Mobile Podcasts: A Cost-Effective Way to Boost Financial Literacy in India

Editor’s note: Throughout 2017, NextBillion is organizing content around a monthly theme, dedicating special attention to a specific sector alongside our broader coverage. This post is part of our focus on financial inclusion for the month of June.

Most Indians have faced a situation where they have waited outside a perfectly functional ATM and helplessly watched a customer struggle to withdraw cash. As a reader of this blog, you likely find it easy to read and understand instructions about basic banking processes, and breeze through simple transactions like ATM withdrawals. But what about those who lack literacy skills, or who are just getting introduced to the world of finance? If a process as simple as withdrawing cash can be so cumbersome for some Indians, how will they navigate more complex but important products and processes like mobile banking, credit rating, debit and savings accounts, loan applications, insurance or recurring deposits?

With 223.6 million RuPay debit cards issued and 289 million Jan Dhan accounts opened since 2015 for underserved communities in India, the need for financial literacy has gotten bigger than ever. And without sustained efforts from the finance sector, the Narendra Modi government’s mega initiative to boost financial inclusion could nose-dive into oblivion. For most in the finance sector, the challenge lies in: (a) transcending language, literacy and connectivity barriers, and (b) making huge investments in hiring for in-person or telephone support for introducing their products and services to this target group.

Leveraging the mobile subscriber base for financial literacy

With more than 1 billion mobile subscribers in India, mobile phone podcasts can be used as a medium to bring financial literacy to underserved communities in India. Podcasts can be used to introduce information about different banking solutions that cater exactly to the needs of this target group. For instance, they could support efforts to sell crop insurance products to farmers, health or life insurance products to labourers, or small loans to housewives and small business owners. To receive this information, the listeners don’t even need to have a fancy smartphone – owning a basic feature phone is sufficient.

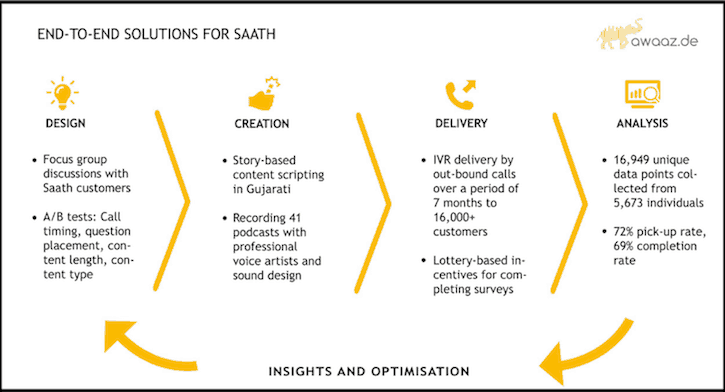

In a recently conducted study funded by the Bill & Melinda Gates Foundation, we supported Ahmedabad-based cooperative bank Saath Savings and Credit Cooperative Society’s effort to understand the financial behaviour of its customers. We implemented our “end-to-end solutions” approach, which involves conducting demographic and psychographic profiling of customers, scripting and creating audio content, delivering this content, and analysing the response.

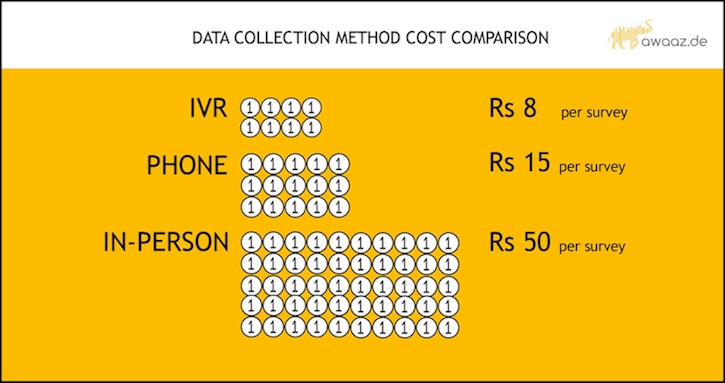

Using our model, we mitigated the language barrier by delivering mobile podcasts about Saath’s different savings products in the local language, i.e. Gujarati. The podcasts were professionally recorded and delivered on the customer’s basic feature phone, and the cost of this solution was only Rs 8 per survey, compared with much higher in-person or telephone survey costs.

Analysing the financial behaviour of customers

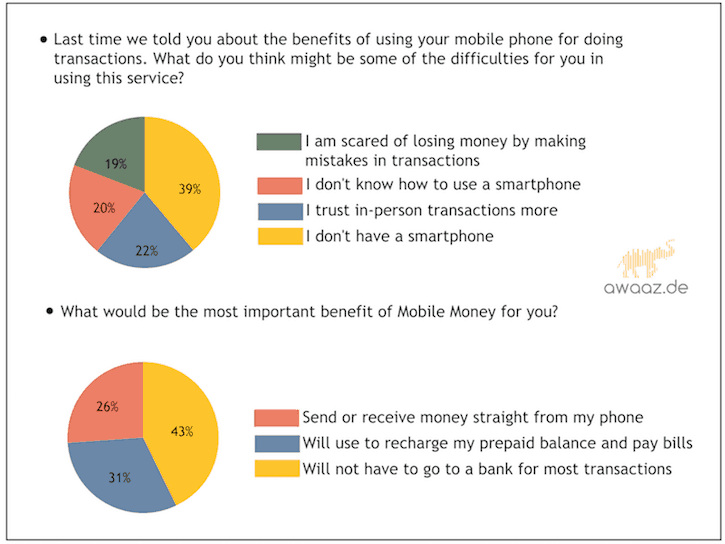

Overall, 41 podcasts were delivered to more than 19,000 Saath customers over a period of seven months in Ahmedabad. The survey revealed the behavioural traits, apprehensions and openness of customers in using different financial products and services. For instance, 19 percent of those surveyed revealed that they feared losing money in transactions, and 43 percent were more open to using mobile money for recharging services or paying bills.

Banking and other financial institutions can benefit immensely from data collected through campaigns like these. They can use these insights to optimise their products, upsell new products, or develop new communication strategies that can engage customers. The possibilities are endless if financial institutions can transcend language, literacy and connectivity barriers.

Download the Saath – Bill & Melinda Gates Foundation Financial Literacy Case Study here.

Bhaumik Shah works at Awaaz.De – an award-winning Indian start-up that builds “inclusive technology” for underserved communities.

Photos courtesy of Awaaz.De.

- Categories

- Technology