Getting In the Game: How Wealthy Individuals and Families Can Bring Impact-First Investing Off the Sidelines

The global social and economic toll of the COVID-19 pandemic, plus ever-rising concerns about climate change, racial injustice, and income and gender inequality, have injected fresh urgency into the quest for solutions for some of society’s biggest challenges. Impact investors have established a leadership role in addressing those issues by channeling billions in private capital to support the UN’s Sustainable Development Goals (SDGs) and mapping their portfolios to SDG themes such as decent work and economic growth, no poverty, and gender equity. While aspiring to do good, they also have aimed to do well, typically investing in enterprises likely to yield market-rate returns. That has benefited many businesses, but it has also left enterprises that emphasize social or environmental impact — but that have lower prospects for competitive financial returns — struggling to attract the flexible, patient capital they need to prove their value to society.

Some impact investors are working to change this dynamic through a type of investing that advocates call “impact-first.” Unlike philanthropy, which gives money away, impact-first investors expect a return — but unlike mainstream investors (and most typical impact investors) they accept less than the market rate.

We’ve never needed impact-first investing more — yet it remains an under-utilized approach. Fortunately, there’s a group of influential and deep-pocketed investors who are ideally placed to change this dynamic: wealthy individuals and families. The Bridgespan Group recently published a report, “Back to the Frontier: Investing that Puts Impact First,” that aims to shed light on this largely untapped opportunity. Based on interviews with over three dozen high net-worth individuals, family office directors, fund managers and intermediaries, the report highlights the barriers that thwart impact-first investing and shows how pioneers in the field have overcome them. We’ll discuss the findings and share some of these investors’ insights below.

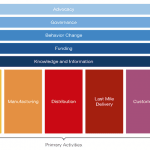

Understanding Impact-First Investing

While not widely deployed, impact-first investing is not a new idea. More than a decade ago, a Monitor Institute report on the emerging impact investing market distinguished impact-first investing from finance-first investing, which aims for market-rate returns alongside social or environmental good. Since that report, market-rate impact investing has gone mainstream while impact-first impact investing has lingered on the sidelines. Of the $18 billion in new capital raised by impact investing asset managers in 2019, almost 92% targeted market-rate returns, according to the Global Impact Investing Network’s annual survey.

That’s because market-rate impact investing fits neatly with mainstream investors’ mentality. The idea of leaving returns on the table in the name of impact runs counter to deeply ingrained beliefs about the primacy of growing investors’ wealth. For doubters, impact-first has the ring of bad investing. “People don’t feel comfortable with this approach initially,” says Margot Kane, chief investment officer at Spring Point Partners, a Philadelphia-based family office committed to impact-driven investments. “You have to challenge all of the accepted dynamics that come with investing and philanthropy.”

Fund managers and professional advisers can be even more wedded to financial returns as a measure of success than their clients. In fact, the ability of professional managers to maximize returns for clients is a point of competitive advantage. Their compensation often is tied to market benchmarks. “Ninety-nine percent of advisers can’t believe you’d want to do this: demand that part of the financial upside of intermediaries and fund managers — like the carry — is tied to achieved impact,” says Charly Kleissner, cofounder of Toniic, a global network of impact investors.

Breaking through this psychological barrier starts by recognizing impact-first investing as one more option on a returns continuum, where it sits between market-rate impact investing and philanthropy. This is not sloppy investing: It’s simply a different way to think about investing and social change, in which impact partially (or perhaps even wholly) supplants financial reward as the currency of success. “We need to change the psychology so that returns aren’t the focal point,” says John Arnold, a philanthropist and former hedge fund manager. “When you get your money back, you should celebrate because you can recycle the capital.”

Bringing Wealthy Individuals and Families into Impact-First Investing

No group is better positioned to infuse impact-first enterprises with capital than wealthy individuals and families. Think of the world’s 2,800+ billionaires, estimated by Wealth-X to hold more than $9 trillion in assets, or the 7,300 family investment offices across the globe that Campden Research estimates manage $5.9 trillion of investable assets. While institutional investors, including most impact investors, have a fiduciary obligation to aim for market-rate returns, these private wealth holders can use their money however they see fit. They have the discretion to declare social or environmental impact a priority for some portion of their investment portfolios. In other words, they are free to invest for impact first.

For these investors, getting started with impact-first investing has never been easier. Today, wealthy individuals and family offices can pick from among three impact-first investment approaches:

Outsourcing: Investors can move some of their capital to one of the growing number of funds, advisers and intermediaries that have added impact-first as an option for their clients. For instance, Jordan Park, Tiedemann Advisers, Align Impact and Avivar Capital, to name a few, provide families and institutions a range of wealth management and impact investing services, including access to impact-first opportunities.

Adopting the lean-team approach: Investors can also add a few specialists to their existing family office staffing to augment, rather than supplant, ongoing portfolio investments by investing through impact-first fund managers. It’s a practical first step for those who are new to impact-first investing. And it’s the approach of choice for experienced investors who want to make room for impact-first investing within their portfolios — principally through third-party asset managers working on issues related to the investor’s priorities — but who don’t want to go all-in.

Building an in-house team: This option — adopted by investors like Omidyar Network, Ceniarth, Blue Haven Initiative and Spring Point Partners — enables the investor to make highly focused direct investments in the impact-first businesses aligned with their priorities. It tightly links impact investors’ values and goals with all investment decisions and also signals their commitment to making impact-first investing a full-time endeavor, not a side bet.

While impact-first investing is building momentum, wealthy investors only allocated 20% of their investments to any kind of impact investing in 2019, according to Campden Wealth Research. That means only a tiny amount of the wealth held by high-net-worth individuals and family offices currently flows to investments purpose-built to address the SDGs — from poverty and disease to inequality, social injustice, environmental degradation and more.

Wealth holders can provide a crucial boost to the impact-first movement — first by testing the waters with a modest initial commitment, then by going bigger as they gain experience. Even if their impact-first investments mainly preserve capital, while leaving some returns on the table in exchange for social or environmental benefit, it’s a tradeoff worth making. There’s never been a better or more urgent time to get started.

Mariah Collins is a manager with The Bridgespan Group, a leading social impact consultant and advisor to nonprofits and NGOs, philanthropists and investors.

Photo courtesy of Markus Spiske.

- Categories

- Investing

- Tags

- impact investing, SDGs