The Impact of COVID-19 as Seen in Solar Payment Data – and How One Off-Grid Energy Company is Responding

Governments across the developing world have implemented a wide range of responses to the COVID-19 crisis, from encouraging good hygiene to imposing partial curfews and full lockdowns. Conventional wisdom is that emerging countries are even less able to cope with lockdowns than developed countries: Many people live hand-to-mouth, and few can work from home in economies where most work is still subsistence agriculture and manual labour.

Moreover, even as lockdowns lift, the economic pain is not yet over. Tourists will not return for a long time, depriving countries like Kenya, Rwanda and Tanzania of a top source of jobs and foreign exchange. And the slowdown in manufacturing activity has led to a collapse in the prices of commodities that many African countries rely on, starving resource exporters like the Democratic Republic of Congo (DRC), Angola and Nigeria of revenues.

At Bboxx, we’ve been monitoring these trends closely as the crisis has unfolded in the 12 markets where we provide clean electricity and other utility services. We collect over 700,000 payments per month from more than 250,000 pay-as-you-go (PAYG) solar customers buying daily electricity bundles, and we have been using this repayment data to assess the impact of the crisis and plan mitigation strategies. In economies where most business is conducted informally and in cash, alternative data such as digital electricity payments can provide a window into the impacts of the crisis that could take longer to show up in national statistics. For instance, we ought to quickly notice if our customers are suffering significant drops in income—that is, if they respond to drops in income by buying fewer days of electricity—reducing their utilization rate for our off-grid solar home systems.

So how is COVID-19 impacting solar electricity users in developing countries? And what measures can be most effective to help keep the lights on for off-grid solar customers?

Reasons for Hope – and Concern – in Solar Payment Data

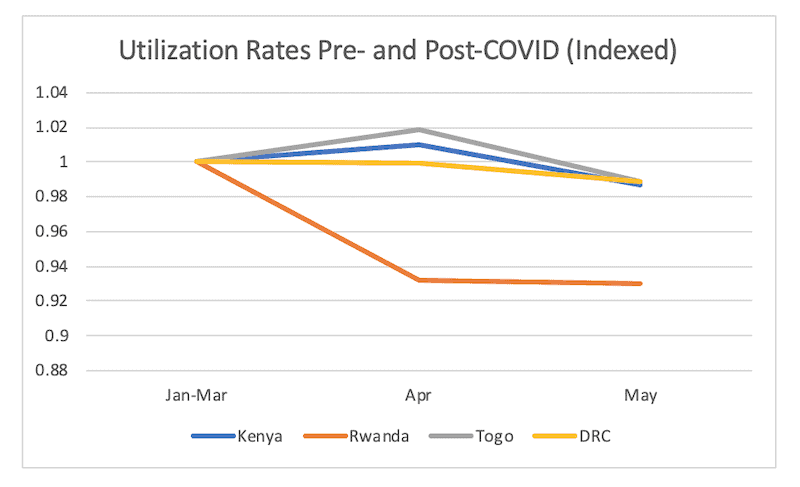

At first glance, the data appears more hopeful than one might expect. In the four markets we analysed—Rwanda, Kenya, Togo and DRC—only Rwanda saw a significant drop in electricity spending—about 7% compared to the three months before the crisis, the equivalent of about two days less energy usage per month. This difference between countries reflects the differing responses of those countries’ governments. In contrast to Rwanda, which announced sub-Saharan Africa’s first and strictest lockdown on March 21, lockdowns in the other markets were either loosely enforced (Kenya), restricted to urban areas (Togo), or non-existent (DRC). Rwanda is now emerging from lockdown, and we are seeing signs of spending levels increasing.

But this resilience in spending could be masking some emerging problems.

For one thing, the virus could still surge in countries without strict lockdowns, forcing their governments to take more drastic—and economically painful—measures. While cases are relatively stable in Rwanda thanks to its early and enforced lockdown (not withstanding some recent outbreaks in border regions), the number of infected people has shot up 1210% in Kenya since the start of May (as of June 25). And even if countries do not lock down, falling commodities prices and collapsing global demand for tourism and exports could still negatively impact these economies.

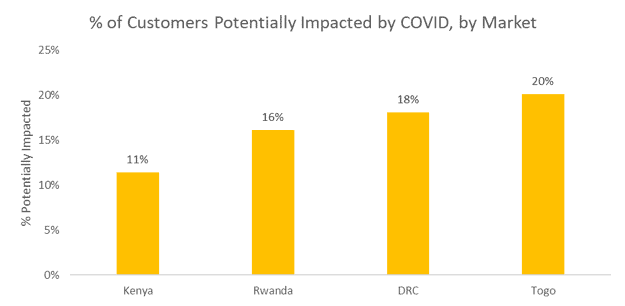

Moreover, these overall numbers may not be showing the pockets of customers who are suffering economically—and the resilience in spending may not last if customers are making sacrifices and drawing down savings to keep buying electricity. Our research shows that up to 20% of our customers in the four markets we analysed have been potentially impacted by the crisis to the extent that it has significantly affected their energy spending – which we’ve defined as a drop in utilization rate of >20% compared to the three months before the crisis.

Similarly, research from Bboxx partner 60 Decibels shows that 31% of customers in Rwanda and Kenya said their financial situation had “gotten much worse,” and 87% had employed some coping mechanism (dipping into savings, borrowing money, etc.) to keep up with electricity payments. In Rwanda, the number of customers saying their Bboxx payments are a burden increased to 17%, from just 4% in 2019.

While this data is preliminary and cannot establish causation, it is an early indication that incomes could be suffering – we are conducting additional research, surveys and analysis to understand this further.

On an encouraging note, the fact that overall electricity usage has generally remained resilient despite these pockets of reduced spending could also indicate that some of the measures Bboxx has taken to help customers continue their energy usage are indeed working.

Helping Customers Weather the COVID-19 Crisis

To help the most impacted households, we reduced the minimum payment size for expired customers. Before the crisis, if a client waited until their electricity credit expired before topping up, they were required to buy at least seven days to reactivate their solar system (clients who are still activated can top up as little as one day). This was to encourage discipline in keeping up with payments. But we anticipated that clients whose incomes were falling might struggle with a seven-day minimum, and thus reduced the minimum payment to between one and three days across the various markets where we operate. While we cannot establish causation, the fact that utilization rates have remained high—and only fell by 7% in the country with Africa’s strictest lockdown—could indicate that this has helped struggling customers.

We have also offered customers generous bonuses that allow them to receive more days of electricity for the same price—effectively, a discount on their daily rate. Bboxx Togo and DRC launched bonuses in April that give 14 free days to customers who buy 30 days of access, and 30 free days to customers who buy 60 days. On May 27 our Rwanda operations launched their own “buy one get one” bonus, and Bboxx Kenya is launching theirs soon. Extra payments from customers able to take advantage of these schemes could be offsetting missed payments from struggling customers, leading to the relative stability in electricity spending we’ve seen.

For the most part, these bonuses do not come in the form of reductions in the total amount customers owe on their payment plans—rather they temporarily activate the customer’s solar system for free. This means they are effectively a form of refinancing: “Free” days the customers get now are paid for at the end of the payment plan when (hopefully) times are better, offering short-term relief to customers when they need it. Based on this early analysis, we have seen customers prioritizing their energy service as essential, and our business model is showing true resilience in these uncertain times.

While these bonuses come at a short-term cost to Bboxx as a business, we firmly believe that it’s well worth it – and we welcome the efforts of GOGLA and others to support the sector during this crisis. We want to keep the lights on for our customers and ensure they also remain happy and loyal, foreseeing a return to normal spending when the economy improves. It is important – now more than ever before – for us to continue our mission of transforming lives and unlocking potential through access to energy.

Anthony Mabonga is Global Credit Manager, Joan Kirunga is Senior Data Analyst, Andrew Kent is a Product Manager and Amaury Fastenakels is Chief Marketing Officer at Bboxx.

Photo courtesy of Bboxx.

- Categories

- Coronavirus, Energy