The Next Frontier in Inclusive Fintech: The Value of Client-Centric Impact Measurement

Fintech is projected to be a $1.5 trillion industry by 2030, a major force in the global economy. Latin America and the Caribbean is a crucial focal point for the sector: While less than one in 10 people worldwide live in the region, around one in four fintechs are based there. Among these, Galgo stands out as a remarkable example, showcasing the feasibility of achieving growth levels that are in line with the industry’s potential, while also generating meaningful impact for its end-users. Its success shows that fintech companies can achieve strong financial returns and impact at the same time.

Formerly known as Migrante (migrant in Spanish), Galgo was initially founded in Chile in 2018 to serve the growing diasporas of low-income, underbanked Latin American immigrants with innovative financial services that enabled them to get established and integrate into their host countries. Galgo has since expanded its offerings to reach wider populations, focusing on providing low-income individuals and the emerging middle class with financing for the purchase of motorcycles via its digital platform. This business model has enabled it to boost financial inclusion while also providing motorcycles to customers who couldn’t otherwise afford them, giving them a source of income generation and thereby improving these clients’ quality of life. It has also allowed Galgo to quickly become a regional fintech powerhouse, expanding first to Peru, then to Mexico — and recently entering into Colombia following its acquisition of Crediorbe last year.

The success of fintechs like Galgo is backed by investment firms that strategically invest in startups that serve the underbanked. However, while financial access is crucial, it does not guarantee financial inclusion or improved living standards — something that must be taken into account by both impact-focused startups and their investors. That’s why two of Galgo’s investors — Community Investment Management (CIM), an institutional impact investment manager that provides strategic debt capital to support responsible innovation in lending, and Kayyak Ventures, a venture capital firm that invests in mission-driven entrepreneurs, primarily in Latin America — have taken steps to help enhance Galgo’s impact by understanding the experience of its end-clients. To that end, in 2023, they partnered with 60 Decibels, a global impact measurement firm where I lead LATAM growth, to directly gather the experiences of Galgo’s clients. We conducted 15-minute phone interviews with a randomized sample of these clients, 200 in Chile and 200 in Peru. These interviews revealed compelling insights into the company’s impact, and the importance of client-centric impact measurement in the broader fintech sector. I’ll share some of these learnings below.

Why Prioritize Client-Centric Impact Measurement in Fintech?

As the fintech industry expands, placing the customer’s perspective at the forefront becomes increasingly crucial, to ensure that fintech solutions are responsible and genuinely enhance clients’ lives. As Bernhard Eikenberg, Head of Emerging Markets Strategy at CIM, explains, “accountability to all stakeholders, first and foremost to the end-users of fintech services, remains at the top of [CIM´s] priorities. Measuring, monitoring and understanding the ultimate impact of fintech on its users can only be understood by taking a customer-centric approach that delves into the experience of the users themselves, and how the usage of those services has affected their lives and their communities over time.”

Focusing on the number of loans provided or clients reached is not enough for fintechs or their impact investors: Instead, it’s vital for both parties to understand how these services impact clients’ lives, incomes and overall quality of life. This requires them to move beyond the common practice of simply gathering output data. Given that impact is multi-dimensional, truly understanding impact requires a combination of both output and outcome data, including insights and experiences from the perspective of end-clients. As Andres Pesce, CEO at Kayyak, puts it, “this data has unique value in helping fintech companies learn from what is working and what is not so that they can maximize their impact. End-stakeholders’ insights also help investors better understand the performance of their portfolio companies and fine tune their own screening, due diligence and monitoring.”

What we learned from client-centric measurement

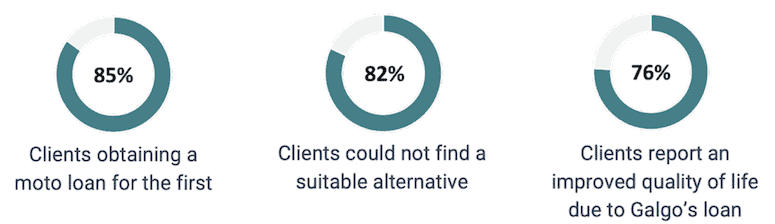

By facilitating financial access through motorcycle loans, Galgo significantly improves its clients’ quality of life. Impressively, we found that 85% of its clients are accessing this type of loan for the first time, surpassing the 60 Decibels’ Financial Inclusion Benchmark for Latin America, which we set at 54%. This underscores Galgo’s ability to reach a client base that has been historically underserved by traditional financial institutions.

Moreover, we found that 82% of Galgo’s clients expressed difficulties in finding a suitable alternative, further emphasizing the fintech’s role in serving a relatively underserved market segment. The impact of this financial access is evident: 76% of clients report an improved quality of life due to Galgo’s loan and the motorcycle purchase it enabled, with reduced commuting times and improved access to convenient transportation being the top self-reported outcomes.

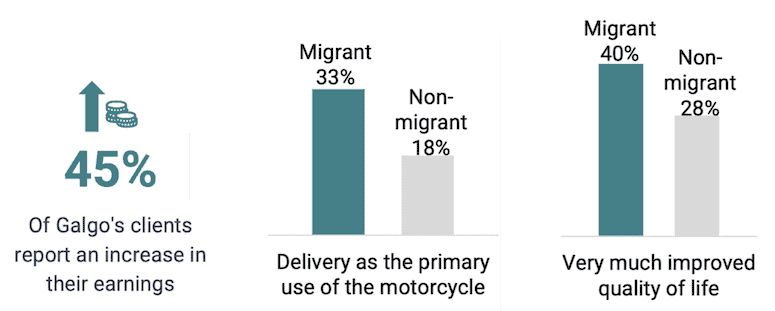

In terms of income generation, 45% of Galgo’s clients report an increase in their earnings after their purchase. Notably, migrant clients are more likely to use their motorcycles for income generation, with 33% using them for deliveries, compared to 18% of non-migrant clients. This leads to differences in wellbeing improvement: 40% of migrant clients report a “very much increased” quality of life due to Galgo’s services, surpassing the 28% reported by non-migrant clients. This finding points the company toward potential areas where it can further increase its impact, raising questions like: Why are migrants reporting higher impact? What are the key drivers of this impact? And how can it generate the same level of impact in non-migrant clients? The study also gave Galgo the opportunity to identify challenges that, when addressed, can improve user experience and increase growth for the business.

Putting Learnings Into Action

By highlighting not only its current impact but also areas for further development, these learnings have provided Galgo with vital information it can use to refine and expand its approach. As Diego Fleischmann, co-founder and CEO of Galgo, explains, “these results — endorsed by an independent expert — confirm our impact and purpose, and show with granular data that our solution solves a meaningful problem in our customers’ lives with strong potential to scale in the region. The study allows us to better understand customer behavior and real-life impact to continue evolving our digital solutions.”

Overall, Galgo’s journey exemplifies the transformative potential of responsible fintech in improving the lives of underbanked individuals. The collaboration between Galgo, the impact investment firms Kayyak and CIM, and 60 Decibels underscores the importance of measuring impact from a client-centric perspective. As the fintech industry continues to evolve, the emphasis on enhancing the user experience and promoting financial inclusion will be central to its success. To achieve this, we need to start gathering and analyzing end-client data to inform decision-making for both companies and investors alike. This is the next frontier in inclusive fintech, and examples like this can help us identify how fintech companies and investors can better use impact data to improve both profit and impact.

Carla Grados-Villamar is a Manager at 60 Decibels and leads its Latin American growth.

Photo via Galgo.

- Categories

- Finance, Transportation