrating the resilience dividend

Source: Adapted from IFAD.

Each phase of this timeline requires different strategies, resources and levels of intervention, as stakeholders work to help communities effectively manage and recover from a shock. It is important to note that recovery may entail reaching a state that surpasses the conditions before the shock occurred. Methodologies that lack comparison or control groups cannot effectively establish the additionality of specific resilience-building interventions across these periods.

Usability and scalability are also critical measurement attributes we analyzed across the different frameworks we examined. Regardless of what’s being measured, the metrics used by these frameworks should be relatively easy to implement and highly relevant to the broader understanding of resilience, facilitating market understanding and acceptance. Some key aspects of measurement that should be considered include the concepts of parsimony (or conciseness), practicality, intuitiveness and generalizability: We used each of these specific underlying measurement characteristics in the Figure 1 comparison.

Our Recommendation for the Best Measurement Approach for Resilience Credits

Deployed across a portfolio of impact assessments, evaluations incorporating IFAD’s Ability to Recover index show that tailor-made investments in value chains increased the resilience of more than 38 million people around the globe. This number is the result of a projection made from impact assessments within a representative sample of projects and target populations, and therefore captures the effects of IFAD’s global portfolio of investments. It presents an example of how resilience measurement can be scaled in a simple, intuitive and concise manner across different contexts and sectors.

ATR also features other key characteristics that make it useful for implementing a resilience credit:

- It’s intuitive and efficient: ATR is relatively easy to understand and cost-effective, as it uses minimal variables and simple methods for effective resilience explanation. Unlike other methods with complex data needs, ATR offers a universal and holistic understanding of resilience (capturing the net results of the stages and effects shown in Figure 2), making it ideal for use in developing resilience credits.

- It’s practical and universal, and widely applicable in various contexts and sectors: That is, different populations can easily answer ATR questions, which are not narrowly focused on specific types of impacts.

- It measures resilience in households and communities after climate shocks, looking beyond national-level impacts: This characteristic is crucial for understanding the benefits of climate adaptation and resilience investments, as it enables the prioritization of the most vulnerable in resilience efforts.

While ATR’s reliance on subjective perceptions presents a challenge and may not fully showcase the reasons why resilience may have improved, it still holds promise. With additional validation efforts, ATR’s limitations can be effectively addressed, paving the way for a more refined understanding of resilience dynamics. For these reasons, we believe it’s currently the best impact measurement approach for establishing resilience credits.

Establishing transparent and fit-for-purpose measurement approaches can provide the foundation for mobilizing scaled A&R investment for climate-vulnerable communities. The ATR metric represents a practical and feasible first step in the development of new data-driven financial instruments like resilience credits. Yet to fully operationalize this nascent instrument, stakeholders will need to advance beyond the measurement of resilience alone. Our focus in the year ahead will be on tackling the challenges of valuing and monetizing those resilience benefits, particularly when dealing with stakeholders who may hold divergent views on the value of resilience benefits.

H.E. Dr. Rania A. Al-Mashat is Egypt’s Minister of International Cooperation, Dr. Jyotsna Puri is the Associate Vice-President – Strategy and Knowledge Department at IFAD, and Jonathan Phillips is the Director of the James E. Rogers Energy Access Project at Duke University.

Photo credit: Marcos Villalta / Save the Children.

- Categories

- Environment, Investing