MSMEs Are the Backbone of Developing Economies: New Research Shows How Digital Platforms Can Boost Their Impact

The world’s working-age population is growing – and nowhere more rapidly than in sub-Saharan Africa. To keep pace with this growing population, 600 million new jobs must be created globally over the next 15 years. That’s a tall order, but micro, small and medium-sized enterprises (MSMEs) are making this goal achievable. MSMEs are the backbone of most economies worldwide, and they play a key role in developing countries, according to the United Nations.

In Kenya alone, there are roughly 7 million non-agricultural microenterprises with less than 10 employees that, in total, contribute roughly 30% of the Kenyan GDP. The Partnership for Finance in a Digital Africa (FiDA Partnership), an initiative of the Mastercard Foundation, recently began research, based in Nairobi, looking specifically at this subset of microenterprises. The research focuses on how they use digital platforms (from social media sites to e-commerce marketplaces and online freelancing websites) to find work and improve their current business operations.

To celebrate Micro, Small and Medium-sized Enterprises Day, we’re highlighting learnings from the 27 micro-entrepreneurs the FiDA Partnership talked to in Nairobi. Their stories offer interesting insights for the platforms they use in their businesses, the development organizations that focus on economic inclusion, and other researchers working at the frontier of economic and financial inclusion.

How are micro-entrepreneurs using platforms in Kenya?

The entrepreneurs we talked to are taking charge and using platforms to fulfill their business needs, even if this involves tweaking the platforms’ functions away from their original purpose.

Using social media platforms to find customers and promote businesses

Despite the existence of platforms like Jumia and SkyGarden designed specifically for e-commerce, most of the micro-entrepreneurs we spoke to actually use a patchwork of different social media sites during their sales journey. For instance, many micro-entrepreneurs in Kenya use Facebook and WhatsApp as “marketplaces” to connect with buyers. Of the 27 micro-entrepreneurs we spoke to in Kenya, 24 used Facebook and WhatsApp to promote, advertise and secure business, compared to a handful who use dedicated e-commerce sites like Jumia.

“Most of our conversations start on Facebook messenger. Following a series of communications, once I confirm you are a potential client, I give you my personal WhatsApp number.”

—Dorcas, a baker and freelance writer

Using platforms to receive payments—or not

Micro-entrepreneurs who use a variety of social media platforms to promote their businesses and coordinate with customers have to move outside these platforms to transact. Preference or geography usually determine payment method. Kioko, a small trader of flash disks, told us he is paid cash-on-delivery for items he delivers in person, and through M-PESA for goods he sends via post or friends. The lack of transaction functionality – even on some dedicated e-commerce platforms like OLX (now Jiji) – means payments have to be organized off-platform.

For those who rely on social media sites, this blend of online platforms for marketing and promotions, and offline tools to transact, is cumbersome, time-consuming and risky. But some social media apps are beginning to integrate payment applications. Whatsapp have been trialing payments in India since May 2018, and there is a lot of debate and discussion around what impact Facebook’s new cryptocurrency, Libra, will have on developing markets.

Accessing credit is another reason micro-entrepreneurs move off-platform to help their on-platform businesses grow. Many entrepreneurs we spoke to access credit — to buy stock or otherwise support their businesses — via online lenders Tala or Branch. Offering loans through a platform can be a great way to increase user retention, and some platforms are already exploring lending for sellers. In Africa, Jumia uses sales history and projections to confirm sellers’ ability to pay for merchant lending underwritten by Branch and others.

Using platforms to learn about becoming a better entrepreneur

Some e-commerce, ride-sharing and online work platforms provide opportunities for skills acquisition and training directly. For example, both Jumia and Jiji use back-end data analytics to deliver programmed advice to micro-entrepreneurs on how to improve posts and advertisements. Jumia also provides comprehensive online and offline training for their merchants. Robert, who has two small shops in Nairobi’s Central Business District and sells mobile phone accessories across a few e-commerce platforms, shared how Jumia’s merchant training has helped him with his business.

“I went to the [Jumia] offices. I was trained on how to run the website and through that training now I’m able to create content. I’m able to make sales, I’m able to track my shipped orders.” Learn more about Robert’s platform practices here.

Online work platforms, such as Upwork, iWriter and Uvocorp, also help upskill their workers. For example Uvocorp, a freelance writing platform, gives new writers a mentor for one or two months – or until they are able to complete jobs by themselves. The mentors coach users through best practices in completing assignments, as well as understanding business etiquette in managing relations with clients.

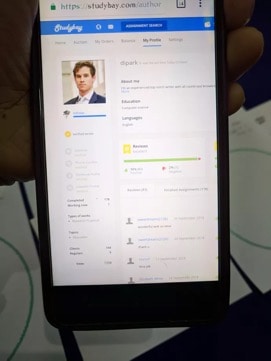

This is different from social media platforms where entrepreneurs develop their own online support groups. For example, Faith sells fresh juice in Nairobi and told us that she connects with a business coach she met through Instagram, who gives her tips on how to improve her juice business. We also spoke to a couple of micro-entrepreneurs who were members of article writing groups on Facebook, where they receive tips on how to win work on online work platforms. Ranging from the ethical to the perhaps unethical, these groups share how to make a profile stand out from the crowd (in the case of the image below, the suggestion was to add an image of a white man), how to use a VPN to mask the location from which you are working, how to outsource work, and how to buy a pre-rated account to help build the impression of credibility and experience.

Supporting micro-entrepreneurs in the platform era is good for economic inclusion

The UN has identified micro-enterprises — as well as small to medium-sized enterprises — as responsible for significant employment and income generating opportunities across the world, and as a major driver of poverty alleviation and development. Given the increasing role that platforms play in the daily business of micro-entrepreneurs, and their success in an increasingly digital world, it’s important to recognize how the spread of platforms presents new opportunities — and challenges — for their economic and financial inclusion.

We’re thrilled to share our recent research on micro-entrepreneurs’ platform practices in Kenya with the wider community. We see supporting micro-entrepreneurs as an important way to positively impact the future of economic and financial inclusion. And, given that upskilling was a key and common practice among the 27 entrepreneurs we spoke to, our current research on transformational upskilling will dive deeper on how platform-led upskilling impacts the livelihoods and lives of online producers. Find it all on our website and join the discussion by following our work on Twitter and LinkedIn. And help us raise awareness of International MSME Day by sharing this post with #MSMEDay19 on your social networks.

Alina Kaiser is Content Strategist and Digital Media Strategist for Caribou Digital, and Communications and Marketing Manager for DFS Lab.

Annabel Schiff is Program Director on the Mastercard Foundation’s FiDA Partnership at Caribou Digital.

Photo courtesy of organization.

- Categories

- Technology