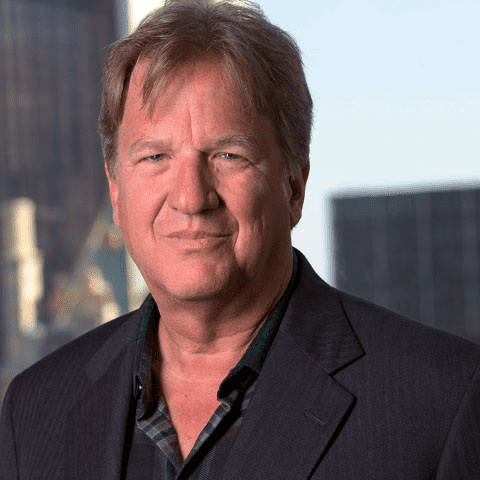

Articles by Jed Emerson

-

Guest Articles

Tuesday

January 17

2023Just Useful… Or Truly Catalytic? How Entrepreneurs Really View Catalytic Capital — And What Impact Investors Can Do About It

Much of the attention in the impact finance sector tends to go to the stewards of capital — investors, foundations and other funders — most of whom firmly believe that catalytic capital is the type of finance that entrepreneurs value most. But as Bjoern Struewer at Roots of Impact and Jed Emerson at Tiedemann point out, it's unclear if investors' assumptions about the value of catalytic capital align with entrepreneurs’ actual opinions about it. They discuss new research that explores what entrepreneurs really value in this type of financing — and how these structures might be improved.

- Categories

- Investing, Social Enterprise

-

Monday

December 9

2013NexThought Monday 12/9/13: Jed Emerson on creating a supportive environment for seed stage impact ventures

Countless early stage entrepreneurs are developing innovative solutions to market problems. Yet investors are inherently looking to manage risks. This difference in perspective is at the heart of a persistent gap in seed stage funding for social entrepreneurs. But as impact investing guru Jed Emerson explains, there is great investment opportunity in this gap—and the fragmented seed stage impact investing ecosystem is ripe for innovation.

- Categories

- Uncategorized

-

Friday

October 26

2012Advancing Impact Investing Platforms… Promise and Peril!: We can’t always assume all investment strategies must scale

Impact Investing is not a single hammer looking for all the nails in the world—it is a diverse and dynamic approach to creating innovative applications of capital in appropriate ways to maximize potential impact. While the promise of investment platforms is, uh, promising, it is important we not start our discussion with the assumption that all investment strategies must scale!

- Categories

- Uncategorized

- Tags

- impact investing, scale