How Innovation Created an Off-Grid Solar Market in Rural Bangladesh — And What Other Countries Can Learn from this Model

When, contrary to all expectations, a little-known experiment in the Bangladesh hinterland became the largest off-grid electrification program in the world, many people were amazed. Some were even baffled, wondering how this could happen in a country better known for cyclones and corruption than off-grid market development. Almost everyone wanted to know: What’s the magic formula? How can we replicate this success?

But the fact is, there was no magic formula. What later evolved into a nationwide solar market began as a small-scale pilot project with a five-year target of 50,000 solar home systems (SHS) in off-grid rural Bangladesh. The project was actually a tiny add-on component to the World Bank’s Rural Electrification and Renewable Energy Development (RERED) project for Bangladesh, which was launched in 2002. And RERED’s design, objective and performance indicators were geared toward grid electrification, not solar. Indeed, few World Bank managers thought even an SHS pilot project could succeed in poverty-stricken rural Bangladesh — except for the Task Team Leader for RERED, S. Vijay Iyer. (I met with Iyer and other key players in these efforts multiple times over the years, as part of research I presented in my book “The Marketmakers — Solar for the Hinterland of Bangladesh.” Much of the information I discuss in this article is based on my research at the World Bank and in Bangladesh.)

Iyer convinced his senior management that thousands of remote off-grid villages would have to wait decades for grid electricity to reach their households. He argued that an earlier World Bank program in off-grid Sri Lanka had shown that decentralized SHS were the solution for rural households. He believed a similar SHS program might work even better in rural Bangladesh, since with financial support from the World Bank, the country’s thriving rural microfinance institutions (MFIs) could help develop a commercial SHS market.

This approach wouldn’t be easy. Developing a commercial market would involve competition, local enterprise, new modes of financing and government support. It would require rules, innovation management and vision to create a market from scratch. And this market development would have to happen not in easily accessible urban areas, but in remote villages with more waterways than roads — for a low-income clientele who had never heard of a solar home system.

Yet in spite of these obstacles, the SHS pilot project achieved its goal of installing 50,000 SHS in August 2005 — 2½ years ahead of schedule. Over the next two decades, the project would spark the emergence of a commercial market and lead to the installation of 6 million solar home systems, lighting up rural households which for generations had never known electric light. These SHS have benefited 25 million villagers, and helped generate an ecosystem of solar suppliers and manufacturers that have fueled the local economy with an estimated 137,400 jobs. But the benefits didn’t stop there: As a result of this new SHS market, the Bangladeshi government introduced a renewable energy policy. New institutions were formed. And the nascent off-grid solar industry expanded from solar home systems to solar-powered irrigation pumps, street lights and smart microgrids.

This is not to argue that Bangladesh’s off-grid solar market development has overcome all obstacles — it certainly hasn’t. The electric grid is still heavily subsidized, making it harder for solar options to compete on price. Subsidized diesel undercuts competition, specifically from solar-powered irrigation pumps. Vested interests still strongly oppose renewables, and a nuclear power plant is scheduled to begin operations in 2025. And with a mere 3.5% of total electricity generated from renewable sources, there’s plenty of work ahead.

However, regardless of what the future holds for off-grid solar in Bangladesh, the country has already provided the rest of the world with a model for how low- and middle-income countries can develop a nationwide, rural market for decentralized solar systems driven by home-grown companies. This is indeed remarkable. But these lessons are still applied all too rarely in the developing world. As of 2022, 72% of global industry investment in off-grid solar went to seven multinational companies, which tend to work primarily in easily accessible — and more profitable — urban and peri-urban areas, excluding the 60 – 80% of the populations in developing countries who live in rural regions. This highlights the need for more emerging economies to follow Bangladesh’s lead and develop their own markets for off-grid solar solutions.

How can other countries adapt Bangladesh’s market-creating innovations to their unique local environments? I’ll answer this question in detail below.

The Importance of Rural Market Development in Off-Grid Solar

The process of building local off-grid solar markets in developing countries hinges on a highly underrated and still little understood priority: rural market development. How can these countries convince local companies to enter the off-grid solar market? How will these businesses be financed, and what incentives can be introduced to create demand for products (usually starting with SHS) that rural, low-income customers typically can’t afford without financing options? What checks and balances can countries institute to ensure that quality systems are installed and serviced by trained technicians? And how can they develop an ecosystem of suppliers, service companies and manufacturers to generate self-sustaining economic growth within this new industry?

This is what countries that hope to follow Bangladesh’s model need to understand. Rural market development in off-grid solar is far more complex than selling a single product. Rather, it aims to support local entrepreneurs’ efforts to develop the solar sector, fuel the local economy and provide a better life for the millions of villagers without electricity. The motto of Bangladesh’s pioneer of solar home systems, Grameen Shakti, was not “buy a solar lamp.” It was “more income and a better life with solar.” In other words, the company marketed SHS as a tool that enabled productive use, whether that involved customers extending their small businesses’ working hours into the night, renting their solar lamps to others for a small fee, or otherwise utilizing these products to increase their incomes. Grameen Shakti’s approach to marketing its products is now hailed as a breakthrough for promoting solar technologies, and it was the key factor that enabled the company to achieve success as a rural startup over 20 years ago.

Any individual company can emulate this marketing approach to sell its solar products to rural customers in developing countries — and many have done so. But what allowed Bangladesh’s young solar enterprises to become a thriving nationwide SHS market? The country had some unique advantages that enabled it to incentivize, train and organize these separate businesses to effectively serve low-income customers in its rural hinterland — and one of these advantages was its uniquely entrepreneurial culture of innovation.

Business as an engine of rural development

Bangladesh has been a global leader in leveraging business for rural development for decades. The most visible example of this is the pioneering work of Muhammad Yunus and Grameen Bank, which sparked the global microfinance movement and fundamentally challenged the way development programs are designed, financed and scaled. By viewing the rural poor as paying customers instead of passive recipients of external aid, Yunus helped demonstrate the power of self-sustaining business as a development tool. Though the basic components of the borrowing model he pioneered with Grameen Bank — i.e., group liability and affordable weekly repayments for loans — existed long before his experiments with poor borrowers in rural Bangladesh, Yunus was the first to combine these elements into a formula for high repayment rates, controllable costs and scale. Hundreds of rural NGOs copied this model, and thousands of financers worldwide adapted it. Meanwhile in Bangladesh, the Grameen approach contributed to the rise of new products and new businesses serving the rural poor — and not just in the microfinance sector.

Grameen Bank provided rural businesses across industries with a clear model for how one innovation can reinforce and build on another to spawn fundamental change. For instance, in 1997 when virtually all rural villages lacked a phone, it launched Grameen Telecom to leverage the bank’s know-how in microcredit to provide mobile phones and increased income to the rural poor. It developed a model in which a Grameen “Telephone Lady” took out a loan from the bank to purchase a phone, then used that phone to provide payphone services to the people in her village. The program spread like wildfire and was copied throughout rural Bangladesh, and soon thousands of these “Village Phones” were in operation. This also led to a growing demand for electricity that was met by Grameen’s newly founded rural renewable energy service company, Grameen Shakti. Launched in 1996, Grameen Shakti provided off-grid village households with the solar power they needed to charge their phones — which in turn provided access to vital information on market prices and available jobs.

In this way, entrepreneurs and the companies they founded have changed the culture of Bangladesh — notably including BRAC, another innovative Bangladeshi organization that has leveraged the power of self-reinforcing enterprises to drive substantial social change. With the entrepreneurial culture these pioneering companies created, it’s little wonder that the World Bank recognized the potential of investing in rural market creation for solar home systems in Bangladesh. But even with these advantages, market-building efforts for off-grid solar systems were unprecedented — and risky. And the challenges facing the Bangladesh Infrastructure Development Company (IDCOL) as the implementing agency for the World Bank’s SHS pilot project were immense.

Using Innovation to Address Market Challenges

Dr. Fouzul Khan was the founder and CEO of IDCOL — the state-owned development financial institution — and the first project manager for RERED’s SHS Program. He began the project with a stream of innovations to meet the concrete market challenges he knew it would face. For instance, he created IDCOL as a corruption-free institution, at a time when Bangladesh was listed as the world’s most corrupt country on the Transparency International Corruption Perceptions Index. To support that effort, he opposed the World Bank’s centralized procurement process, which he viewed as a hotbed of corruption. Instead, he argued that the companies that participated in the program needed to procure their own equipment from private sector suppliers and set the prices of their own SHS, in order to create a competitive market. (The Bank agreed to these measures.) He ensured that only qualified rural companies would be selected for the SHS Program, by outsourcing the entire selection process to an independent committee, in order to avoid political influence: a major organizational achievement. Significantly, he also established an independent technical standards committee, to guarantee that participating companies would comply with quality SHS standards that were rigorously enforced by technical inspectors, both before and after the solar home systems went to market.

Khan formed IDCOL into a proactive company that worked like a police force and a fire department at the same time, in part by leveraging its connections to Bangladesh’s network of microfinance institutions. He understood that the program could only succeed if it conducted rigorous monitoring of the financing, installation and repair of the SHS. And he knew that the MFIs which were financing consumers’ purchases of SHS were geographically distributed organizations with hundreds of village branches and thousands of staff enabling their operations. That meant they were well-placed to function as rural solar service companies in addition to their microfinance operations, so he worked with these MFI partners to develop this capacity, and most of them set up their own separate departments for SHS operations — much as Grameen Bank had done with Grameen Shakti. As a result, Khan knew that even if management couldn’t anticipate where and when “fires” would break out, the program would have the machinery in place to quickly adapt and innovate to address the unexpected challenges that are common in a dynamic rural market.

In all these efforts, success was contingent on continuous feedback from these rural MFIs/solar service companies and from the suppliers that participated in the program. So Khan established monthly face-to-face meetings between these businesses (known collectively as participating organizations or POs) and IDCOL’s management, to discuss problems before they got out of hand. His innovative finance model, for example, was somewhat unfamiliar terrain for the MFIs/solar service companies. In essence a blending of microfinance and project finance provided by IDCOL, it allowed for loans in local currency with little or no collateral and affordable monthly payments for the customer. This was something the POs understood: Their main challenges involved the implementation of the Bank’s financing, which required extensive monitoring and reporting to ensure full compliance with IDCOL’s policies.

At these monthly meetings, participants discussed how this model was working in practice. The meetings were energetic, at times cathartic: PO managing directors presented their problems and suggestions for improvement. Those that worked as solar suppliers were invited to share their own challenges and solutions, while those that served as MFI branch managers gave their views on village market trends. But it was leadership that made these group discussions work: The meetings were chaired by Fouzul Khan himself. These meetings serve as prime examples of how market-building efforts can promote shared intelligence to find new ways to get things done.

As a result of all these efforts, Bangladesh’s rural market for solar home systems grew by leaps and bounds. In little more than a decade, over 50 POs had entered the market. Installations peaked at over 861,000 systems in 2013. But then this momentum collapsed, as SHS installations plummeted to under 3,500 in 2018: a profound lesson in what happens when complacency hinders innovation, which I discuss in “The Marketmakers — Solar for the Hinterland of Bangladesh.”

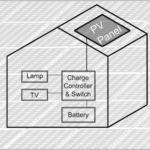

However, though Bangladesh’s SHS Program came up short during its final phase, it was far from a failure. For one thing, millions of quality SHS still dot the country’s rural landscape. And SOLShare, an innovative climate-tech company, is currently building on the infrastructure developed by the program by interconnecting these existing solar home systems into peer-to-peer swarm microgrids. It’s clear that the program’s market-building efforts have led to a paradigm shift, enabling the next generation of innovators to transform SHS customers from mere consumers into solar entrepreneurs, who can trade their self-generated surplus electricity among each other and generate income.

This is the true power — and lasting legacy — of market-creating innovation. And it’s the future we want to see, not only in Bangladesh but across the developing world.

Nancy Wimmer is the director of the renewable energy research company microSOLAR, and an entrepreneur, researcher and advisor for microfinance and renewable energy to the World Council of Renewable Energy.

Photo courtesy of SOLShare.

- Categories

- Energy, Technology