We Asked Small Business Owners How Digitalization is Impacting Their Businesses: Here’s How They Responded

Digitalization has quickly become the go-to strategy for improving the performance of Latin America’s micro and small enterprises (MSEs). Many governmental and private initiatives have supported their technological transformation over the last few years, primarily since COVID-19 restrictions drastically altered their way of conducting business. It is well known that implementing digital solutions in a firm’s operational processes can provide numerous benefits: expanding its customer base, boosting productivity and creating efficiencies, thereby accelerating revenue growth. But we know little about how MSE owners themselves experience these changes. For example, how do they think that digitalization has affected their sales? And which digital solutions have improved their business, and by how much?

To answer these questions, Decodis — a social research company using tech-led listening to provide nuanced insights into vulnerable populations — has been tracking the digital journey of a sample of 114 mostly women-led MSEs in Colombia, Mexico and Peru since late 2021, through four automated surveys. This study aims to help inform the decisions of the DigitAll program, an initiative led by Fundación Capital and supported by the Mastercard Center for Inclusive Growth. Through DigitAll, Fundación Capital has been promoting and facilitating the adoption of digital solutions for over 50,000 MSEs in these three countries since 2020, with the goal of integrating them into the digital economy. The findings presented in this article reflect the results of the first two surveys of the study, which were executed between December 2021 and August 2022.

Social media and digital payments are front-runners in MSEs’ digitalization

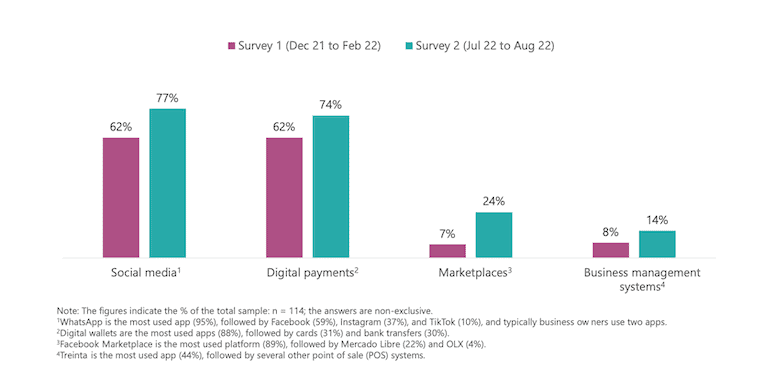

Chart 1 below compares the results of our first survey — conducted between December 2021 and February 2022, several months after the start of the DigitAll program — to the results of our second survey six months later. The first survey showed that there was already high uptake of social media and digital payments in early 2022, with considerably lower uptake of marketplaces and business management systems — e.g., digital systems for financial and inventory control. In August of that year, there was continued progress in the adoption rates of all digital solutions. Social media and digital payments continued to be the most widely used, with 86% of the total sample taking up one or both of these tools. In contrast, marketplaces and business management systems remained the least adopted.

Chart 1: Evolution in the adoption of digital solutions

It is not surprising that social media and digital payments are the most popular solutions among these businesses. Their adoption was already spreading among MSEs in the region due to the COVID-19 crisis, when most of these businesses experienced a severe decline in revenues, with some (25%) even forced to temporarily close their stores for several months due to the strict lockdown measures imposed in their countries. As Claudia, a woman entrepreneur manufacturing and selling clothing at a textile market in Bogotá, Colombia, said: “It was very tough. We had no sales because the market was closed for six months. Yet we still had to pay rent.”

Like most companies worldwide, these firms were pushed to adapt their business models to stay afloat, leading them to implement digital solutions to sell online: “When the pandemic started … we began posting some things on Facebook and WhatsApp and doing delivery. This allowed us to, at least, maintain sales,” said Jessica, the owner of a stationery shop in Lima, Peru.

From digital adoption to increased sales

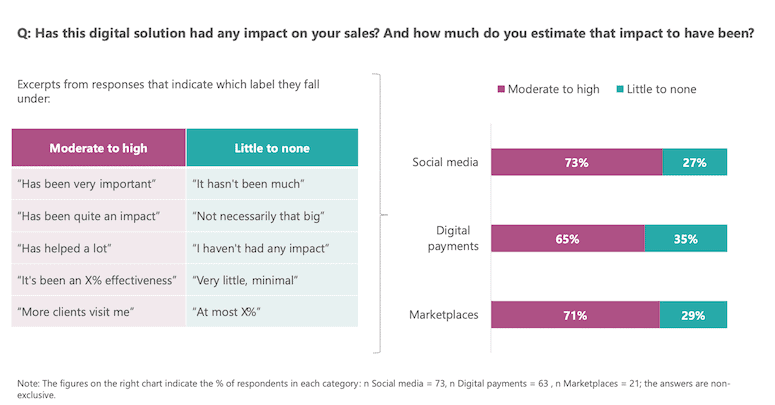

To capture the impact of digital solutions on business, we asked the entrepreneurs in an open-ended way what effect each solution had on their sales and overall business. For social media, marketplaces and digital payments solutions, we asked three questions: 1.) Has this digital solution had any impact on your sales? 2.) How much do you estimate that impact to have been? And 3.) In what other ways have these solutions impacted your business, and why? For business management systems, we only asked the third question. Most of the entrepreneurs had a great deal to say: All those who responded affirmatively — with neutral or enthusiastic expressions — to the first question were categorized under the “moderate to high impact” label. In contrast, those who responded negatively — with disapproving or negation expressions — were classified under the “little to no impact” label. Chart 2 below shows that business owners were generally enthusiastic, with 65% to 73% specifying that the tool was positive for their sales.

Chart 2: Creating sales improvement estimates from an open-ended question

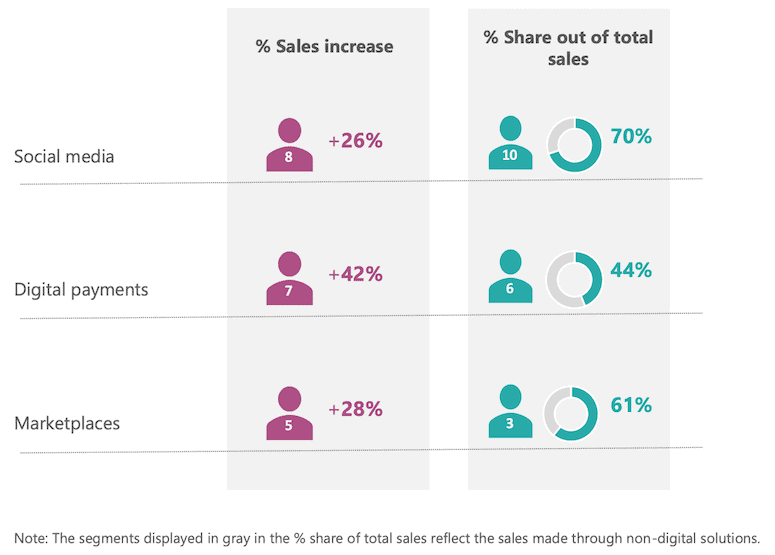

However, as shown in Chart 3 below, 34 of the 114 respondents were able to be more specific and provide quantitative estimates of the impact on their sales. They mentioned two different types of impact: 1) sales growth and 2) share of total sales. The first estimate involves the percentage of total sales increase as a result of using each digital solution. The second involves the percentage of total sales that are now coming through each tool — i.e., how many customers buy through social media and marketplaces vs. in-store, and how many customers pay through digital payments vs. cash.

Chart 3: Quantitative estimates of sales impact from digital tools

These estimates, while not reliably verified or captured across the entire sample, provide a picture of the extent to which each solution may influence sales, and the degree to which they are embedding themselves into the business. For example, digital payments were estimated to have created a 42% increase in sales on average, even though less than half of sales are paid digitally. Conversely, social media and marketplaces were estimated to increase sales by 26% and 28% respectively, but they were involved in an estimated 70% and 61% of sales among the sub-sample who specified a quantitative figure.

All of this evidence is quite promising — it would seem that digitalization has a sizable impact on sales, according to business owners themselves. But is it credible? To shed some light on interpreting these numbers, we delved a bit deeper and asked respondents how these digital tools increased sales to this extent.

Digital Payments: How do they help improve sales?

Out of all participants using digital payments, most (65%) said they experienced an impact on sales since adopting them. These payment methods have enabled businesses to grow primarily by attracting and retaining non-cash customers. As María, the owner of a small restaurant in Lima, mentioned: “Sometimes people would not buy from you because they … did not have cash. Now, with Yape [Peru’s leading digital wallet], they can instantly pay me.” It makes sense that the impact on sales should be so high, given that digital payments can bring in new clients.

In addition to the impact on sales, business owners mentioned several other advantages of using this solution. For instance, 37% saw an improvement in the convenience of making sales transactions — e.g., they can make and receive payments quickly and without complications, like worrying about having change, and the money now goes directly into their accounts. Others mentioned benefits like improved security, increased credibility with clients, and the ability to track transactions.

Social media: How do they help improve sales?

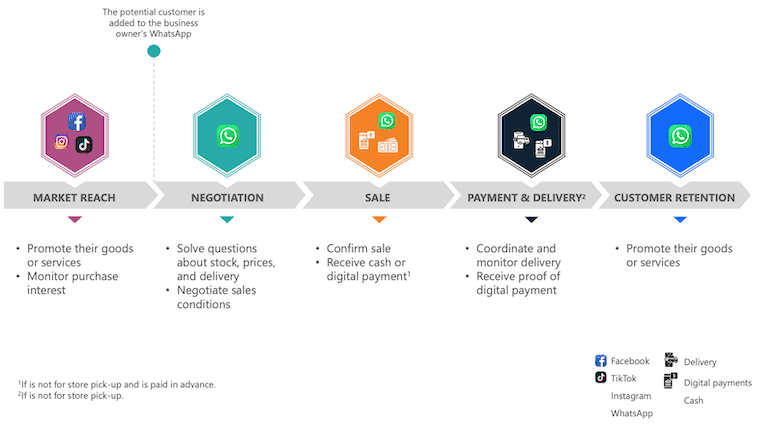

Out of all participants using social media, most (73%) said they experienced an increase in sales due to adopting this solution. The most-used app is WhatsApp: However, as Diagram 1 below shows, making a sale is a more intricate process involving different social media apps at different points in the sales journey.

Diagram 1: Sales journey using different social media apps

Facebook, Instagram and TikTok are used mainly to reach the market through posting photos and videos of the products and services, sharing offers, and checking comments. But as a customer moves toward a purchase decision, the conversation shifts to WhatsApp, where the business owner answers questions and negotiates delivery. As Julia, the owner of a handmade jewelry business in Lima, explained: “I post photos on Facebook, and once the person is interested … I add them to my WhatsApp contacts on my personal phone and start coordinating the sale.” The customer then pays digitally, and the business owner shifts to WhatsApp once again to confirm payment and monitor delivery and post-sale concerns. Once a customer has been added to WhatsApp, business owners further advertise their products and services to them by sharing their business catalogs and promotions using the app’s status and broadcast features to encourage recurrent purchases.

Online Marketplaces: Nascent promise for even bigger sales growth?

While very few business owners have started utilizing marketplaces (like Facebook Marketplace) to sell online, this solution has shown initial signs of important growth — five out of seven participants using them reported a positive impact on their sales due to these platforms. That was the case for Raquel, a woman entrepreneur selling ornaments from her home in Lima: “More or less 30% [of sales] are from people that I already know. And the rest are from new people who contact me through these platforms.”

Survey responses from several respondents highlighted the potential of marketplaces to grow small business revenues — and revealed a key reason behind their effectiveness: While social media is limited to existing clients or those within the business owner’s social network, a marketplace immediately expands the reach beyond those limitations. For some business owners, these marketplaces have become so important for their sales that they have ceased to have a storefront and gone completely virtual, saving money on rental costs and generating sales more efficiently.

Business management systems: A driver of efficiencies rather than growth

It is clear that business owners see digital payments and social media as drivers of revenue growth. However, the same does not apply to business management solutions, which include point-of-sale inventory tracking systems and apps like Treinta that provide both inventory and financial control services. While participants reported experiencing positive impacts in adopting these systems, they did not associate these benefits with economic returns. When referring specifically to inventory control tools or features, respondents talked about improvements in sales control, stock management and production, as well as reductions in human errors and manual work. And when talking about financial management tools or features, participants cited improvements in accounting control and organization, better data management, greater customer trust, and easier decision-making. However, they did not describe these benefits as sources of revenue growth.

Furthermore, although there has been a nascent upward trend in adopting business management systems since our first survey, most entrepreneurs are still reluctant to implement them. More than half of those not using these systems replied negatively when asked if they would be interested in adopting one, mainly because they feel their inventory is small enough to manage without digital support: “I do not find it necessary because I do not have too many products. … Thus, I do not need to make an inventory,” explained Guillermina, the owner of a small grocery store in Puebla, Mexico.

Coming out of an economic slump during the pandemic, having faced the possibility of their firms shutting down — and seeing many other firms that did — it may be understandable that business owners have focused first on digital solutions that provide a sizable and immediate boost to revenues. Moreover, it is not surprising that they favored those digital tools they were already using in their personal lives — 81% said they had already been using social media, 88% had been using messaging apps (such as WhatsApp) and just under 50% were already using digital payments.

If these preferences continue, then the adoption of marketplace platforms should be next on the list for adoption. However, whereas using social media and digital payments in their personal lives decreases the barriers to adoption in using these tools in their businesses, understanding how to set up and manage a marketplace page is likely to be more intimidating for business owners without direct assistance.

We will continue this research for another six months, during which time we will conduct two more surveys. Going forward, we will expand our focus beyond the acquisition and use of digital solutions, to understand how embedded they are in the business — and where else business owners see value in digitalization.

If you are interested in learning more about this research, contact us at info@decodis.com, or visit our website to read our latest publications.

Daryl Collins is the CEO and Founder, and Maria Pia Torres is a Project Manager at Decodis.

Photo courtesy of Adam Cohn.

- Categories

- Finance, Technology, Telecommunications