It’s Time Research Caught Up with Microfinance Realities

Today we’re pleased to announce the release of Measuring the Impact of Microfinance: Looking to the Future, the third in a series of papers commissioned by Grameen Foundation. This series was initiated in 2005 to survey and contextualize the available evidence on the impact of microfinance. I got involved in the project in 2009, when I met Alex Counts, Grameen Foundation’s founder and then-CEO , at a conference in Chicago. We discussed the first Measuring the Impact paper, and the evidence on the impact of microfinance that had emerged in the intervening years. By the end of that conversation, I’d volunteered to write a second paper in the Measuring the Impact series, which was published in 2010. In early 2015, I was delighted to be asked to author the third paper in the series, Looking to the Future, as well. (For the record, my relationship with Grameen Foundation is limited to writing these two papers, which I do as a volunteer through the Bankers without Borders initiative, as part my research agenda at Dominican University. I have complete editorial control over the content.)

When I returned to the microfinance literature last year, there were two key questions to sort out. First, what had happened in microfinance impact research since 2010? And second, what was going on with microfinance practice?

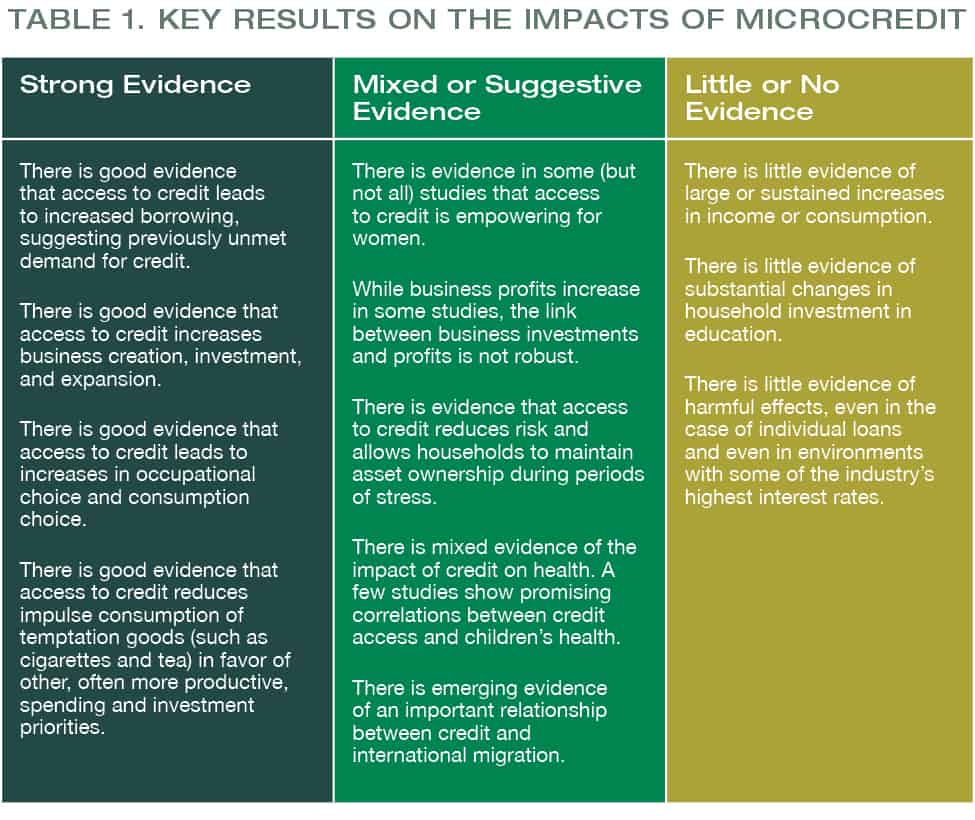

In answer to the first question, there was a lot of new research. The best-known papers were certainly the recent batch of microcredit randomized control trials that were published in the American Economic Journal: Applied Economics, in early 2015. The results from these studies have been widely discussed and summarized (on NextBillion and in numerous other places), and I’ve included detailed summaries of each in Looking to the Future as well. The research has shown (repeatedly) that while loans do not lead a typical family directly out of poverty, access to a broad range of reliable financial services, including loans, has an array of positive impacts on clients. Although these are, admittedly, selected examples, recent research presents strong evidence that access to credit yields increases in business creation, investment and expansion. There also is good evidence that access to credit leads to increases in occupational choice and consumption choice, including reduced impulse spending on goods like cigarettes. (See the table below from the paper.)

There are a couple of important considerations regarding these studies. First, regular readers of this blog are well aware that “microcredit” (small loans, the subject of the studies) is not the same thing as “microfinance” (a broader suite of services that includes credit, but also savings strategies and various insurance products), but a lot of the media coverage of these studies seems to conflate the two, which is imprecise and confusing at best, and in some cases downright misleading. Second, while the results of these studies are important, there is a lot of other illuminating new research as well, including a really interesting emerging relationship between credit and migration, and numerous studies making the case that savings programs (in a variety of forms) are beneficial financial tools.

What about the second question, though, about microfinance practice? Throughout the Looking to the Future project, I spent a good deal of time talking with development practitioners and one message came up again and again: Practice has changed, quite a lot, since 2010. Specifically, development practice has shifted toward emphasizing the bundling of financial and in some cases non-financial products, expanding the reach of financial services, and exploring the complex ways in which products, services and education affect the lives of poor clients. It seems to me that this shift has been, at least in part, a response to the growing body of microfinance impact research.

It has been a worthwhile project to write Looking to the Future, but having pored through the research, I believe this whole endeavor is poised to take a new direction. Earlier papers in the Measuring the Impact series concluded with anticipation of additional studies of the impact of credit. Now, through replication across diverse geographies and implementations, multiple studies directed at the high-level questions – the impact of credit on household economic and social indicators, and business indicators – have produced similar results. It is time for research that takes a new approach by designing studies through meaningful partnerships between researchers and practitioners and that will produce actionable findings and continue to contribute to improved practice. This might lead to the question: Wait, this is NOT a debate about research methodologies, e.g. RCTs, qualitative studies, mixed methods? The answer is an emphatic: Correct! It’s time to reframe the research questions – setting aside the question of whether “microfinance” can “solve poverty” and moving on to a next generation of research which accurately reflects both the nature and the intentions of current financial inclusion practice.

With that in mind, I would like to invite readers of this blog to make suggestions for what should come next. Five years from now, what are we hoping to know more about? And what are the research questions that will move us forward toward that knowledge? This link will take you to a short survey where you can provide your ideas. We are hoping to hear from many people with a variety of perspectives, and I’ll put together a summary of the responses that will be available in a few weeks.

Top image: Ugandan women with savings box. Image courtesy of Grameen Foundation.

Kathleen Odell is an associate professor of economics and acting associate dean at Dominican University’s Brennan School of Business, located just outside Chicago in River Forest, IL.

[yop_poll id=”10″]

- Categories

- Uncategorized

- Tags

- microfinance, research