Making Financial Health a Global Reality: Four Strategic Directions for Increasing Customer-Centricity and Business Growth

Customer centricity is important, and many financial service providers recognize the value of putting customers’ needs at the top of their strategic agenda. The reason for this is clear: A Dimension Data report finds that 84% of companies that focus on improving their customer experience also report growing revenue. And a study from Deloitte demonstrates that customer-centric companies are 60% more profitable than their counterparts. An article from Forbes lists 50 similar statistics. Yet despite some notable progress, much still needs to be done to achieve customer-centricity in the financial services sector – particularly in developing countries.

What is holding us back?

Part of the problem is that providers tend to view customer-centricity as synonymous with customer convenience, which is driving many financial innovations in emerging markets to focus exclusively on making products more accessible. This has led financial service providers to design and market innovations that primarily address obstacles to access, such as avoiding queuing at the bank and enabling customers to make deposits at the market. Along with access, user experience is also a key focus of these innovations, with providers aiming to make product use seamless via simpler interfaces and the use of agent banking, among other things. In short, with the increasing focus on access to financial services, financial inclusion has become the end goal. However, access and seamless usage do not necessarily result in better customer wellbeing.

Last summer, UNCDF and MetLife Foundation released in-depth research on financial health conducted by their i3 Program: “Delivering Financial Health Globally: A collection of insights, approaches and recommendations.” The report shows that innovations focused on financial health provide greater growth outcomes for financial service providers. This research explores the constituents and drivers of financial health, provides a framework to define and measure it, and maps out the roles of different stakeholders in the process. It also provides simple and practical recommendations that can help financial service providers become more customer-centric by prioritizing financial health in their business strategy. Below, we’ll discuss these findings in more detail.

A case for financial health

For over a decade, governments, central banks, financial institutions and others have been focused on financial inclusion. However, there is evidence to show that financial inclusion does not necessarily lead to financial health. A study by the U.S.-focused Financial Health Network conducted in 2021 shows that barely a third (34%) of Americans are financially healthy despite near-universal financial inclusion. Similarly, while financial inclusion in Kenya increased from 83% to 84% between 2019 and 2021, the percentage of adults deemed financially healthy declined from 22% to 17% in the same period.

The COVID-19 pandemic has shown why having access to financial services is not enough: Under unexpected crises and adverse circumstances, individuals can have a hard time recovering economically or meeting their ongoing financial commitments. The pandemic has also exposed the fragilities of our economic and social systems, particularly among the poor and marginalized communities trying to navigate the global financial ecosystem. People all over the world, especially from low-and moderate-income backgrounds, are losing their jobs and seeing their income and assets erode, making them even more vulnerable.

Financial health is an emerging topic of research, advocacy and practice that aims to understand, measure and ultimately improve the elements of wellbeing that are associated with the financial lives of individuals. Authors in the UNCDF and MetLife Foundation study argue that financial health is a more inclusive approach than financial inclusion, and that it encompasses four important aspects of an individual’s financial life:

- Financial security: the ability to meet current and ongoing commitments, including basic needs and planned expenses;

- Financial freedom: a financial condition beyond financial security, which emphasizes individual financial goals involving the things one values;

- Financial control: the ability to feel in control of one’s finances, with no or limited financial distress; and

- Financial resilience: the ability to respond to and recover from shocks.

In short, financial health is a state in which people are able to meet their current needs, absorb financial shocks and pursue financial goals.

Customer-centricity and financial health

With its focus on the financial lives of individuals, the financial health approach is arguably more customer-centric, in that it’s anchored more around behaviours than the mere focus on inclusion: It offers principles to define impact more holistically, measure it systematically and create it sustainably.

For fintechs and other financial institutions, financial health provides a fresh lens for examining customers’ needs and aspirations, and most importantly for understanding improvements in their lives and their resilience. This kind of approach has both social and commercial benefits, allowing organizations to build more financially healthy customers – and by implication, to increase the financial health of their institutions. Financially healthy customers will save more, borrow responsibly and manage risks better. They are financially more capable, which can lead them to use a more diverse range of financial products and services that will keep them financially included and engaged in the system.

A practical roadmap for building financial health

Authors in the report provide a simple and practical roadmap that guides financial service providers in adopting and operationalizing customer-centricity, by prioritizing financial health through four key strategic considerations:

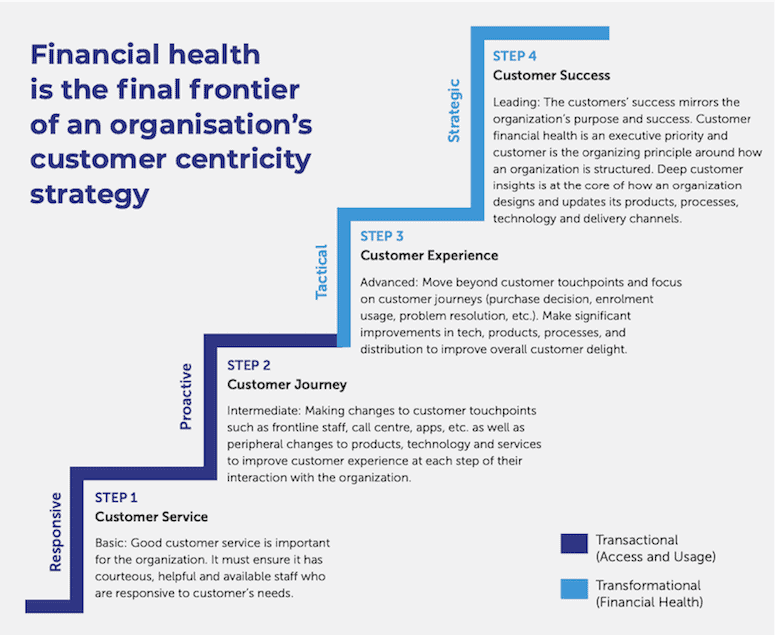

- Treating financial health as a strategic imperative: Financial health is either an executive priority – or it is not a priority at all. It cannot be a pilot programme or the responsibility of a single department. The first step in embedding this focus is to understand where the organization currently stands in terms of customer-centricity and financial health. The next step is to make financial health a strategic decision which is core to how the organization is led, designed and managed. To that end, the research provides an indicative framework to evaluate an organization’s customer focus. This framework acts as a quick reality check and helps guide its journey from being transactional (focused on access and usage) to transformational (focused on building customers’ financial health).

- Reprioritizing the metrics and measurement model: The authors suggest three areas that are essential to developing a robust metrics and measurement model:

- Developing a system to measure and understand customers’ financial health;

- Designing customer-focused metrics that cover customer outcomes, customer perception and organizational growth or efficiency;

- Reviewing and reprioritizing metrics related to institutional growth and efficiency that are mostly internal or growth-focused, like enrolments or usage – as well as efficiency-focused metrics like revenue-per-client, cross-sell and up-sell.

- Aligning technology, products, processes and partnerships: It’s important to identify priorities and develop a step-by-step execution blueprint that is manageable, measurable and appropriate to the unique context and capabilities of the organization. These could include improving technologies to suit customer needs, adding or removing some products from the product portfolio, simplifying processes, and adding or terminating partnerships. The authors also provide a practical summary and overview of how improvement in the financial health of customers affects key business metrics which, in turn, drive an organization’s return on investment at multiple levels.

- Deepening customer relationships and building customer trust: Instead of having to resort to generic financial literacy, education and marketing campaigns, providers should focus on building a connection with their clients and providing personalized financial solutions to help them improve their financial health.

While available data demonstrates that organizations focused on maximizing customer value generate significantly better returns than organizations that are simply pushing products and services, the key dilemma here for most financial service providers is that the move toward financial health will require them to make investments now that will pay off only in the long run. Focusing on customers’ financial health might seem like a radically different way of doing business, but there is sufficient evidence that there is a strong business case in doing so. Indeed, it is perhaps the most sustainable way to stay competitive and relevant to customers.

Pallavi Dhakal is Financial Health Communications Adviser, Ankita Singh is Research and Insights Specialist, and Neha Kumar is Program Specialist at UNCDF’s Centre for Financial Health.

Photo courtesy of UNCDF.

- Categories

- Finance