NexThought Monday – Everybody Loves M-Shwari: So why isn’t everybody using the mobile banking service?

In late 2012, the Commercial Bank of Africa (CBA) and Safaricom, the parent company of M-Pesa, joined together to form M-Shwari – a mobile service that pledged to offer low-income customers access to formal credit and savings services with a formal bank.

Since its launch, M-Shwari and has received tremendous attention from the media, as well as praise from digital financial service industry proponents and advocates. And earlier this month M-Shwari announced it has reached 10 million customers. But has this attention led to strong consumer awareness, and if so, has that awareness translated to improved financial access?

Since 2013, InterMedia, a global research consultancy where I serve as director of research and operations for the Africa branch, has been running the Financial Inclusion Insights Program (FII). The program seeks to understand the challenges and opportunities related to promoting financial inclusion in eight countries in Africa and Asia. Kenya is one of the FII countries that we have studied, with a particular focus on the triggers and barriers to uptake and use of a range of digital financial services (DFS).

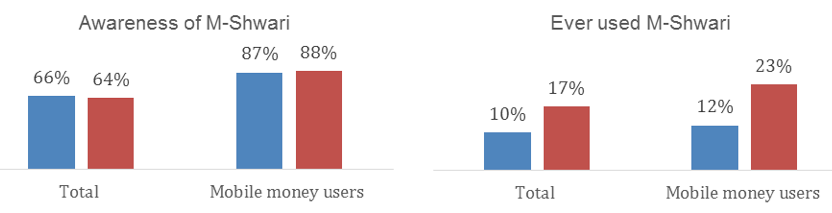

As a part of the FII program, InterMedia studied current and potential users of M-Shwari in a long-term evaluation. According to the FII survey in Kenya in September 2013, in just over a year after launch M-Shwari was the best known and the most commonly used beyond-basic-wallet product on the Kenyan DFS market. The research found 87 percent of mobile money users and 66 percent of Kenyan adults were aware of M-Shwari; 12 percent of mobile money users and 10 percent of adults were using the product. Those results were more then twice the numbers of Lipa na M-Pesa, the second most popular values-added service (VAS).

Between 2013 and 2014, awareness remained the same; however, the use of M-Shwari showed significant increase among the general population as well mobile money users (Figure 1).

Figure 1. Awareness and use of M-Shwari among Kenyan adults and mobile money users

Source: InterMedia Kenya FII Tracker surveys Wave 1 (total, N=3,000, 15+; mobile money users, n=2,390), September-October, 2013, and Wave 2 (N=2,995, 15+; mobile money users, n=2,300), September 2014

Existing M-Shwari users demonstrated very high levels of product engagement: 80 percent accessed their account within 30 days prior to the survey, 84 percent rated the product as “good” or “very good.” In addition, 93 percent of users said they would continue using M-Shwari and 95 percent would recommend it to a friend. The key advantage of M-Shwari, according to users, is that M-Shwari is “like a bank but better than a bank.” M-Shwari says it is as safe as a bank and it allows for the consolidation of several financial activities (borrowing, saving, deposits, withdrawals, inter-account transfers) onto one mobile platform.

Despite high user satisfaction, M-Shwari is not the only, or the primary, financial tool for its users: 10 percent of users store at least half of their savings on M-Shwari and 20 percent receive at least half of their loans from M-Shwari. Most users reported relying on another financial service, such as SACCO, for example, for day-to-day cash-flow management with M-Shwari playing a complementary role. This limited use is in addition to the awareness-use gap demonstrated by the survey data – only about 15 percent of those aware proceeded to a trial – and there are barriers that hinder the transition of knowledgeable nonusers to users.

There are several factors that can help explain the gap between the high regard for the services and limited use. First, some of the users remain unsure about how the credit limit is defined. In particular, they do not know whether the amount deposited and saved on M-Shwari plays a role in the amount they are allowed to borrow. Users say they deposit and store money to increase their loan limits, making deposit activity the key predictor of the intent to borrow.

Another factor that might be working against M-Shwari, as noted by the users, is the combination of a low loan limit and a very short repayment term. This restricts the use of loans through M-Shwari to a few specific cases, including small-scale emergencies, but does not allow for long-terms business investments.

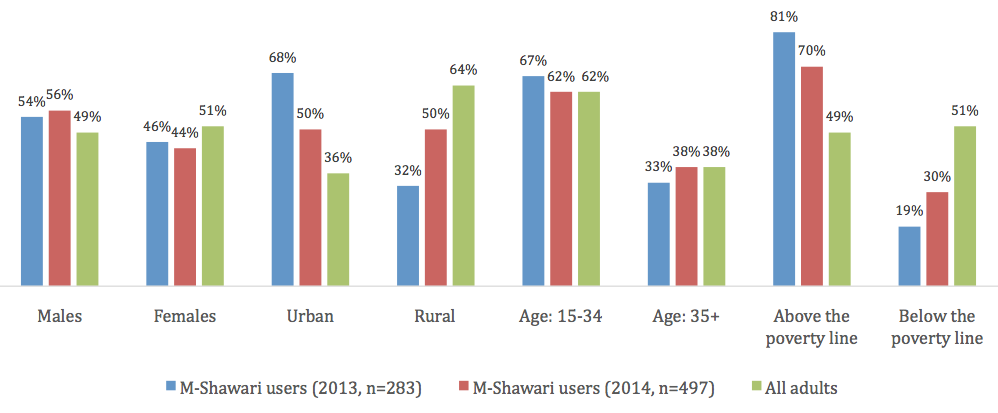

Based on their demographics, the bulk of current M-Shwari users belong to the early adopter group: The majority are urban males, adults living above the poverty line (>$2.50 a day), and mostly 15 to 34 years old (Figure 2). Most are well-educated, have professional or service jobs (a teacher, doctor or a nurse) and have access to formal financial services: Two-thirds report a bank account other than an M-Shwari. While the demographics of the users changed between 2013 and 2014 to include more rural and below-the-poverty-line users, the overall profile remains almost the same as a year ago. M-Shwari users are financially comfortable and relatively young, which means they also might be financially adventurous and in a position to experiment with M-Shwari without the fear of long-term financial consequences. Such financial freedom might be, at least currently, difficult to afford for the bottom of the pyramid populations.

Figure 2. M-Shwari users in 2013 and in 2014, by demographic characteristics

Source: InterMedia Kenya FII Tracker surveys Wave 1 (N=3,000, 15+), September-October, 2013, and Wave 2 (N=2,995, 15+), September 2014.

Based on the current user feedback, we identified three strategies* that can help M-Shwari scale up and enhance user experience: user education at sign-up, continuous provider communication with existing users and flexible repayment schedules. Provider transparency, investment in users’ financial literacy and a flexible repayment schedule will lower adoption barriers for the vulnerable groups (rural residents, females and those below the poverty level) which would help convince those groups to start using M-Shwari.

* InterMedia is not consulting for M-Shwari nor does it have any financial relationship with M-Shwari, CBA or Safaricom.

Anastasia Mirzoyants-McKnight is Director of Research and Operations at InterMedia Africa.

- Categories

- Uncategorized