Shifting from Financial Inclusion to Financial Health: Strategic Focus Areas for Providers and Other Stakeholders

Financial inclusion has been a global development priority for decades, but it still has a long way to go in improving financial health for the majority of customers, especially among low- and moderate-income segments. One reason for this lack of progress is that financial health is harder to define and measure. The framework to measure financial inclusion is binary and easy to grasp: The key priority is “access to financial products” – and people either have it or they don’t. Financial health, in contrast, is multi-dimensional and subjective: It requires customers’ long-term engagement with financial products, which makes it difficult to show quick or unambiguous progress. Due to these complexities, and the gap in financial product access which took time to fill, the question of whether these products were improving users’ long-term financial health was pushed to the sidelines.

Yet that question remains, and it is growing more urgent as the global financial health deficit becomes clearer. In the past decade, 1.2 billion people around the world have obtained a financial account. Yet more than two-thirds of adults in Kenya, Vietnam, Greece, Chile, Colombia and Bangladesh would not be able to cover basic needs for three months using just their savings or by selling assets, in the event they lost their incomes. India, for all its progress in financial inclusion, has reported a 48% dormancy rate in account usage, suggesting that these accounts are having a limited impact on financial health. Similarly, despite financial inclusion in Kenya increasing from 75% to 83% between 2016 and 2019, the percentage of Kenyan adults deemed financially healthy declined from 39% to 22% in the same period. And financial health remains an issue even in more affluent markets: The U.S.-focused Financial Health Network shows that only 33% of Americans are financially healthy, despite near-universal financial inclusion.

Efforts to boost financial inclusion have focused mostly on supply-side efficiency. But achieving financial health will require more engagement on the demand side – i.e., with low- and moderate-income users. And this will imply a significant shift in overall strategy across stakeholders. In this article, we’ll define three of the key strategic focus areas that are necessary for improving financial health, exploring how they differ from the approaches taken to boost financial inclusion.

Avoiding the ‘Copy/Paste’ Approach Used in Financial Inclusion

The first strategic shift can be understood by considering one of the biggest successes of financial inclusion: the microfinance model. The fundamentals of this approach – a focus on women, the use of group collateral and more frequent loan repayment – have remained the same across geographies. The model achieved scale due to its simplicity, as providers were able to copy and paste it across markets with only minor modifications.

But when it comes to increasing the usage of financial products beyond credit, efforts to copy and paste successful models have not yielded similarly successful results – especially in savings and insurance. One reason is that while the value proposition for microcredit is clear and intuitive for lower-income customers, who can easily understand the purpose and uses of a loan, other products are harder to explain, with less immediate and apparent value. And while financial institutions can be inspired by other institutions’ sporadic success in achieving increased customer usage due to innovative designs for non-credit products, they require a more nuanced understanding of the target customers before replicating these successes.

Understanding and Responding to Local Customers’ Needs

This leads to the second strategic shift: Focusing on local customers’ unique financial needs. Achieving success with non-credit financial products requires institutions to adjust product features to better suit the needs of users, so that the products can be more easily integrated into customers’ lives. It also requires these providers to adjust to various cultures, financial systems and regulations, and user preferences and current behaviour.

However, many financial service providers are still very early in even documenting the full spectrum of variables involved in replicating products across customer groups, let alone making adjustments based on those variables. To convince customers to adopt and use a full suite of financial products, providers will need to develop a more nuanced understanding of their needs, contexts and limitations, in order to design products that address them.

Adopting a Longer Timeline for Financial Health

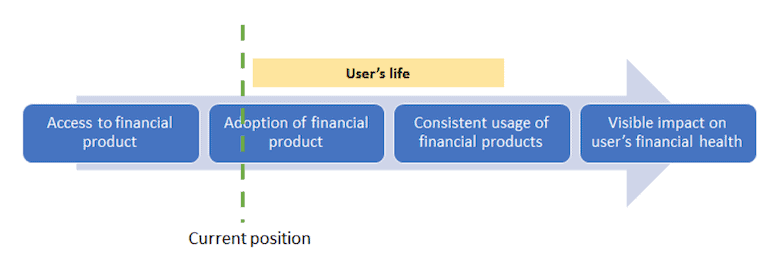

The third strategic shift can best be described with an analogy: Shifting gears from financial inclusion to financial health is akin to racing a Formula 1 car vs. playing a football match. The success of inclusion efforts was primarily dependent on individual institutions (the “driver”) getting a suitable product (the “car”) across the “finish line” of customer adoption. Once a certain number of customers had access to financial products – from savings accounts to loans and insurance – the race was won.

In contrast, financial health is like football: It’s a matter of fostering successful team-wide coordination among multiple players (i.e., various stakeholders including financial institutions, policymakers and donors/funders) to successfully put the ball in the goal (i.e., to increase the acceptance, adoption and regular usage of the financial products). But the game isn’t over when one goal is scored: Financial health requires these stakeholders to continue their efforts to maintain consistent customer usage of these products – and consistent benefit to the customer’s life – over a longer period of time. The graphic below illustrates this longer timeline, and estimates how far the financial sector has progressed toward the ultimate goal of financial health.

Financial Health: Moving Past the Current Status Quo

To move customers toward financial health, all stakeholders will need to make a fundamental shift. They will need to both broaden their timelines for the measurement of impact and make the corresponding adjustments in their outcome expectations, moving away from binary results based only on account access to embrace the larger goals of financial security, resilience and quality of life. They will need to focus on local innovations suitable for local needs, promoting and encouraging them while resisting the temptation to simply replicate other models that have reached scale.

None of these goals will be easy to achieve: Sustaining local innovation is costly and does not guarantee large customer uptake early on, and it requires greater flexibility to build and design new products that meet regulators’ approval – not to mention the challenges of understanding customers’ needs in the first place. The question is whether financial institutions and policymakers have the capacity to maintain these efforts consistently.

Sustaining this new focus will require a clear break from earlier interventions focused primarily on inclusion. To that end, the sector will have to move past the current status quo of inclusion-based metrics, and a concerted effort must be made to bring all stakeholders onto the same page in adopting a more robust framework of financial health.

Fortunately, there is already a growing realization among many stakeholders of the need for these changes, and we have started to witness some momentum in this direction. For instance, UNCDF recently came out with a white paper on “Delivering Financial Health Globally,” which touched upon some of these core issues.

But make no mistake, executing this shift in focus among stakeholders is just the beginning. A long and arduous journey awaits, which will require a fundamental evolution in customers’ product preferences in order to achieve lasting improvements in their financial health. This will require financial institutions and other stakeholders to make closer observations of customer behaviour, and to shift tactics in response to changing situations on the ground. They’ll also need to improve customer communication and trust around new products, work toward intuitive product designs, and explore new partnerships for scale to move the needle on financial health.

However, without a clear focus on key strategic areas, these tactical moves may not bear fruit, even in the longer run. To quote the Chinese philosopher and strategist Sun Tzu, “Tactics without strategy is the noise before defeat.” And in this case, defeat could mean another decade of delay in achieving financial health for millions. Choosing the right strategic focus areas – including those discussed here – will lay the building blocks for the right tactical moves, preparing the ground for global financial health.

Nishant Kumar is co-founder and CEO, and Sonal Agrawal is co-founder and COO of Lakshya.

Photo courtesy of Adam Cohn.

- Categories

- Finance