Social Impact Incentives: A New Solution for Blended Finance

When Javier Lozano and Fernanda Zorrilla co-founded Clínicas del Azúcar (CDA), they were driven by one idea: to transform the traditional, insufficient and unjust model for diabetes care in Mexico. With good reason: Diabetes is the number one cause of death in the country, with more than 14 million people suffering from the disease. Before becoming an Ashoka fellow, Lozano had worked in native communities, focusing on education and nutrition projects. There he witnessed firsthand how people struggle to get access to the most basic services. This experience shaped his way of thinking and triggered his passion to solve such problems with the help of state-of-the-art technology.

Today, after six years of operations, CDA is the largest private provider of specialized diabetes care in Mexico. Nine clinics are reaching more than 50,000 patients, 95 percent of whom are experiencing access to specialized diabetes treatment for the first time in their lives. Still, there is an almost constant challenge for the company to balance financial and social performance – especially when trying to access patients at the lower levels of the Base of the Pyramid (BoP). So how to fully embrace the mission and expand the market-based model to very low-income patients?

New blended finance solution

This is where social impact incentives (SIINC) come into play. SIINC is a new solution for blended finance created by Roots of Impact and the Swiss Agency for Development and Cooperation (SDC) in 2016. In principle, it aligns profitability with social impact by paying social enterprises directly for proven social outcomes. This may resemble social impact bonds, but the structure of SIINC is far more straightforward and offers an important twist. Ongoing premium payments increase the enterprises’ regular revenues during the intervention and thus allow it to scale. The beauty of this enterprise-centric approach is that it makes it easier for companies to crowd in impact investment and become self-sustaining. In essence, it tilts the business toward the needs of the poor. After raising an equity investment, CDA is now able to implement new models for specialized diabetes care at the BoP. A careful design of the impact metrics is thereby essential to the entire SIINC process. For CDA, payments are triggered once the ratio of BoP clients improves and success rates of the diabetes treatment increase (measured by patients’ glycated hemoglobin levels, which indicate the risk for diabetes-related complications). This is stipulated by a straightforward contract between the outcome funder and CDA.

A story like CDA’s is certainly not unusual for social enterprises with highly scalable business models and a huge potential for impact. They often need to keep social and financial bottom lines closely aligned once they scale. Integrating SIINC can ensure that impact is not neglected on the path to strong growth. On the contrary, it can be accelerated. In addition, creating economies of scale will lead to better profitability in the long run. For CDA, the end game of the intervention is that the social enterprise will not need SIINC payments any more. Instead, it will either be self-sustaining with the expanded client reach and/or have a high chance to convince public bodies to buy its solution and take over the results-based payments. That outcome would be a triple win situation for government, BoP diabetes patients and the social enterprise alike.

Courtesy of Clínicas del Azúcar

Untested markets

This is not the only type of problem that SIINC can effectively address. For pioneers like Village Infrastructure Angels (VIA), the logic is somewhat different. Social enterprises such as VIA operate with new business models in relatively untested markets and are too visionary for the risk appetite of a typical impact investor. At first glance, giving poor communities across the globe access to safe, affordable and renewable energy may seem to be a rather familiar impact investment case these days. But well-planned and -managed solar power solutions that allow communities to go one step further – such as to run agriculture mills, pump water, equip schools and electrify clinics – creates a scope of impact that reaches well beyond the simple task of lighting. This is where VIA disrupts the existing market.

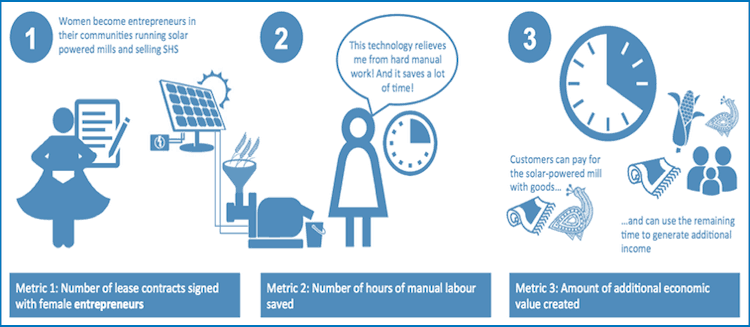

Without new ways to crowd in capital, VIA’s novel approach would therefore have a hard time finding the necessary financing. SIINC can make a real difference here. The Latin American SIINC project – in partnership with the Inter-American Development Bank (IDB) and support from Ashoka – is starting to show its real potential. After VIA’s founder Stewart Craine and the project partners agreed on three impact key performance indicators that support women’s empowerment (see the graphic below), SIINC payments will now boost the company’s bottom line and create more impact for the outcome payer’s buck. Not only that, VIA enables women to use cleaner, simpler, safer and quieter solar-powered micro-milling technology. It also saves women lots of time previously spent on manual labor and opens up opportunities to do more productive work or support children’s education. In addition – and this is the decisive benefit of SIINC – VIA has become much more attractive for impact investors, which has led to advanced negotiations with financiers about a new round.

All in all, SIINC has the chance to demonstrate that impact investing can be much more effective. This is done either by allowing true pioneers like VIA to access investment in untested markets with a high level of perceived risk, or by enabling fast-growing players, like CDA, to stay true to their mission when pursuing an aggressive scaling plan by reaching deeper levels of impact.

In any case, the partners in the Latin-American SIINC public-private development partnership – SDC, IDB, New Ventures and Ashoka – are enthusiastic about its potential. “Public funders and philanthropists play a vital role in unlocking the potential of inclusive business models,” confirms Dr. Peter Beez, head of focal point employment and income at SDC. “More effective solutions are therefore key: They open the doors to exploit this promising path while at the same time acknowledging the realities of the market.” Impact investors also highly value the effects of the SIINC model. “The increased BoP focus is very much what we want to see as an impact investor,” says Peter Bladin, chief impact and research officer at Global Partnerships, who has led the fund’s investment in CDA.

At the end, it’s all about the impact that these outstanding social enterprises will be able to create; for example, access to specialized diabetes care for everyone. And it’s about the best and most effective way to secure impact investment for them to scale.

Bjoern Struewer is founder and CEO and Christina Moehrle is an adviser at Roots of Impact, a specialized advisory firm for more effective impact investing and blended finance.

Photo courtesy of Village Infrastructure Angels

- Categories

- Energy, Health Care, Investing, Social Enterprise, Technology