Insuring the Next 400 Million in India: Why the Mutual Insurance Model Presents a Clear Path to Scale

There has been extensive discussion of COVID-19’s devastating impact on India’s healthcare system, focused on challenges ranging from a lack of medical oxygen to limited hospital capacity. But the pandemic has also brought to light the inadequate health and health-financing infrastructure in the country. There has been widespread media coverage of the huge out-of-pocket expenditures patients are paying for COVID-19 treatment. Even insured patients are paying out of pocket for COVID care, as insurance companies, private healthcare providers and regulators debate about what insurers should pay.

The COVID-19 financing experience is one sign of a larger risk protection gap across income groups. India’s share of the global insurance market is only 1.72% though it accounts for almost 18% of the global population. On the supply side the insurance market is lopsided, with a large number of insurance distributors and a very small number of insurance manufacturers: India has only 67 insurance companies; in contrast, the U.S. has 5,929 and Germany 530.

To better understand these issues and explore a potential solution, the Bharat Inclusion Initiative recently release a report, “Insuring Bharat: Scaling-up People-Led Risk Protection,” published as part of the Bharat Inclusion Research Fellowship. The study looks at the potential of mutual and cooperative insurance to close the risk protection gap in India, and identifies use cases showing how this people-led insurance model can be scaled. Below, we’ll share some key takeaways from the report and discuss some of the solutions it highlights.

Closing the Risk Protection Gap in India

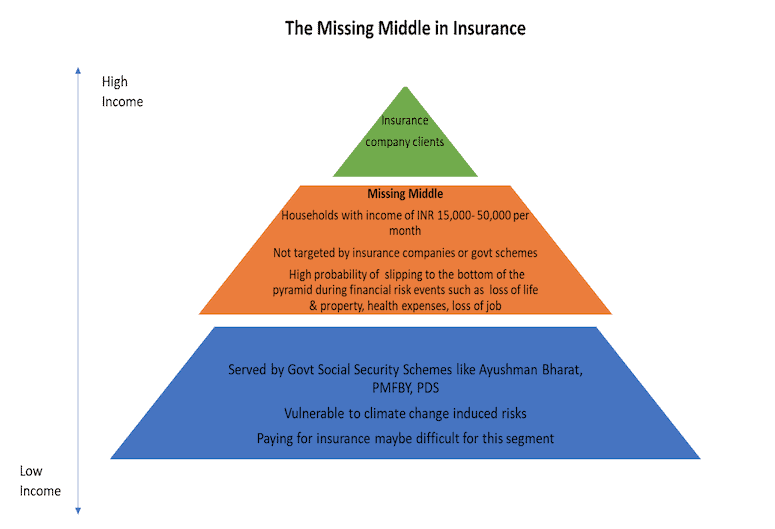

India’s insurance penetration is low in part because of a gap in its standard risk protection options. Its high- and middle-income households are the core target group for conventional insurance policies. The people at the bottom of the pyramid, generally the poorest of the poor, are eligible for the government’s social security schemes. But in between these two groups, there is a vast segment that has the ability to pay but has not been tapped by insurance companies – and that isn’t eligible for government options.

poorest of the poor, are eligible for the government’s social security schemes. But in between these two groups, there is a vast segment that has the ability to pay but has not been tapped by insurance companies – and that isn’t eligible for government options.

This market segment includes a massive number of uninsured people. According to a 2021 Indian government report, central and state government schemes provide hospitalization coverage to around 700 million people at the bottom of the pyramid, while around 250 million people are covered by private voluntary insurance and social health insurance. That means the remaining 400 million people – i.e., 30% of the Indian population – do not have any kind of health insurance. As per the government’s report, this “missing middle” population is not a homogeneous group: “It primarily consists of the self-employed (agriculture and non-agriculture) informal sector in rural areas, and a broad array of occupations – informal, semi-formal and formal – in urban areas.”

Mutuals have a presence in 77 countries, and comprise over 26% of the global insurance market. They are recognized and regulated in most major economies – except India.

Catalysing the Growth of Mutuals in India

Why then does a country as diverse as India not have multiple insurance business models? Why not have people-owned insurance companies?

India is no stranger to community and cooperative-based financing models. The country has 854,355 cooperatives with over 290 million members, and more than 80 million women participate in 7.3 million self-help groups (SHGs), which gather savings from members and use the pooled funds to give loans to group members. Given this history, and Indians’ familiarity with cooperative models, mutuals could provide a viable avenue to democratize access to affordable insurance. Additionally, the long-term, value-based and needs-driven approach of mutuals makes them an appropriate platform for building resilient communities and improving access to insurance in India.

At present India has 19 mutual insurers covering over 3.5 million people. These mutuals are not regulated by the government’s insurance regulator, and are registered as societies or cooperatives that serve only their members. Most mutuals are run by women collectives and grassroot financial institutions, and hence women constitute more than 90% of their primary membership. Many communities have started their own mutuals because of the lack of availability of appropriate products in the market, the increasingly unviable premiums of commercially available products, the tedious claim settlement processes of insurance companies, and the need for a transparent and accountable risk management system.

Despite the advantages of the mutual model, the lack of regulation has been the biggest impediment to scaling up mutual insurance businesses in India. However, a couple of recent developments have the potential to catalyse the growth of mutuals in the country:

- First, the committee on Standalone Micro-insurance Companies set up by the Insurance Regulatory and Development Authority of India has, for the first time, acknowledged the work done by mutuals in the country’s microinsurance segment. It recommends a reduction in the minimum amount of capital on-hand required for mutuals and cooperative insurers to set up microinsurance companies – bringing this requirement down from the current level of INR 1 billion (around US $13.3 million) to INR 200 million (around US $2.7 million). This currently high upfront capital requirement is an entry barrier for mutual companies that want to focus on microinsurance.

- Second, the success of mutual aid models in China has generated interest in mutual insurance amongst investors, donors and insurtech companies, and this presents a great opportunity for Indian mutuals to mobilize funds. The high penetration of smartphones and the availability of cheap internet has opened a floodgate of opportunities for these providers to scale at low costs.

Three Use Cases to Scale the Mutual Model in India

The “Insuring Bharat” study has identified three use cases that can be adopted by mutuals to scale their operations, depending on their nature and area of strength:

- Leveraging the self-help group movement to scale mutual insurance: Insurance still remains a weak link in SHGs – savings and credit have been performing the function of insurance in these groups. SHG federations with four to five years of experience would be the best-suited institutions to change this by running their own mutuals, as they share the same foundational values of community ownership and participation. They also have a basic financial and distribution infrastructure that’s ready to expand into insurance offerings. Their potential to scale can be seen in their extensive existing network, which operates across 706 districts and 36 states/Union Territories.

- Building a “digital twin” for mutuals: Mutual insurance models in India are extremely localised. They are exclusive (i.e., only open to the members of their local group/community) and investment-heavy, and they require a long learning curve to build. But as more and more people in India get connected to the internet and have smartphones, there is an opportunity to build a digital mutual insurance product that mimics grassroot mutuals’ values and services, and bridges the country’s risk protection gap. The market for this kind of product could be massive: India had over 502 million smartphone users as of December 2019. Even if we halve the number of smartphone users to estimate the number of potential digital mutual clients, it comes to an overwhelming 250 million people in urban and rural India.

- Building a Sharia-compliant model of insurance: Muslims have typically shied away from voluntary participation in insurance activities, as there are no Sharia-compliant products available in the Indian market. However, the mutual model of insurance is consistent with the Islamic norm of sharing and caring through mutual support and cooperation – and India has the second-largest Muslim population globally at about 195 million, comprising 15% of its total population. To capitalise on this opportunity, existing mutual and cooperative insurers can offer Sharia-compliant mutual insurance products, or financial institutions and community-based organizations with a significant Muslim clientele/membership can run their own mutuals.

Regardless of which providers pursue it and which approach they take, the mutual model represents a major opportunity to reach out to the vast missing middle in India, and to create a primary model of risk management that’s currently missing. The COVID-19 crisis has exacerbated the need for insurance solutions that work at scale. Now the onus is on the key insurance stakeholders – policymakers, regulators, cooperatives, civil society organizations, investors and reinsurers – to act.

Payal Agarwal is a Board Trustee at Uplift Mutuals.

Photo courtesy of Uplift Mutuals.

- Categories

- Finance, Health Care