Deconstructing the Monolith: Why Understanding Women’s Individual Needs is Key to Closing the Gender Gap in Financial Inclusion

A few years ago, a FINCA survey showed how women’s livelihoods were severely hampered by social bias and economic discrimination in the Democratic Republic of the Congo (DRC). With more than half the day spent in unpaid household labor, women who go into business find few opportunities beyond running small trading enterprises with low prospects for profits and growth. And even when they operate more profitable ventures, they make less money – for instance, the daily profits of women entrepreneurs who work in wholesale trade are four times lower than those of men. With a social and legal environment that is hostile to women’s equality, it’s no surprise that DRC ranks 151 out of 156 countries on the World Economic Forum’s 2021 global gender gap index.

The fact that only 14% of Congolese women own financial accounts is both a symptom of this problem as well as a contributing factor, because financial exclusion denies women entrepreneurs the resources they need to compete. As one of the leading microfinance banks in DRC, FINCA is committed to solving this problem by offering products that are tailored to women’s needs. But what does this mean in practice? In 2020, we surveyed 2,800 financial consumers in the country to find out.

Understanding the Reasons for Women’s Financial Exclusion

Perhaps counterintuitively, our top-line data shows that focusing on gender as the defining characteristic of a female client is exactly the wrong approach. Women are not a homogeneous segment – to better understand them, we must go deeper into the sub-groups that they inhabit, based on the circumstances that shape their financial needs and behaviors. While women suffer discrimination across-the-board, they are disadvantaged according to their age, location and education level in ways that men are not.

If financial inclusion is being able to find the right product for your needs, then product awareness is the first crucial step of the journey. This is where women’s struggles begin: Their product recall is about half that of men, meaning that when asked to name financial products within specific categories (savings, loans, mobile banking and insurance), about twice as many women were unable to name more than two products overall. But rural women are especially disadvantaged compared to their urban counterparts, while men’s product recall is the same regardless of where they live. Women also display big variances in product awareness by age, especially among youth (<25) and women over 55. Meanwhile, men’s product recall is almost identical at every stage of life.

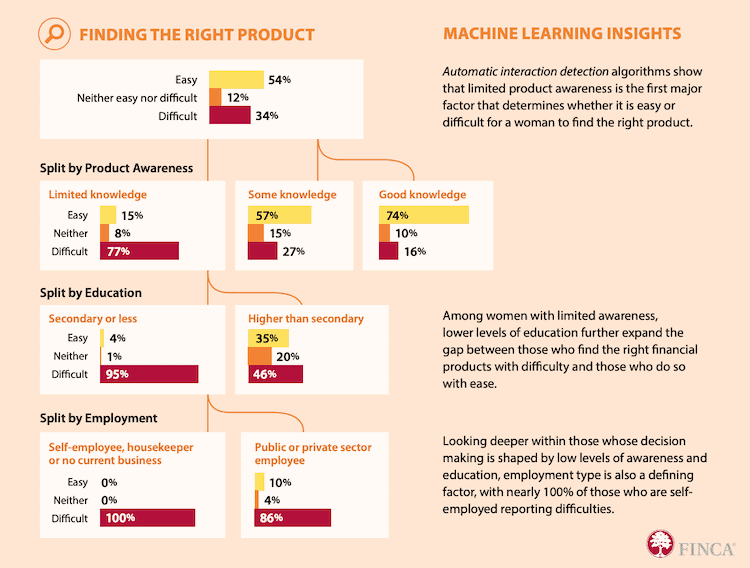

This same pattern holds when we look deeper into the data. Going beyond descriptive analysis, we used machine-learning to create a model of consumer struggling, where the goal was to predict whether it was easy or hard for a woman to find the right product. We used a supervised learning algorithm with automatic interaction detection (a data analysis method that looks at how different variables in the model interact with each other) to classify female respondents by the level of difficulties they experienced in finding the right financial product. At each step, the algorithm tested every possible variable that might cause women to have trouble finding a suitable product, to identify those factors that contributed most to this issue. The process repeats until no further factors are found to have a statistically significant effect on women’s ability to find appropriate financial products.

The Factors Preventing Women from Finding the Right Financial Products

The machine learning analysis, shown in figure 1 below, confirmed our belief that limited awareness was the strongest single factor in predicting women’s struggles to find suitable products. This result shows that information is a precious asset for women consumers. Something as simple as knowing what the choices are can be a game-changer in finding the right financial product. If a woman doesn’t know what options are available, she can’t make use of them, furthering the cycle of exclusion.

Figure 1: Machine Learning Results

The analysis produced a deep description of how each factor is shaped by the ones “hidden” beneath it. For instance, of all possible variables in our data, education is the strongest predictor of women’s ability to find the right products for their needs. Among women with limited awareness, 95% of those with secondary or lower levels of schooling struggle as financial consumers, while more advanced education cuts the incidence roughly by half. Going one level deeper, we found that employment type is also an important factor: Among women with lower education levels and limited product awareness, 100% of those who are self-employed struggle to find the right product. Formal employment improves the situation somewhat, though not to the same degree as more education.

Putting these Findings into Practice

The implementation of these findings starts with a clear understanding of where the problem lies. Limited product awareness is not a problem of women in general, but rather of the specific women for whom this constraint is most debilitating. For instance, we know with absolute certainty that a self-employed woman with low education is almost guaranteed to have very limited product awareness, and this will undermine her ability to find the right financial product. Other efforts to better serve women customers are pointing in the same direction: To close the gender gap in financial inclusion, we have to start by “deconstructing the monolith” of female clients and digging into sub-segments of the market to understand their specific needs and constraints.

Empowered customers make informed choices and exercise more control over their financial lives. Business logic leads to the same conclusion: Better-targeted customers are more profitable in the long term because they are more motivated and loyal over time. As measures to target women clients spread and the circle of beneficiaries of these efforts expands, new demand for financial services will arise and a virtuous cycle will take hold. To that end, data can mark out a clearer path to success by identifying the specific social influences that help or impair women as they navigate an increasingly complex financial landscape.

Scott Graham is Vice President for Research and Data Science, and Anahit Tevosyan is Director of Research, at FINCA International.

Photo credit: Axel Fassio/CIFOR

- Categories

- Finance