Going Local: Mobile financial service providers must consider local differences in access & usability, says Grameen Foundation

Mobile Financial Services (MFS) have received much attention as a way to further financial inclusion. But as we’ve written before, the mobile phone is not yet accessible enough to reach significant portions of the unbanked. Our research found that poor women in particular are left behind. Access, familiarity, convenience and security are significant issues.

At Grameen Foundation, we believe that these barriers can be addressed. We recently expanded on our initial research around gender and mobile financial services, taking a two-pronged approach. The first—which we’ll discuss here—was a partnership with InterMedia to utilize a mixed approach of qualitative and quantitative research methods in India and the Philippines. The second—which we’ll discuss in a separate posting next week—was a qualitative usability study in partnership with CKS in India, the Philippines and Uganda.

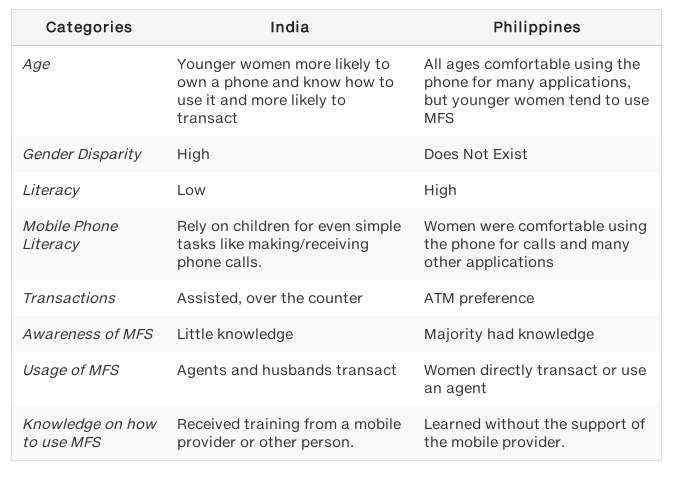

Our biggest finding was the high degree of variations in comfort levels and usage patterns among these poor, rural women. Global assumptions and generalizations cannot be made. It’s important that financial service providers (FSPs) and mobile network operators (MNOs) understand the local nuances associated with the use of the mobile phone as they decide to bring mobile financial service offerings to these women.

In India, the cultural norms within the household are very different from the Philippines. Indian women tend to rely on others (husbands, children and relatives) to use the mobile phone. This greatly impacts their ability to build comfort and confidence in the use of not just the mobile phone, but financial services. Women in the Philippines, by contrast, have a relationship with the mobile phone on a par with their male counterparts. Many poor women are aware of mobile financial services and are comfortable using these services independently.

This is just one finding of many in the study; here are a few more of the highlights.

For the full study, click here.

The second prong of our approach, which we’ll discuss in a separate post next week, was conducting in-depth qualitative usability research with a small number of women in India, the Philippines, and Uganda.

Editor’s note: This post was originally published on Grameen Foundation’s blog. It is cross-posted with permission.

Debbie Dean leads several global financial service programs at Grameen Foundation, including their microsavings initiative, which is helping microfinance institutions in India and the Philippines to develop savings programs for the poor.

- Categories

- Uncategorized