Housing Series: The Power of Collecting Accurate Data

Editor’s Note: NextBillion has launched month-long series on Housing for All in partnership with Ashoka. Please follow the series HERE and join the discussion with your thoughts and insights.

The Challenge

Entrepreneurs know the toughest part of succeeding in a new market is to prove it actually exists. “Need” does not always translate into “demand,” and neither necessarily translate into buying the products offered. Many a company applying their time-tested market surveys (developed for middle- or upper-class consumers) or using official demographic data to evaluate the potential of a new BoP market have failed. Either the data showed too little demand to warrant penetration, or it looked enormously promising by the numbers, but when approached, sales were deeply disappointing.

Ashoka’s India Housing for All initiative faced this same “data disconnect.” Our hybrid value chain model included both businesses (large builders or real estate developers) and citizen organizations (trusted and knowledgeable after decades working in India’s slums with BoP families). When we asked about market information on new affordable homes, we got two different perspectives that seemed contradictory.

One relied on the information from the experienced grassroots citizen organizations (e.g. SEWA and SAATH) across the country and our own staff’s first-hand interviews with people living in slums. We were convinced that India’s affordable housing sector was real, underserved, with huge deficits in available homes at prices the BoP could afford, and ready to be unlocked by private market interest and investment.

The other view came from the private builders, developers and housing financial institutions, who were interested in this narrative. But they were not convinced by the data they saw from official demographic, government census and housing information which they used to analyze new development risks and opportunities. Data doubts tarnished their enthusiasm to invest.

To convert their interest into a good business opportunity, our challenge was to transform the informal sector slum dweller into a formal sector customer. We knew there was a disconnect between the information from our partners in the slum communities and the official data developers used. We set out to find how the disconnect was caused. Either our numbers were wrong, or the official ones were. And in any case, we needed to get accurate information – about affordable housing demand, preferences, ability to pay, priorities to close the deal – from potential customers as well as from the builders’ perspectives (size of project, risks vs. rewards, etc.).

Closing the Data Divide

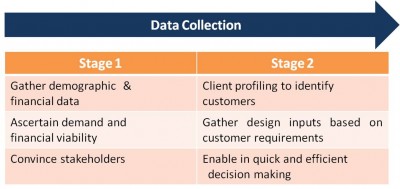

We designed a two-stage, data-driven solution that was also “hybrid” – slum dwellers and community workers to make on-site visits to targeted customers to ask more detailed, important questions about their housing needs, on one side, and on the other, using cutting-edge technology to record characteristics and identity accurately, analyze data correctly in one central location by trained staff to translate it into reliable and useful information for planning and evaluating housing projects.

Here’s how it works:

Stage 1: Targeted Customer Outreach to Ascertain Demand

We select a representative sample of slum dwellers from different slums to answer a survey questionnaire. The survey was designed to capture 26 demographic, financial and geographic parameters such as the size of the family, occupation, current ownership status, monthly surplus income, proof of identity and savings record.

We employed slum residents and community workers and trained them to get honest answers and to use their cell phones to photograph for accuracy and later identity verification the interviewee (potential home and loan customer) and input it immediately into a hand-held digital tablet with formatting to minimize human error, and send it to a central data analysis point in our offices.

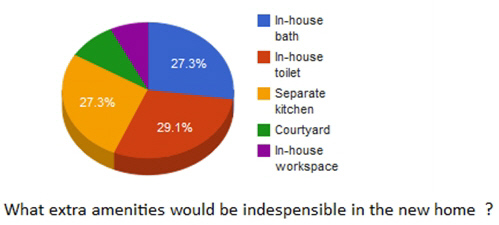

The Level of Detail Makes all the Difference: Data collected on new parameters gave specific guidance to architects and developers about their target market and ideal customers. For example:

Stage 2: Client Profiling to Identify Customers

During the second stage, we publicize information about the new affordable home development planned project across different slums near the project’s location. We then do a survey of interested customers to record the details such as current assets, availability of relevant documents, and access to finance. We use this survey to gather their preferences on desired number of rooms and estimated monthly income. These responses help architects tailor the design and layout to suit customer needs and assist the financial institution’s approval of an in-principle loan.

The information captured reduces the cost of business development and customer acquisition to a fraction of what it would be otherwise, making the process financially and operationally viable for the developers and financial institutions.

The vital role of including local citizens in data collection

Citizen organizations, with their deep trust and understanding of the community, play a pivotal role in the entire two-stage process of data collection. In slums, where a wide range of income groups live side by side, they identify and target the right customer pool at a nominal cost. Their familiar faces helps to elicit accurate and sensitive information that often is not shared with government officials or professional survey takers who arrive in slums.

The benefits of training slum dwellers themselves to help gather data gives them new income, develop technical skills, and informs them about affordable housing options. Instead of being “outsiders” to improvements, they become purveyors of information to neighbors and family members, rising in esteem.

We asked them how hard it was to work on the tablets and Android app, and the answer this community surveyor in Madurai gave us was repeated by all those we trained: “We all have touch phones, so it is very easy to use this device. Also, we are able to do many more households in a day because of the device. Pen and paper surveys take lot more time.”

The results of their work convinced microfinance institutions, private companies and realtors to invest in new housing. They were able to better plan and make quick decisions for new sites to develop and finance.

Technology as an powerful enabler

Traditional pen and paper surveys left too much room for inaccuracies and inefficiencies to creep into the system.

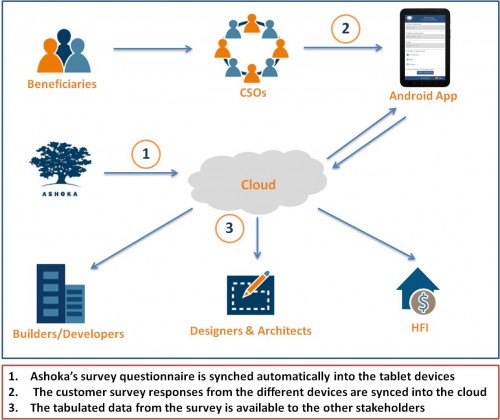

Instead, we designed an Android cloud application that was synched automatically to hand-held, tablet devices.

We trained community workers and citizen survey takers to carry these tablet devices into the field for collecting the data.

Along with the data, they snap photos of the customer and of his/her relevant documents.

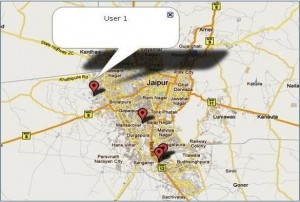

The tablet devices also record the exact location of the current residence using the  GPS technology. This acted as further proof of residence. As the data is instantly synched, it helps Ashoka HFA staff to constantly monitor the quality of data, even from a remote location. The data thus captured is presented to builders, architects and housing finance institutions in the form of graphs, tables and photos. The technology made the entire process efficient, accurate and extremely cost effective. Plus, it served to efficiently qualify new customers for microfinance housing loans, as much of the verification was already in our files.

GPS technology. This acted as further proof of residence. As the data is instantly synched, it helps Ashoka HFA staff to constantly monitor the quality of data, even from a remote location. The data thus captured is presented to builders, architects and housing finance institutions in the form of graphs, tables and photos. The technology made the entire process efficient, accurate and extremely cost effective. Plus, it served to efficiently qualify new customers for microfinance housing loans, as much of the verification was already in our files.

Accurate Data Making the DIfference

Data – accurately collected and analyzed from the ground up – are providing a voice to an otherwise inivisible and ignored business segment. The quality of the data also is binding different stakeholders into a Hybrid Value Chain model providing real value to BoP customers and businesses. A prominent developer in Bangalore reported that: “When I saw the profiles and the surplus income of families, it helped me to connect it to the kind of project we wanted to develop. It is this data that gave us confidence to take the first step.”

The hybrid survey model is not only valuable, but extremely scalable and cost-effective. We have already received inquiries from several countries interested in learning how to use our survey system. For example, we will soon travel to Mexico to train CEMEX (a global building materials company) and the citizen organizations working at the community level, to implement a similar solution for their affordable housing initiatives. Clearly, accurate data can transform the informal housing sector slum dwellers into formal market customers.

Please like NextBillion on Facebook, follow us on Twitter and/or join our LinkedIn group.

- Categories

- Technology