Five Things We’ve Learned Creating Data Standards for Inclusive Fintech

It’s no secret that capital is flowing into fintech. In 2018, global fintech investments exceeded USD $100 billion. Yet for those of us focused on financial inclusion, it’s becoming apparent that investment is highly-concentrated among a relatively small group of companies. It’s also hard to know with certainty if these companies are inclusive, due to a lack of clarity around how to define and measure inclusion.

With support from MetLife Foundation, our team at MIX is in the process of researching and designing a data solution that will help direct capital into inclusive fintechs in order to reach the 1.7 billion unbanked people around the world. We set out to create data standards – the key input into this data solution – that meet the needs of both fintechs and investors. We’ve conducted over 40 interviews with fintechs, investors and ecosystem actors. We’ve also assembled and consulted a Working Group and Advisory Group, both comprised of top experts and practitioners working in fintech. Through this process, we’ve gained insight into how we can design and collect information on data standards to drive capital to inclusive fintechs. Here are five things we’ve learned so far:

Fintechs will share data…with the right incentives

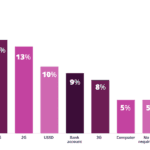

We recently concluded our initial analysis of applications to the Inclusive Fintech 50. The competition, funded by MetLife Foundation and Visa with support from Accion and IFC, aims to identify the most promising early-stage fintechs driving financial inclusion. In designing this competition, we were cautioned that start-ups would not share data. However, nearly 600 fintechs submitted applications that included data on investments, customer numbers, business models, and revenues and expenses. Therefore we can confidently say that, with the right incentives and assurances of confidentiality, fintech startups are willing and able to share data.

Fintechs need data too

Providing fintechs with the data they need can help to incentivize data sharing. We reviewed numerous data platforms that publish company- and industry-level data on a range of categories, including fintech. Nearly all these platforms target investors, with only one-third explicitly naming startups as one of their target audiences. Yet in interviews with fintechs, it is clear that they have their own data needs: They want to find investors, understand how they are performing against their peers, and gain insight into the types of metrics investors expect to see. Often, they want to know all of this before they start fundraising.

Everyone wants benchmarks

Investors, fintechs, associations and incubators all tell us that they are looking for benchmarks. Benchmarks can help fintechs understand how they are performing against their peers, and provide visibility into how similar companies are performing in different markets when they are preparing for international expansion. For investors, benchmarks can provide a basis of comparison during the valuation process, which is especially important for investors who are new to fintech. For associations and incubators, benchmarks can help ensure their member companies are on track relative to peers, and they provide a basis for marketing the relative success of their members when searching for funding and investment partners.

Data can support the growing demand to demonstrate inclusivity

A recent IFC report, Creating Impact: The Promise of Impact Investing, builds on the premise that a growing number of investors are interested in demonstrating that they are a force for good, and that profit is not their sole objective. At the same time, the report points to the risk of “impact-washing” – claiming impact without being able to prove that impact. “Fintech is promising precisely because it offers new models for reaching those who were previously un- or under-served,” said Sarah Willis, Director of Financial Health and Inclusion at MetLife Foundation. “But there is an open question about the transformational impact of fintech on financial health of low-income people. We will continue to be active in the space.” The right data standards in an easy-to-use data sharing platform can help fintechs and investors alike to demonstrate, track and measure their intent to be inclusive, and how that intent translates to positive social and economic impact over time.

Inclusivity can be demonstrated through business metrics

Fintechs are willing to share data – yet they emphasize in interviews that, by nature of being a start-up, they are time- and resource-constrained. They are not able to conduct large-scale impact assessments, or to gather additional data beyond what is essential to run and grow their business. Therefore, we need to ensure that inclusivity can be demonstrated through standard business metrics. Inclusivity starts with basic observable factors: a mission statement that explicitly mentions reaching a segment of the population currently underserved by financial services, and the ability to state the problem they are trying to solve to better reach that segment or segments. Over time, fintechs can demonstrate if they are, in fact, solving this problem better than their competitors through data points such a customer retention rate, referral rates, and documented customer feedback from call centers or other sources.

We hope that you’ll follow and contribute to our effort to use data to drive more capital to inclusive fintechs. Stay tuned for the announcement of the Inclusive Fintech 50 winners in mid-June, and soon after, the draft of the full set of data standards including key performance indicators and inclusivity metrics, which will be available for public comment. In the meantime, email fintech@themix.org to learn how you can get involved. Together, we can ensure that fintech realizes its potential to deliver affordable, accessible and appropriate financial services to everyone, everywhere.

Blaine Stephens is the COO and Chrissy Martin Meier is the fintech lead at MIX.

Photo via Wikimedia Commons.

- Categories

- Finance, Investing, Technology