Augmented Reality for Financial Literacy: An Innovative Approach to Delivering Immersive Customer Education

Kavita Kumari is a woman Business Correspondent (BC) – i.e., a retail agent engaged by a bank to provide financial services at locations other than a bank branch or ATM. She works in the hinterlands of Bihar, India, and regularly struggles to learn about the new financial products and services that her BC network manager often adds to the network’s product basket. She says, “I hate attending physical training sessions, as it requires me to stay away from work and my kids for longer periods. I prefer online training, as I don’t lose out on money and precious time with my kids – but I lack continuous motivation and interest to complete those.”

Kavita’s case underscores the challenges faced by many Business Correspondents in India, as online training has become the new normal during the pandemic. It highlights the need to make the experience of online learning fun and engaging – a need that is more important than ever, especially when it comes to on-the-job training.

Augmented reality (AR) offers a promising solution to this challenge. AR is an immersive technology that integrates virtual content with the physical environment, enabling users to engage with a mobile application through a blended reality experience. AR technology and tools can keep users engaged with training applications for longer periods, and can be very helpful in teaching them new things through gamification. In research conducted to understand the impact of an AR-based mobile application on the learning motivation of undergraduate health science students at the University of Cape Town, it was shown that the use of an AR mobile app increased students’ motivation by 14%. The attention, confidence and satisfaction of the students increased by 31%, 11% and 13% respectively, and these increases were found to be significant. Another study showed that the use of an AR-based application increased the learning performance of a group of secondary school students in Sofia, Bulgaria by 36%. More broadly, research has also shown that the efficacy of the digital delivery of financial education is high, with multiple benefits in terms of helping adults to manage their finances and gain the confidence to make better financial decisions.

However, despite these benefits, AR has found limited usage in driving financial education – in contrast to its growing usage globally in sectors such as healthcare and agriculture. For instance, Anatomy4D and Augmented Reality Telecommunication use AR to give medical professionals, students and teachers an interactive, 4D understanding of human anatomy by illustrating the spatial relationships of organs, bones and muscles. Similarly BidOn has developed an AR application for training in the agriculture sector, which enables users to understand how farm equipment works in actual farmland. Applications like these have resulted in increased productivity via the virtual training of users in these industries.

The untapped potential of these tools in India’s finance industry highlights an opportunity for the sector to innovate, test and scale AR-based models for delivering financial education – especially to the country’s low-income segments. That’s why, with support from the Bill and Melinda Gates Foundation and collaboration from five partners, Grameen Foundation India is piloting AR-based models as part of our Business Correspondent Network Manager (BCNM) Experiments And Demonstrating Scale (BEADS) project. One of the project’s goal is to build the capacities of BC agents and customers who have smartphone and internet access. To that end, it provides different types of AR-enhanced training geared to the unique needs of both BCs and their customers.

Three Augmented Reality features GrameenGuru is using to deliver financial education

The BEADS project pilot has developed an AR mobile application called GrameenGuru. After some feature updates are completed, the app will be given to business correspondent agents and also to customers with smartphone and internet access, allowing them to explore training modules focused on different aspects of financial inclusion. While agents will learn about products and services, customer-centric sales and promotion approaches, and other elements of their role as BCs, customers will learn about the financial products BCs can offer, the points of access where these services are available, and the benefits they can provide. Below are a few uses cases for the GrameenGuru app.

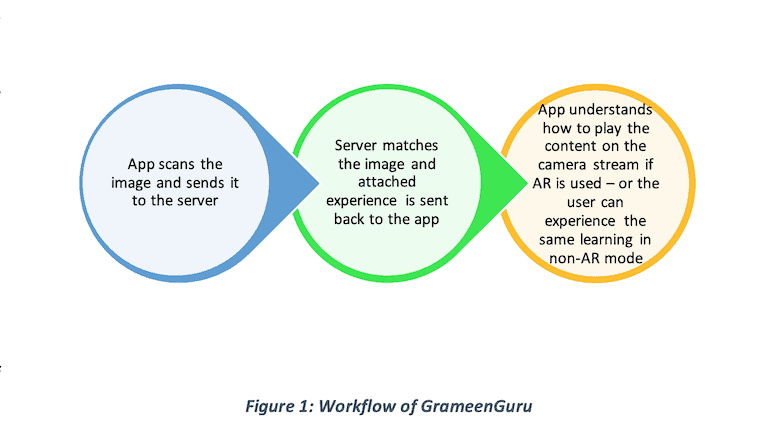

Scan and Learn through GrameenGuru: BC agents like Kavita can learn about different financial products and tools by focusing their smartphone camera on any AR “marker” pre-fed into the app’s servers. These markers are essentially digital images of a bank or other financial service provider’s main distinguishing characteristics, which can include their name, logo, ATM machines, etc. The GrameenGuru team has uploaded these images – representing the service providers that users most often encounter – to the app’s servers, allowing the app to recognize them when users scan these markers with their smartphone cameras in the physical world. When they do, an avatar called “GrameenGuru” appears on their phones, explaining the provider’s products or services and related features to the learner in the vernacular. For instance, suppose an agent chooses to scan the logo for AePS (Aadhaar-enabled payment system, an Aadhaar and biometric-based digital payment tool) or the logo for UPI (Unified Payments Interface, a mobile-based payment method). In that case, the avatar will explain the features and usages of these tools to the agent. The application can also work in an offline library mode with no internet, and any new training modules on additional topics uploaded to the application server get automatically refreshed whenever the user gets online.

AR and Non-AR Modes: The AR environments created by the application have immersive learning features, allowing learners to select topics of their choice, and engaging them through interactive lessons. For example, suppose a user scans the image of an ATM or chooses “How to operate an ATM” from the menu within the app. In that case, the AR application creates an environment on the smartphone screen in which the user can see an image of an ATM overlaid on the actual ATM the camera is focused on in the user’s real environment. The moment they choose an action – e.g., “Change the PIN” – by tapping the relevant part of the overlaid image, the application delivers the relevant training content. Mobile handsets capable of handling AR functionality will generate both AR and non-AR 3D animations of the same experience while users are online. But if the device is not capable of handling AR functionalities, or if the user is currently offline, the application will offer only the 3D mode, stating, “Your device doesn’t support AR, you can enjoy the same experience in the 3D mode.”

Gamification and Voice-Based Queries: Gamification elements have been incorporated into the GrameenGuru application to make financial education more engaging, and to build more sustainable and long-term financial habits among users. Agents can play role-based AR games to better understand their role as BC agents, and to receive tips for delivering customer-centric service. They can even use the app’s AR-based stories and product demonstrations to educate their customers. GrameenGuru can also capture voice-based queries in the user’s chosen language, and display the available content in response to these requests. The application also acts as a training needs-assessment platform, as it helps administrators to analyse and identify users’ learning needs based on their searches within the app. Administrators can then respond by developing new content and uploading it to the application for capacity development.

Enhancing the Augmented Reality App to Address Common Obstacles to Financial Inclusion

The initial successes and learnings from our pilot and field experiences have pushed Grameen Foundation to expand the horizon we had initially envisioned for the application. The app will be used not only to improve BCs’ knowledge and services, but also to improve customer access to BC agents and other financial service providers. To that end, we are working on three main feature enhancements, which will include:

- Locating nearby BC points: The app will use Google map integration to enable customers to get the route to the nearest BC point, bank branch, etc.. Initially, this integration will be done for the five partners under the BEADS program, and later it can be expanded to other BCNMs.

- Scanning and learning about available services: The app will expand its scan-and-learn functionality, which will result in customers being able to scan any bank or BC point logo, prompting the GrameenGuru avatar to talk about a wider range of the services available at banks and their BC points.

- Simulating a virtual bank branch or BC points: During the Human Centered Design research Grameen conducted for this project, we assessed user behaviours related to financial services. In the process, we found that crossing the first transaction hurdle was a key barrier preventing customers from low-income households – especially women – from accessing financial services. The application will aim to overcome this obstacle through simulation: Users will be provided with a booklet with the logos and other distinguishing characteristics of many common financial service providers, enabling them to familiarize themselves with the process of scanning AR markers and to access the app’s content at home. When they perform an AR scan of a bank image, logo or other marker from the booklet (or even an actual logo from real life), the GrameenGuru app will generate a virtual bank branch or BC point environment on the screen, through which the user can learn about transactions and understand the provider’s actual processes before physically visiting any banking point. This will lessen new customers’ fear of conducting a transaction for the first time, by avoiding the need to ask others for assistance – and the possibility of being embarrassed due to a lack of knowledge of these processes.

Consumer empowerment is the key to realizing the positive outcomes of financial inclusion. But the deepening of financial inclusion, resulting in the improved financial health of low-income households, can only happen if customers have a well-rounded understanding of financial products and services. With increasing digitization and gamification, and improved access to smartphones and the internet, technology such as AR can play a defining role in driving financial education, especially for low-income households.

Piyush Singh is Project Director of Innovation in Digital Finance, and Rahul Ranjan Sinha leads the Client Insights for Impact team at Grameen Foundation India.

Photo courtesy of Grameen Foundation India.

- Categories

- Education, Finance, Technology