Making Subsidies Smarter: How to Create More ‘Bang for the Buck’ in Blended Finance

Editor’s note: This is the second article in a two-part series. Here is the first: ’It’s Not About Subsidies’ – And Five Other Myths About Blended Finance.

The art of blended finance is creating maximum additionality with a range of instruments and approaches – and as discussed in the first part of this series, that inevitably involves subsidies. This strategy can be very powerful in correcting market failures in underserved markets. Nevertheless, for these subsidies to be worthwhile, they must be provided in return for development impact – and this impact should be supported by evidence rather than assumption. Moreover, it’s important that the subsidy is not eaten up by the cost of maintaining complex blended finance structures – otherwise the investee ends up getting access to finance on terms that are quite comparable to other, more traditional sources.

Recognizing both the value and the proper use of subsidies is key to maximizing the impact of blended finance. Below, we’ll look into these topics in more detail.

How to Make Blended Finance More Effective

There are two ways to significantly enhance blended finance:

- First, by providing the subsidy directly to the value creator – which is typically the enterprise or the project on the ground that raises investment. This direct-to-entrepreneur funding improves the profitability of the enterprise and makes it more attractive for investors, who benefit indirectly through a better risk-return profile for the investment.

- Second, by linking these subsidies to the achievement of pre-agreed development outcomes, which creates powerful incentives to push the businesses towards results that go beyond good intentions.

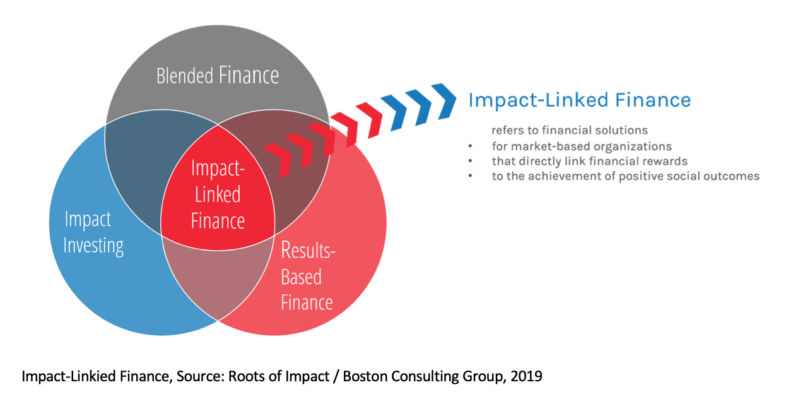

If both criteria are fulfilled, then the subsidies deserve to be called “smart,” as there is a high probability that public funding or private catalytic capital will be spent effectively. There is a new term for this practice – “Impact-Linked Finance” – which refers to financial solutions for market-based organizations that directly link financial rewards to the achievement of positive social outcomes. It has the potential to influence the next generation of blended finance by aligning development funding with concrete results, ensuring maximum additionality and “impact leverage.”

Impact-Linked Finance is an effective way of aligning positive impact with the economic viability of the investee enterprises, because the funding goes directly to them. The practice lies at the intersection between blended finance, impact investing and results-based finance. It bears many similarities to results-based finance, but differs in two key points: Firstly, it is used to catalyze private investment for businesses, as opposed to just providing payments for results. Secondly, it is rewarding the achievement of outcomes (e.g., decent jobs and increased income for target beneficiaries) as opposed to outputs (e.g., people trained). It thus represents financing for businesses that are willing and able to deliver positive impact beyond the usual scope.

The first in a line of Impact-Linked Finance tools that reward businesses for their impact were Social Impact Incentives (SIINC), introduced in Latin America in 2016. SIINC proved effective at enabling the financing of high-impact enterprises in healthcare, off-grid energy and agriculture without compromising their business acumen. However, the principles of SIINC can be applied in a much broader spectrum: Rewards for positive impact can be built into financing instruments across the board. In other words: Irrespective of whether they’re implemented with equity, debt, guarantees or any other instrument, rewards for positive outcomes represent a powerful way of “baking impact into the provision of finance.” For example, lenders can link the interest rates of loans to pre-defined impact performance metrics, and then decrease the rate as soon as this impact is achieved. Here, the “impact-linked loan” effectively lowers the financing cost, and creates a strong incentive for enterprises to outperform on positive impact.

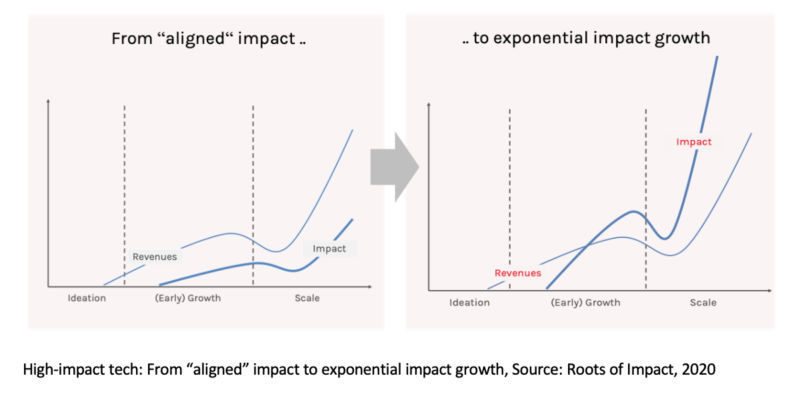

Impact-Linked Finance’s potential for making a difference is particularly high for tech-enabled enterprises in their early stages, when there is still a high level of flexibility about the strategy for scaling. As they grow, venture capital-backed tech companies – even if they are pursuing a mission for inclusivity – tend to focus less on the poor and vulnerable. Yet venture capital firms – and even impact investors – typically do not provide “better terms for better impact” to these enterprises when they are young. But they easily could, provided they collaborated with public funders who compensate them for impact-linked rewards to their investees. While in traditional impact investing the impact is typically “somehow aligned” with the financial return – with a tendency for that alignment to drift away over time – Impact-Linked Finance enables high-impact tech companies to align profitability with exponential impact growth from the very start – and to sustain that alignment over time when these companies generate economies of scale.

How to Monitor and Manage Success in Blended Finance

Capital leverage ratios – expressed by the amount of private dollars mobilized for every public dollar provided – are often viewed as an effective way of measuring the success of blended finance. But if blended finance is used to create positive impact, then capital leverage alone is a misleading indicator. Mobilizing private capital as much as possible with as little proprietary funding as possible does not inherently incorporate any impact considerations. Moreover, optimizing for higher capital leverage typically leads providers of catalytic funding and investors to move away from high-impact areas where their support is needed most, because it is more “expensive” to mobilize private investment in these areas.

Another misleading marker of success is when a funder’s (typically subsidized) guarantees or first-loss capital are never drawn upon. Public funders may consider this an encouraging sign of a maturing market. But if a risk-reducing mechanism does not cost the funder anything in the end, it has probably generated negligible levels of additional impact, because it did not lead the “de-risked” investors to actually take higher risks, i.e. selecting more early stage companies that default more often than mature enterprises. In reality, this capital is often exactly what is needed to make things happen that wouldn’t have happened anyway.

So what is a useful measure of effectiveness in blended finance? Quite simply: It’s the cost of creating the intended impact. Providers of catalytic capital can use a cost-effectiveness analysis that assesses the subsidy involved in blended finance, based on the following: measure of effectiveness = attributable impact per dollar of subsidy (equivalent to the amount of grant needed).

Here’s a practical example: Providers of the subsidy for a blended finance project supporting an employment initiative might ask themselves: “How many disadvantaged young people in Guatemala have been placed in long-term jobs with a given amount of subsidy?” (Stated another way, they might inquire: “How much subsidy was needed to place one disadvantaged young person in Guatemala in a long-term job?”) This kind of benchmark could help public funders working with the private sector to reach higher levels of effectiveness and efficiency, and finally create a market for impact.

Of course, every cost-effectiveness analysis needs to consider the specific context, systems-level effects and more. However, neglecting to measure and manage outcomes is not an option at all for sustainable development, as it would mean flying blind. A focus on the unit-cost (representing the subsidy) per impact also enables a comparison with non-investable solutions, such as those provided by NGOs (which are typically 100% subsidized, if not income-generating.) Put simply: Whenever a business is in a better position than an NGO to deliver intended outcomes more effectively and efficiently, there is good reason to use subsidies to accelerate this. On the other hand, if an NGO proves to deliver the outcomes better and less expensively, there is no reason to use the subsidies for a business.

Four Steps for Improving Blended Finance

Engaging in blended finance – and consequently providing subsidies – can be highly impactful if implemented in a smart way. Objectively, it can be an effective means for achieving development goals – but policymaking and public opinion are not objective. The methodologies used in blended finance are quite complex for the stakeholders and decision-makers involved, and public funders are accountable to taxpayers and the public. It is easier to justify grants to non-profit organizations than it is to make the case for subsidies to for-profit actors, in particular to private investors – not only to the public but also to the politicians who represent them.

That’s why more transparency on this topic is urgently needed. Whenever billions of dollars are spent by development finance actors to achieve pre-defined objectives, the public should ask: Are these funds being deployed most effectively – and what exactly do we achieve by providing subsidies as opposed to other forms of financial support? These questions will be easier for the development and impact finance sector to answer if we agree on a new form of accountability, based on calculating the subsidy needed to create the intended outcomes.

Here is an action list for providing this degree of accountability, and making blended finance an effective tool for achieving higher levels of impact:

- Let’s start by demystifying the current practice of blended finance, and enabling fact-based decisions. This could involve providing education specifically for decision-makers in public agencies and other organizations providing catalytic capital. They are the starting point: There is no blended finance without catalytic capital.

- Let’s create transparency. We need independent data and research on the impact and subsidy level of specific programs and transactions, to inform policy-makers and the public. A public discussion about the use of development finance should address the question: What outcomes are we able to create or catalyze with the resources provided (and at what cost)? Obviously, in this discussion we need to simplify things and talk about costs, subsidies and grant equivalents frankly and directly, as opposed to couching them in the terms of opaque structures and models that nobody understands.

- Let’s stop making financing volumes and capital leverage ratios the basis for measuring the success of development-focused investments. Major industry players such as development finance institutions and catalytic funders need to change their measurement, reporting and decision-making practices, and provide a better understanding to the public about the appropriate levels of additionality and concessionality in their investments. Impact targets need to be based on the effective use of funds, as opposed to “how much money goes out the door.”

- Let’s revise all principles, guidelines and tools for blended finance practitioners according to principles of effectiveness and additionality. To that end, independent institutions could develop assessments of blended finance structures that consider their impact potential, cost-effectiveness, long-term sustainability and catalytic effects.

By following the above steps, the sector can shift the paradigm, moving from an assumption that more money inherently leads to more impact, to a deeper understanding of how to leverage funds effectively to maximize their impact on specific development goals. This will allow practitioners to go back to business and innovate, develop, implement and manage blended finance solutions that really make a difference.

Bjoern Struewer is Founder & CEO at Roots of Impact and Lead of the Initiative for Blended Finance at University of Zurich. The Initiative runs executive education programs for public funders and catalytic capital providers on how to use blended finance effectively.

Photo courtesy of PublicDomainPictures.

- Categories

- Investing