Strengthening the ‘Environment’ Component of ESG: How Financial Institutions Can Bring Green Financing into the Mainstream in India

Environment, social and governance (ESG) reporting has become a critical enabler for many companies that are navigating the transition from “shareholder capitalism,” in which the interests of a business’ owners and investors are of primary importance, to “stakeholder capitalism,” in which businesses take the needs of customers, workers, communities and other key stakeholders into account. The growing focus on ESG frameworks is being driven by a conscious and aware investor community, and by increasing global pressure from legislators, advocates and the general public to leverage business for social good. ESG’s momentum is due to accelerating climate change, deteriorating natural resources, decreasing labor rights, increasing corruption and other negative externalities that unsustainable and unethical business practices have caused.

For businesses that are big enough to be listed on a stock exchange, for whom ESG disclosures are mandatory, adopting cleaner procurement policies (i.e., avoiding corruption, child labor, arms trafficking, etc. in procurement) and accessing greener supplier chains are two of the many tangible ways of showcasing ESG-conscious strategies. But for financial institutions, ESG consciousness boils down to adopting decision-making and underwriting principles for financing that are aligned with ESG guidelines.

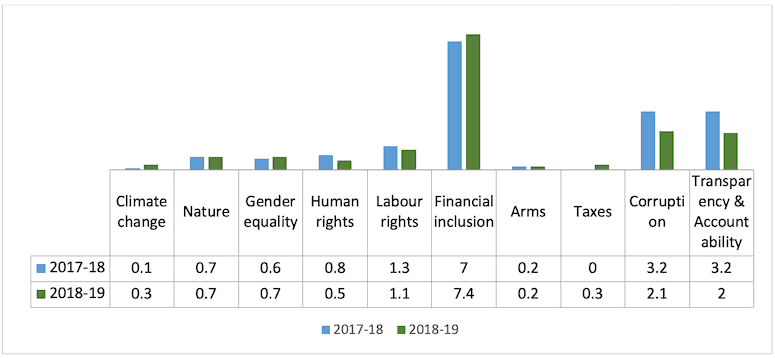

In India, financial institutions have shown an increased focus on the governance component within the ESG framework, as illustrated by a growing number of policy measures taken by the government and cleaner and stronger governance practices. These institutions have also prioritized the social component, most notably through their focus on financial inclusion. However, the environment component has generally been less of a priority. The latest Fair Finance India Policy Assessment 2020 noted this discrepancy, highlighting that assessed banks in India have scored highest on the themes of financial inclusion, followed by corruption and transparency and accountability, whereas they have scored very poorly on the environment theme, which includes climate change and nature. The chart below illustrates these findings:

Source: Fair Finance India

Green Financial Instruments: Contrasting India to the Global Market

In the global market there are dedicated ESG funds and green instruments (ranging from green bonds to green insurance) to facilitate projects – not only in the domain of climate finance, but also focused on the environmental objectives necessary to support sustainability. These projects may address clean and renewable energy, solid waste management, carbon efficient urban infrastructure, climate resilient agriculture, biodiversity and resource conservation, etc.

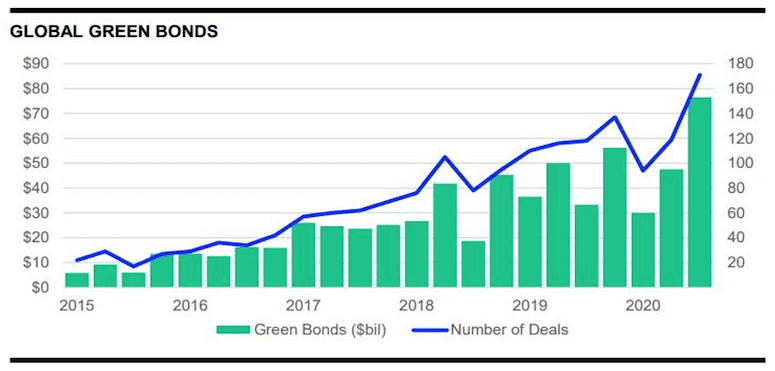

In the third quarter of 2020 a record $76.5 billion in green bonds were raised globally, from 171 issuances by national governments, multilaterals and banks. According to a report by the British non-profit Climate Bonds Initiative, the cumulative global green bond issuance exceeded US $1 trillion and stood at US $1.05 trillion in 2020, with an average annual growth rate of 60% since 2015. This total is expected to reach US $2.36 trillion by 2023.

Source: Refinitiv Deals Intelligence

But despite this growth in the overall market, there has been sustained neglect on the part of Indian financial institutions in developing strong internal policies to accelerate the pace of green financing instruments that help address climate change and support the enterprises which have the least negative externalities on the environment.

Compared to the global market, green financing has only recently begun gaining traction in India. Green finance flows in the country totaled US $17 billion in FY 2017 and US $21 billion in FY 2018. But according to recent reports, green finance inflows have remained constant since then, partly due to COVID-19, as India raised about US $19 billion in green capital in FY 2021. India’s Intended Nationally Determined Contributions (INDCs) under the Paris Climate Accords indicate that the country would need US $2.5 trillion from 2015 to 2030 to achieve its major targets, including reducing the emission intensity of its GDP by 33-35%, creating an additional carbon sink of 2.5-3 billion tons of CO2 through expanding forests, and installing 40% of its total electricity capacity from non-fossil fuel-based energy sources. To reach these goals, around US $170 billion would be required per year, which is around 6.5% of India’s GDP in 2022. While the country’s current green financing volume is only about 10% of the total annual funding required across sectors to meet these INDCs, it is nevertheless a good starting point. And as India’s financial markets and institutions are becoming more receptive to green financing instruments, these numbers are projected to increase at a much higher rate in near future. Funders across the country are gradually beginning to engage in green financing: After the launch of India’s first green bond by Yes Bank in 2015, other financial institutions – including the State Bank of India, the Export-Import Bank of India, Axis Bank, Union Bank of India and the Industrial Credit and Investment Corporation of India, along with government institutes like National Hydroelectric Power Corporation and Ghaziabad Municipal Corporation – have followed suit.

However, while the issuance of green bonds has found an initial foothold in the Indian financial space, it’s also necessary to mainstream other green financial instruments, like green equity, green equity indexes, green banks and green lending.

The Current State of Green Financing Policy Directives

India started its journey towards green financing in 2009, when Voluntary Guidelines on Corporate Social Responsibility were issued by the Ministry of Corporate Affairs as part of the government’s efforts to mainstream responsible action by business. The government followed this up in 2011, by setting up the Climate Change Finance Unit within the Ministry of Finance as a coordinating agency for the various institutions responsible for green finance in India. In the same year the government also revised its Voluntary Guidelines on Corporate Social Responsibility and launched the National Voluntary Guidelines on Social, Environmental and Economic Responsibilities of Business, which further evolved into the National Guidelines on Responsible Business Conduct in 2019. Though the guidelines did not contain any targets or regulations on green finance, they are considered a landmark policy in terms of increasing institutions’ awareness of environmental externalities and paving a path for financing to reduce these externalities.

Doing its part, the Securities and Exchange Board of India developed its Business Responsibility Reporting framework in 2012, which made it mandatory for the top 100 companies listed on the National Stock Exchange to disclose their performance on ESG parameters (this requirement was extended to the top 1,000 companies in FY 2019-20). In May 2017, the Securities and Exchange Board also issued guidelines for green bond issuance, specifying their disclosure requirements. And in 2021, the Business Responsibility Reporting framework evolved into the Business Responsibility and Sustainability Reporting (BRSR) framework, which provides guidelines for the preparation of Business Responsibility Reports for companies in India that are listed on the stock exchange, as well as those that are unlisted.

From the green financing perspective, India’s BRSR framework has facilitated the more structured inclusion of non-financial reporting, widening the scope of responsibilities of businesses. The need for businesses to measure and report any environmental impact they make under the BRSR framework creates an added layer of transparency that enables financial institutions to understand companies’ environmental impacts and make appropriate investment and capital allocation decisions in response. (This reporting is voluntary until FY 2021-22, but will become mandatory for the top 1,000 listed companies by market capitalization as of FY 2022-23.) The Reserve Bank of India has also done its part by including renewable energy projects as part of its Priority Sector Lending targets, thus assigning tangible targets to all the country’s banks, upon which they can be audited yearly.

Challenges and the Way Ahead for Green Finance in India

While the government’s support and the sector’s momentum mean India’s financial institutions have immense opportunities to make forays into green financing, they continue to face significant challenges.

One major challenge that needs to be addressed immediately is related to classification: There’s an urgent need to define what is green and what is not, with clear scope and boundaries. This is an extremely critical step, as it will help financial institutions to frame their internal guidelines and policy directives.

Currently, more often than not, the terms green financing, climate financing, ESG financing and sustainable financing are used interchangeably. There is an increasing need for a specific taxonomy for quantifying green financing, created by the government or a government-related entity, and augmented with sub-categories (e.g., renewable financing, carbon sequestration, green infrastructure, etc.) and negative lists (i.e., types of financing that do not qualify as green). This will not only help in policy formulation at the government level to create appropriate incentive and disincentive structures, like easier access to credit, better ratings, etc., it will also help in categorizing what is green and what is not – as well as determining “how green” a project is, and tracking and measuring the overall state of green financing in the country.

In the meantime, the way forward for financial institutions in India is to incorporate green financing as a key strategy for their portfolio investments. Financial institutions can bolster their green financing portfolios through four easy steps:

- Understand the current baseline: This involves understanding the green financing expectations of financial institutions’ key stakeholders, including determining whether the institutions have the right data, the right capabilities and the right processes to monitor and manage their green portfolios going forward.

- Know what’s expected: This requires institutions to have an awareness of the specific targets and expectations that are required of them by the regulators.

- Integrate green finance into the risk framework: This involves gauging not only the reputational risk but also the credit risk involved in green financing, and integrating it into banks’ broader risk modelling frameworks.

- Develop a green financing strategy: This includes integrating green finance goals/activities into the overall business strategy of the organization, by leveraging the greater expected profit margins and returns that will be generated by these activities.

By taking these steps, and addressing the challenges discussed above, India’s financial institutions can finally bring green finance into the mainstream. In the process, the country can ensure that its ESG funding efforts aren’t leaving the environment component behind.

Aryasilpa Das Adhikari is an Associate Director at ACCESS ASSIST and leads the Inclusive Finance India Initiative; Priyank Sharma is Manager at the Inclusive Finance India Initiative; Srishty Anand is the Research and Knowledge Specialist at Oxfam India and leads Fair Finance India.

Photo credit: Prashanth Vishwanathan (IWMI).

- Categories

- Environment, Finance, Investing