Data + Digitization: The Key To Helping African Banks and Microfinance Institutions Support Their Customers During COVID-19

Since arriving on the continent’s shores early this year, the COVID-19 virus has had a significant impact on Africa’s economy. In April, the International Monetary Fund (IMF) published a report highlighting the declining economic outlook for the region, with gross domestic product (GDP) expected to contract by 1.6% and real per capita GDP expected to be about 4.5% lower by 2024 compared with the pre-COVID-19 projections. The IMF projects 2020 to be the worst year for the continent’s economic growth since its record-keeping began in 1970.

Concerns are also mounting about the likelihood that there will be an increase in non-performing loans which will impact businesses, industries and individuals across the continent. As part of the solution to mitigate this impact, Patrick Njorge, the governor of the Central Bank of Kenya highlighted the importance of leveraging new digital finance technology to support individuals and businesses with monetary transfers, loans and savings services.

Financial technology is essential for banks and microfinance institutions (MFIs). Adapting a digital financing system that allows financial services institutions (FSIs) to pre-screen their customers and extend their services through a branchless infrastructure will enable them to both reach new customers and better service existing ones. By incorporating these measures, FSIs will be able to reduce their credit risk on loans and allow consumers to obtain greater access to financial products online. In the immediate term, they will also be better able to operate despite the social distancing measures that are restricting individuals from accessing financial services in person.

Incorporating a data API platform to better understand customers

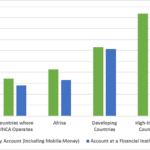

In sub-Saharan Africa, the World Bank estimates that around 350 million individuals are unbanked – a number that accounts for 17% of the global total. The lack of a financial credit score restricts these individuals from accessing loans, because lending institutions determine the creditworthiness of potential customers based on past repayment data. Based on an Ernst and Young study, the absence of a financial profile that is associated with unbanked individuals can result in up to 90% of new-to-bank applicants being rejected due to existing loan application decision-making policies. In light of COVID-19, McKinsey has reported that African banks could see revenue falling by 23-33% between 2019 and 2021. In response, the report recommends banks accelerate their digital adoption to serve customers more effectively, by integrating digital processes and data analytics that update lending processes, customer onboarding and risk-scoring frameworks.

For banks and other financial institutions, the most scalable way to boost this digital adoption and reach more unbanked individuals would be through a unified data Application Programming Interface (API) platform that allows them to use traditional and alternative data (user-permissioned mobile data), artificial intelligence and advanced analytics for credit scoring purposes. As the pandemic accelerates the need to deliver financial services, banks and financial institutions will benefit from these additional data points, which will enable them to make data-backed decisions so that credit-worthy individuals and businesses can receive their loans on time and through branchless channels, reducing the spread of COVID-19.

A digital platform will be necessary to service customers at scale

Much like how the SARS epidemic in 2003 accelerated the use of digital financial services in China, the ongoing COVID-19 crisis is driving forward digital finance to help consumers receive funds in Africa. For these reasons, banks and financial institutions have to rethink distribution, moving away from costly branch networks to consider remote channels for customer engagement. As McKinsey analysts have pointed out, this could have a major long-term impact on the sector. Recalibrating towards digital channels could improve a bank’s cost-to-serve ratio and provide financial services to remote customers who have been underserved historically.

To reap these benefits, banks and financial institutions will need to invest in mobile applications and platforms that extract user-permissioned data so they can launch branchless banking and expand financial operations. Individuals and businesses would also benefit from these measures, because they would limit the risk associated with COVID-19 and allow customers to securely receive funds online. From an accountability perspective, the use of digital channels for financial services would also allow for proper tracking of funds.

Pngme’s early traction indicates large benefits from digital finance

At Pngme, we have been building a unified data API platform that incorporates traditional and alternative data to support FSIs developing financial products on the African continent. Based on our engagement with partners in Kenya, Nigeria and Ghana, the use of a unified data API platform has allowed us to create unique financial profiles (financial identities) of users on the Pngme platform who previously lacked access to credit in Africa. As a result of COVID-19, we have quickly developed our technology and partnered with FSIs to create digital onboarding flows, and to automate and streamline their lending processes. This is helping them speed up their customer evaluation, complete the onboarding and approval of loans in a transparent manner, and de-risk their business in a period of uncertainty. In Nigeria, the combination of our unified data API and mobile lending toolkit has been impactful for clients like Readycash, whose entrepreneurs and small businesses have been able to access credit quickly and digitally to secure emergency funds during COVID-19. Pngme has enabled Readycash to serve existing customers with new financial products, while also reaching new customers who were previously unserved under traditional credit models.

This momentum is exciting, but there’s more work to do. For the African continent at large, the financial sector needs to look into digital technology as a way to serve customers and deliver much-needed financial services that allow the economy to circulate funds and drive forward the economic recovery from the COVID-19 crisis. We believe Pngme’s approach provides one model for how FSIs can leverage these digital tools for their own benefit – and for the benefit of their customers and the broader economy.

If you’d like to learn more about how Pngme is scaling digitisation for financial services institutions, drop us a line here.

Cate Rung is the co-founder and COO at Pngme.

Photo courtesy of Eric O. IBEKWEM.

- Categories

- Coronavirus, Finance, Technology