A $200 Billion Opportunity: What Payment Data Shows About the Rise of Africa’s Digital Economy

Africa’s digital economy is growing rapidly, and it could go faster. We think businesses, financial institutions and governments are in a prime position to add a further US $200 billion to the continent’s GDP in the next six years by supporting that growth. Although this exceeds projections from the IFC and others, we believe it’s a realistic goal.

At Pesapal, we provide technology for point-of-sale (POS) and e-commerce payment processing in Kenya, Uganda, Tanzania and Rwanda. Our work in these markets gives us a unique perspective on how, and where, digital transactions are happening in Africa. Since 2009, we’ve worked with tens of thousands of African businesses — in sectors ranging from retail and petroleum, to travel and hospitality — to process transactions online and in person.

We’re bullish about the digital economy because we see first-hand how markets, business models and talent are accelerated with access to digital payments technology. Additionally, we see more investments flowing to companies that are building affordable hardware and software that enable African entrepreneurs to connect to digital financial systems.

We focus a lot on “digital baskets” in our work with merchants. This term refers to purchases completed via an e-commerce “cart” or through digital transactions at a physical POS. A look at average digital basket sizes among retail and hospitality operators on the Pesapal platform gives a glimpse of why we’re so optimistic about the digital economy’s growth prospects.

Growing Comfort with Digital Channels Among Retailers and Customers

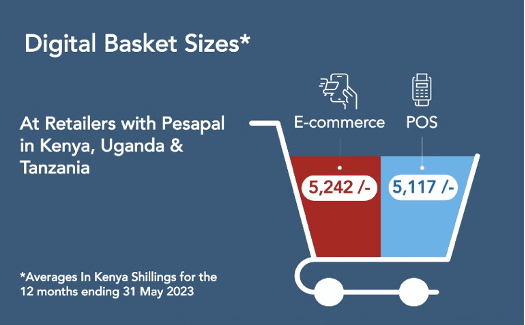

Let’s start with big retail brands. As Figure 1 shows, when they have access to payment technology and platforms (in this case Pesapal’s), their e-commerce basket sizes are on par with their POS transactions.

Figure 1

One of the things this tells us is that these merchants and their customers are already comfortable with different digital channels.

As other retailers develop this comfort level with digital payments, we’re expecting massive changes in the retail landscape. Over the next few years, merchants will increasingly tailor their business models towards e-commerce.

With the right payment platform, they can unlock substantial sales growth by doing this. On average, businesses that sign up for Pesapal’s e-commerce services are doubling their digital basket values within a year of going live.

This is obviously good for these retailers, but it’s also good for consumers. As mobile internet access increases, they will have greater choice and access to more affordable goods and services.

Impressive Uptake of Digital Payments in the Hospitality Sector

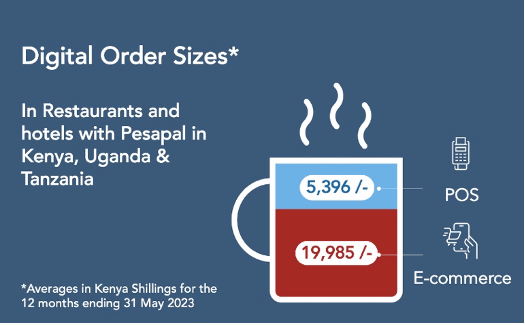

We see even greater uptake of digital payments among hospitality businesses that use our platform. Restaurants and hotels on the Pesapal network have embraced e-commerce, and already see higher order sizes online than companies in the retail sector. This trend has accelerated since the pandemic, as these businesses were forced to diversify their sales channels to remain viable during COVID-19 lockdowns. However, there are other contributing factors.

Figure 2

We work with thousands of hospitality businesses to expand their digital booking and ordering systems, so they can integrate with e-commerce, booking and delivery platforms — including both Pesapal’s payment solutions and digital services from other platforms. Compared to retail, the hospitality sector’s higher levels of integration with these platforms is a key driver of the substantially higher value of its e-commerce sales, as seen in Figure 2.

There are other trends that are likely to drive digital payment uptake in hospitality — and growth in the digital economy more broadly. For example, restaurants’ final-mile ecosystems in East African cities have become much more efficient. Whether customers place an order through food delivery apps, or request a pickup by their local motorcycle taxi, it’s now quick and affordable to get food delivered.

This has helped unleash a wave of digital products, both from existing restaurants and a growing number of digital-first food outlets — often called “cloud kitchens.” But for businesses in either segment to innovate and scale, they still need digital systems that facilitate online orders and POS payments together. As these systems become more accessible and affordable, we expect to see further growth for the whole sector — with a positive impact on job creation.

The Impact of Mobile Money Payments and Enabling Technologies

Another reason for optimism about Africa’s digital economy is the ongoing growth of mobile technology and access. Much has rightly been said about mobile money payments as a driver for innovation in East Africa’s digital economy. Indeed, many Pesapal customers were able to launch their digital products simply by taking payments on their phones. But as they’ve scaled and looked to attract different customers, these businesses needed to expand their payment options.

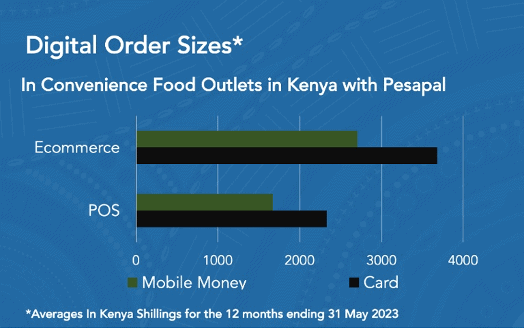

Figure 3

Figure 3 shows how convenience food outlets in Nairobi, which accept both cards and mobile money, are transacting through these different channels.

Though their growing use of these channels is promising, these businesses have faced the challenge of finding ways to seamlessly manage mobile money and card payments across multiple sites.

Traditionally, for merchants to scale to multiple sites, they have needed different POS devices, mobile phone lines and till numbers. There was no automated reconciliation or integration with ordering systems. The result was a mishmash of payment devices, with no controls or accountability — something that has presented a real barrier to these businesses’ ability to expand.

But now, with access to technology that is purpose-built for Africa’s unique payments landscape — including both Pesapal and other emerging providers — merchants have one of the most critical building blocks for scaling their outlets and sales channels.

How Digital Economy Solutions Boost International Transactions

Another area where digital economy solutions are making an impact involves international transactions. For most small merchants — who tend to transact in cash and mobile money — billing foreign visitors and taking international online payments have been problematic. But e-commerce platforms and recognised payment systems have played a huge role in addressing perceived issues around payment safety and customer recourse.

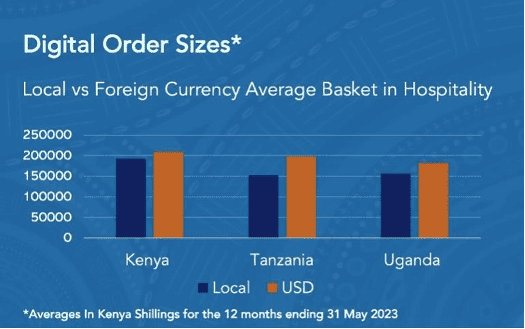

Figure 4

More international transactions are good for business. If we look at restaurants in East Africa (see Figure 4), we can see that servicing foreign customers delivers higher average transaction sizes.

It’s important to note that all the foreign currency payments we studied for this data point were paid by cards. Cards offer convenience for customers who don’t use mobile money. And we believe that the customer protection offered by credit cards is still massively important in building trust between buyers and sellers.

Figure 4 also shows that local transaction values are not too far behind those of international customers. This highlights the fact that there is untapped demand in local markets. But the digital economy is inclusive, and there’s also potential for further product diversification as merchants widen their appeal beyond their local stores to expand into the nationwide market.

As regional distribution and fulfilment become more seamless, merchants can scale even further to the regional level. This represents a valuable opportunity, with the East African community alone presenting a potential market of over 170 million consumers.

As stakeholders in the payments, e-commerce and finance ecosystems, we are supporting businesses’ efforts to tap opportunities in Africa’s digital economy — including the opportunity to drive innovation, entrepreneurship and job creation.

We have seen how our payments platform can empower entrepreneurs to grow. By providing them with the digital tools they need to maximize their sales potential, we can support their journey to scale and facilitate cross-border trade, while enabling them to navigate the growing complexity of this dynamic region.

Agosta Liko is the CEO and Co-Founder of Pesapal.

Photo courtesy of Polina Tankilevitch.

- Categories

- Finance, Technology