The Longest Last Mile: Are India’s Poor Ready for Digital Financial Services?

The digital payment services market in India is flooded with new products that offer innovative technologies that make receiving and sending money instant, affordable and hassle free. Today, there are more than a dozen channels, largely relying on access to smartphones/computers and the internet, which offer consumers the option of making digital payments at the click of a button. With the recent policy push to transform India into a digital economy, the focus in the context of financial inclusion seems heavily inclined toward digital financial services (DFS) for all. But are India’s poor ready to shift to digital platforms of financial services?

The current state of the sector seems to suggest that the emphasis on digital financial services in the Indian market will yield utopian results. However, India’s poor are far from reaching this stage. This post looks at some of the key challenges that lie ahead for India’s poor in transitioning from manual to digital modes of payment services.

Barriers to Adoption and Usage of Digital Payment Services

Access to and Usage of Bank Accounts

While India has made significant progress in accelerating financial inclusion, challenges continue to remain on both the access and usage fronts. Making transactions digitally requires regular use of one’s bank account through a digital device. However, statistics suggest otherwise; as of 2016, 37 percent of India’s population remains excluded from formal financial services and 60 percent are non-active users of their bank accounts. With the Indian government launching one of the biggest financial inclusion drives in India under the Pradhan Mantri Jan Dhan Yojana (PMJDY) programme, the number of bank account holders has increased in the last three years; however, 26 percent of the accounts opened remain inactive with zero balance. Lastly, only 30 percent of bank account holders have digital access to their bank accounts, making it difficult for the remaining 70 percent to engage in digital transactions.

Access to Mobile Phones and the Internet

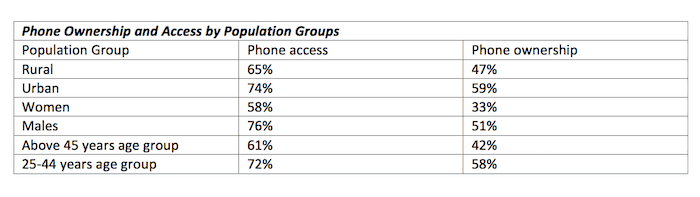

In addition to a bank account, the shift toward digital platforms requires phone ownership (preferably smartphone), internet access on the phone and digital literacy to use these technologies adequately. While mobile phone access is nearly ubiquitous in India, women over the age of 45 and those with only primary level schooling, the elderly and people living in remote and rural areas are more likely to lack access to and ownership of mobile phones. Moreover, only 22 percent of Indian adults use the internet and 17 percent own smartphones, (almost) a must-have for many digital financial services platforms. Additionally, consumers also face infrastructural barriers such as poor network connectivity and irregular electricity, especially in remote and rural areas.

Source: Financial Inclusion Insights

Awareness, Knowledge and Attitudes toward DFS

Barriers to use also stem from low levels of consumer capabilities. The 2016 FII survey found that 49 percent of a representative Indian sample had low levels of digital literacy. Digital literacy was even lower for vulnerable groups: the elderly were 18 percent more likely than the youth to be digitally illiterate, and both women and those with lower levels of education were also less digitally literate than average. A less tangible element is the lack of trust in digital services, which is often common with new consumers, especially when the interface is cumbersome. When transactions fail due to poor connectivity or confusing instructions during, the initial trust placed in the platform is quickly revoked and the customer reverts to cash. Behavioural factors thus play a huge role in the stickiness of using cash instead of digital modes for financial transactions.

Acceptance of Digital Infrastructure

Limited acceptance of digital infrastructure by local merchants is both an access and usage barrier as it means that the digital ecosystem does not support its usage. Even when armed with debit cards or mobile wallets, consumers have few places to use these digital products due to the lack of electronic point of sale terminals (EPoS) and retailers who accept digital payments. As of May 2017, India has 2.6 million EPoS terminals—far fewer than the number of the retail establishments and small and medium businesses (15 million and 36 million, respectively). This challenge further increases in rural and remote areas, which have even more limited avenues for transacting digitally.

These challenges point toward the several demand and supply barriers that prevent the last-mile consumers, especially individuals from poor and low-income households, from making efficient use of the many digital payment services that are on the market. These obstacles can be broadly viewed from the spectrum of barriers to access and barriers to use. The access barriers tend to be technology-based, while the usage barriers are mostly, though not exclusively, related to knowledge and attitudes.

A Way Forward for boosting financial access and usage

DFS is undoubtedly a powerful channel for making financial services accessible to the poor at low cost and risk. However, despite the power DFS possesses, the barriers to its access and usage prevent it from unleashing its true potential and reaching out to the masses. Given the current set of challenges, it becomes imperative to implement innovative solutions that could bridge the gap between access and usage of DFS, especially in the payment space, since payments seem the easiest to digitize.

One potential solution that has been implemented by financial service providers (FSPs) has been to employ third party individuals, commonly referred to as agents, to assist them with offering services on their behalf to their client base. Agents play a crucial role in digital financial services, both by performing or facilitating digital transactions (acting as alternatives to both portals/ATMs and traditional bank tellers) and by providing a human face representing the FSPs and thereby building rapport and trust among their customers in the process. Leveraging this trust, agents can promote the usage of DFS by making their customers familiar with the tools and platforms available for digital payments. Agents can also compensate for their clients’ lack of digital literacy, numeracy skills and ability to use smartphones and other digital devices required for making transactions digitally. Additionally, FSPs will also need to invest heavily in promoting the usage of the new products introduced in the market through innovative solutions.

On the demand side, consumer capabilities will need to be improved to make the last-mile consumers more familiar with understanding the benefits of using DFS along with developing tools and platforms for DFS that are more intuitive and consumer friendly. However, given the current scenario and keeping in mind the different options available for consumers to make digital transactions, policymakers and practitioners should focus more on finding solutions to usage challenges rather than introducing a plethora of products that very few people use.

Anoushaka Chandrashekar works as a senior research associate with the financial inclusion team at IFMR LEAD.

Misha Sharma is a project manager at IFMR LEAD

Photo credit: Meena Kadri, via Flickr.

Homepage photo: Spyros Petrogiannis, via Flickr.

- Categories

- Finance, Technology